-

The finance industry faces a steep, uphill battle in trying to convince the Consumer Financial Protection Bureau that the long-standing use of arbitration agreements is beneficial for consumers.

March 10 -

In unusually expansive comments, Consumer Financial Protection Bureau Director Richard Cordray provided new details Tuesday about proposals due soon from the agency while offering insights into an internal battle over easing a key mortgage rule.

February 10 -

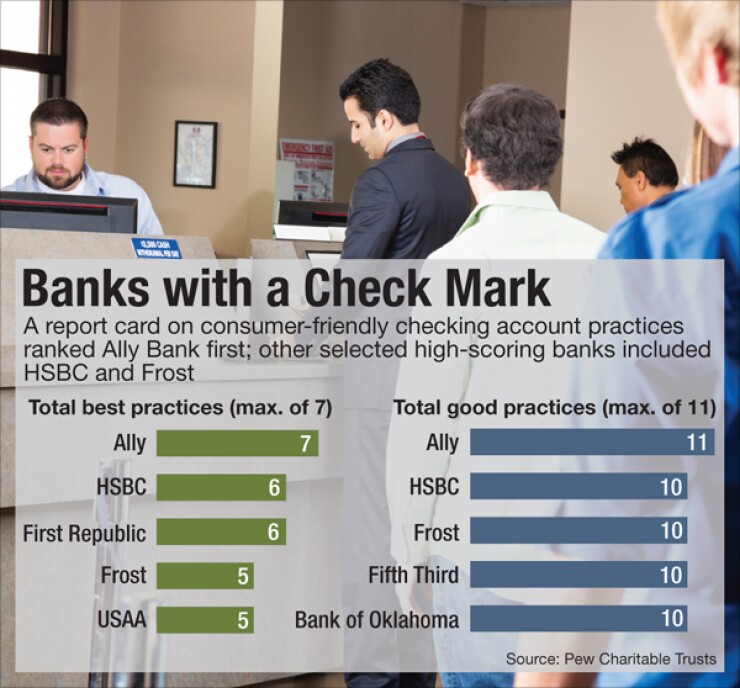

Some large banks have adopted more consumer-friendly policies, but many still engage in practices that seem designed to maximize overdraft fees, according to a new report from the Pew Charitable Trusts.

April 9

The country's big banks are making some progress in how they treat checking account holders, but their strides are too slow and inconsistent, according to a new report card from the Pew Charitable Trusts.

Pew graded 45 of the nation's largest banks based on their disclosures to consumers and their policies for charging overdraft fees, among other practices. The study, released Tuesday, found several areas of improvement from

"This product continues to be laden with terms that put consumers at risk," Susan Weinstock, the director of Pew's consumer banking initiative, said during a conference call with reporters. "And our data show that the market is not going to make this product safe."

Pew has published its report card since

One Pew recommendation that has gained substantial traction over the last few years involves a summary box that clearly discloses the key terms of a checking account.

Pew developed a

"I think the disclosures have definitely improved a lot," Weinstock said in an interview.

She applauded M&T Bank, Bank of Oklahoma, USAA Bank, Frost Bank, Key Bank, U.S. Bank, TCF Bank and HSBC for adopting disclosure boxes, while arguing that other banks should be required to follow suit.

"It's like a food label," Weinstock said. "The FDA mandates that every can of soup should have a food label. The CFPB should do the same."

Pew is also pressing the CFPB to limit the size of overdraft fees and ban the reordering of transactions from high amount to low, a practice that can lead unwary customers to rack up big charges.

Large U.S. banks have made limited progress in curtailing overdraft fee practices that harm consumers, the Pew report found.

Out of 32 banks that Pew has evaluated for three consecutive years, 18 do not reorder transaction from high to low or charge overdraft fees, the report stated. That was a slight improvement from the two previous years.

Meanwhile, the median overdraft fee charged by the big banks was $35 the same as in earlier years.

The report looked at 45 of the nation's 50 largest banks by domestic deposit volume. The other five banks East West Bank, First Citizens Bank, New York Community Bank, Signature Bank, and Synovus Financial were excluded because Pew's researchers were unable to obtain the necessary disclosure documents online or through the mail.

For the third consecutive year, Ally Bank finished first in Pew's rankings, adhering to all 18 of the practices that Pew endorsed. HSBC, First Republic Bank, Frost Bank and USAA all finished near the top of the report card.

E-Trade Bank had the lowest score in Pew's rankings. FirstMerit Bank and Bank of the West were also near the bottom of the list. Spokespeople for those three banks did not respond to requests for comment.