Earnings season is starting to slow down, but three big companies are slated to announce earnings this week. What should investors look for?

Workday Inc (NYSE:WDAY):

Technology company Workday will post its first quarter fiscal 2016 earnings results on Tuesday, May 26 after market close. Wall Street expects the company to post a loss of ($0.08) a share and $244.71 million in revenue, up from a loss of ($0.13) a share and $159.7 million in revenue the same quarter a year prior.

Workday develops and provides cloud applications for finance and human resources. The company has established itself as one of the fastest-growing businesses in the Software-as-a-Service (SaaS) cloud computing space and in Big Data business. Averaging a 70% revenue growth over the past four quarters, Wall Street believes Workday is showing no signs of slowing down.

Additionally, Workday continues to see strong demand for its services and is expected to post a 60% increase in billings growth. Investors will be looking to see if the company will offer a projection of what to expect for the rest of the year.

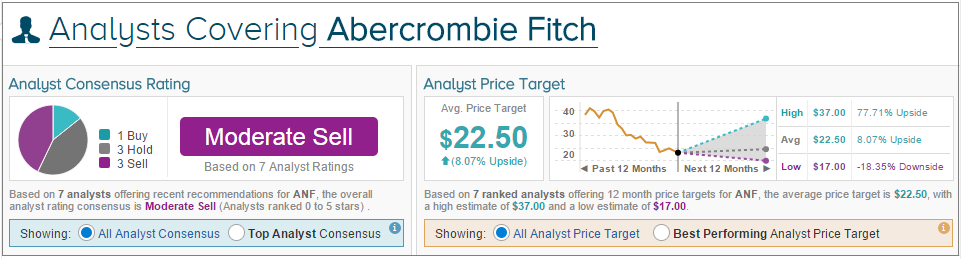

On average, the overall analyst consensus for Workday on TipRanks is Hold.

SeaDrill Limited (NYSE:SDRL):

Oil company SeaDrill is slated to post its first quarter 2015 earnings results on Thursday, May 28 after market close. Analysts expect the company to post earnings of $0.62 a share and $1.26 billion in revenue, down from earnings $6.23 per share and $1.221 billion in revenue year-over-year.

Oil prices in general began to fall dramatically in June 2014, reaching as low as $50 a gallon this past January. Consequently, SeaDrill suspended its dividend several months ago in an effort to create margin safety while oil supply and demand began to even out. Wall Street and investors alike were hopeful that supply and demand would balance out by the end of the year, but now it seems that will not happen for as long as another two years.

Additionally, SeaDrill has already invested billions of dollars into 15 new build vessels, with only a few under contract to enter service over the next 18 months. The company currently has a $13 billion debt, which could grow as its new build vessels enter service.

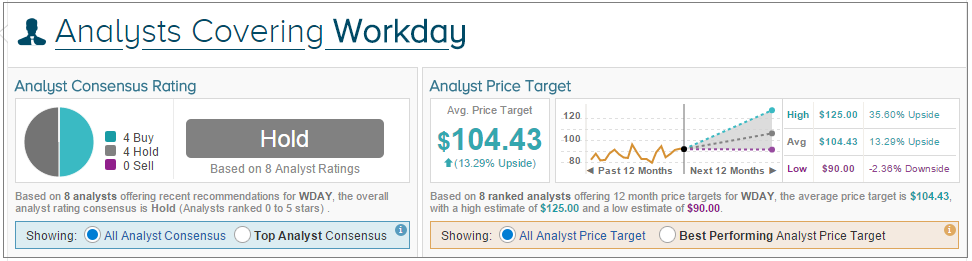

On average, the overall analyst consensus for SeaDrill on TipRanks is Moderate Sell.

Abercrombie & Fitch Company (NYSE:ANF):

Retailer Abercrombie & Fitch is set to announce its first quarter 2015 earnings results on Thursday, May 28 before the market opens. The company is expected to post a loss of ($0.33) a share and $731 million in revenue, compared to a loss of ($0.17) a share and $822.43 million in revenue the same quarter last year.

The retail chain was once extremely popular amongst teenagers, but A&F has been struggling to keep adolescents interest in its clothing over the past several quarters. In fact, comparable store sales dropped 10% in the last quarter.

The company has also been searching for a new CEO since Mike Jeffries stepped down earlier this year. Investors will be looking for an update on its progress in finding someone to fill the position. Many consumers had a sour taste in their mouth from Mike Jeffries, who came under fire last year for comments about who can and cannot shop at A&F. Jeffries wanted the shop to be for “cool kids,” and did not stock women’s clothing in extra-large sizes. Investors hope that Jeffries successor will help turn the company around.

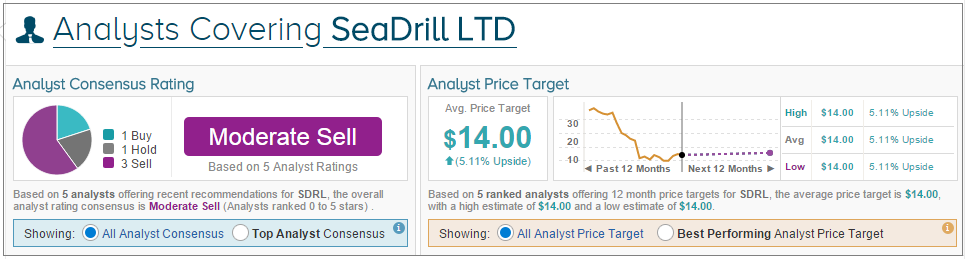

On average, the overall analyst consensus for Abercrombie & Fitch on TipRanks is Moderate Sell.