Is a recession around the corner? Some analysts believe the key to that answer resides with transportation companies like FedEx (NYSE:FDX), Union Pacific (NYSE:UNP) and Ryder System (NYSE:R). Specifically, if less and less unfinished goods are being moved to manufacturers, wholesalers and retailers, then one might anticipate sluggish growth, or even economic contraction.

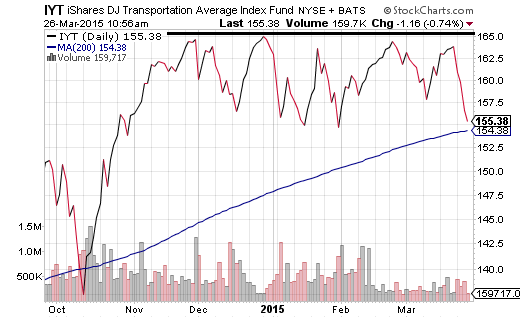

How might one determine the collective well-being of transporters? The iShares Transportation Average ETF (ARCA:IYT) tracks the investment results of an index comprised of airline, railroad and trucking corporations. Perhaps surprisingly, the transportation sector appears to be struggling in spite of cheap oil.

Unlike exchange-traded trackers for the Dow Industrials ETF (ARCA:DIA) or the S&P 500 SPDR Trust (ARCA:SPY) – broader stock market proxies that have hit all-time highs in 2015 – IYT has not reached a new pinnacle since December 29. In fact, since the “Bullard Bounce” ran its course between mid-October and late November of last year, the transportation sector has run into heavy resistance.

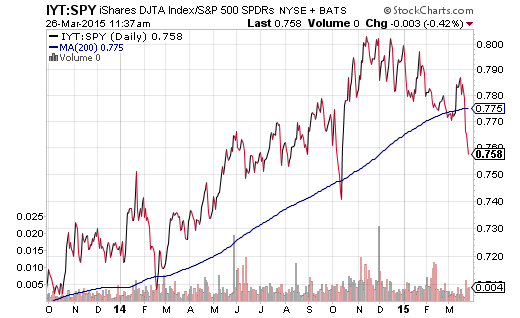

The IYT:SPY price ratio is another way to look at the changes that are taking place. For example, a rising price ratio might be indicative of a generally favorable perception for the health of the domestic economy. Indeed, the momentum for IYT relative to the broader market’s SPY is evident for the better part of the last eighteen months; IYT:SPY effectively held above a critical trendline.

More recently, however, the favorable trend has been waning. The change in sentiment appears to have occurred around the beginning of November. Did something significant transpire at the tail end of October? Back on October 29, the Federal Reserve formally ended the third iteration of its controversial quantitative easing program (QE3). Ever since, economic forecasts as well as economic realities have been diminishing.

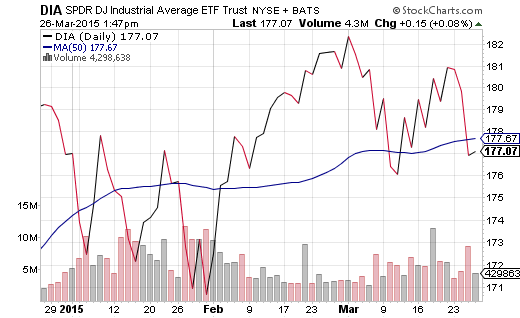

There are those out there who extol the virtues of the relationship between the Dow Transports proxy (ARCA:IYT) and the Dow Industrials ETF (ARCA:DIA). In particular, if IYT does not eclipse its December 29 highs/resistance level and DIA breaks below lows set in January, the market environment might then become bearish. Right now, even as DIA falls below a short-term 50-day moving average, it does not appear ready to plunge below late January lows.

Nevertheless, the Fed lowered its growth expectations for the US economy for 2015, 2016, and 2017. Equally concerning, we’ve already witnessed Fed officials suggest that they will not be impatient, nor will they necessarily raise overnight lending rates at any time in 2015. Making matters more delicate, GDP growth expectations for Q1 as recently as February have been scaled back to as low as 0.2% (by some models) from a previously more upbeat 2.5%. Others would not be surprised by a negative number. (How crazy does a recession sound if GDP comes in negative for Q1 and the Fed is still talking about possible tightening in the summertime?)

As unlikely as an upcoming recession may seem, IYT and the transportation sector may be more prescient than anyone would like to believe. My colleague Rob Charette uncovered some statistical evidence based upon the 35 stock bull markets since 1900. In brief, if the current uptrend does not surpass its March 2 peak in the next 30-40-days, there is a high probability that the next bear market may have already started. What’s more, bears in major stock averages tend to be leading indicators of recessionary pressure.

Recession possibilities notwithstanding, I doubt the will power of the Federal Reserve to raise overnight lending rates beyond a face-saving 0.25% in the 2nd half of 2015. They may do so to maintain a measure of credibility. On the other hand, they will likely speak about the action in the same way that they removed the word “patience” from their forward guidance; that is, they may discuss an ultra-slow path of rate changes that may not even project a path of getting toward 1.0% by year end 2016, as well as mentioning data-dependency that would allow them to revert back to QE stimulus as necessary.

We are already seeing the volatile consequences of trying to back away from the electronic creation of currency. U.S. stocks are wobbly. The yield curve is flattening. And without greater Fed assurances of economic strength or monetary policy neutrality, investors may need to consider a diverse approach to hedging stock risk. National munis via iShares S&P National Muni Bond Fund (NYSE:MUB), reverse carry trade currencies like CurrencyShares Japanese Yen Trust (ARCA:FXY) as well as precious metals like SPDR Gold Trust (ARCA:GLD) combine to provide a measure of protection. All three of these ETFs exist in the FTSE Custom Multi-Asset Stock Hedge Index (MASH Index).