UnionPay takes aim at global footprint to rival Visa, Mastercard

China UnionPay has maintained a low-key style as it expands overseas, despite being one of the world's biggest payment service providers

As cash-rich mainlanders crowd popular tourist spots around the world, the dominant domestic payment service provider China UnionPay has been sharply expanding its global presence.

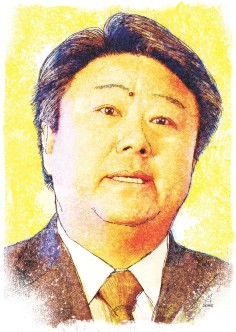

"We are big in size but we feel that the focus should be put on improving our services now," said Cai Jianbo, an executive vice-president of UnionPay who is also the chief executive of UnionPay International, the subsidiary focusing on the company's international business.

"We believe it's the hard work and first-class service, not the scale, which make a company globally renowned."

On the eastern bank of the Huangpu River in Shanghai, the headquarters of UnionPay International is located in an eight-storey office building.

Although it is dwarfed by the office buildings along the city's prime areas, most of which are owned by state-controlled enterprises, UnionPay appears unfazed as the company puts its best foot forward in going outbound.

"We go to places where Chinese tourists go and we want to offer the services they need abroad," Cai said. "Chinese travellers have become more sophisticated and they look for quality services, which prompts us to work harder."

Chinese shoppers are the world's biggest spenders on luxury items, and most of their goods are bought overseas when they travel.

To better tap mainlanders' increasing wealth, UnionPay has been fine-tuning its services and mapping out a series of new marketing strategies to meet their demands.

Recently, it relaunched an online trading platform to facilitate cross-border shopping by consumers given their keen interest in foreign-made products.

Unlike corporate giants such as property developer Shanghai Greenland Group and investment conglomerate Fosun Group, which are looking to tap the overseas markets with big-ticket spending, UnionPay displays a low-key style in the mainland's go-global campaign.

Piggybacking on the mainland's huge population, UnionPay has issued 4.5 billion cards since its founding in 2002, making it the world's largest card brand.

UnionPay's transactions jumped 48.4 per cent last year to reach 32.3 trillion yuan (HK$40.9 trillion).

The mainland's payment market is off-limits to foreign players but UnionPay could soon face competition on home ground after Beijing pledged to open the market for transactions to foreign banks and card firms last month.

Apparently, an expanded international network in tandem with an increasing number of outbound mainland tourists could become a new growth engine for UnionPay.

Most mainland travellers would give priority to using UnionPay to settle payments because it would save them up to 2 per cent in transaction fees compared with Visa and MasterCard.

UnionPay has secured a foothold in more than 140 countries and regions and is on par with the two global card giants in several markets such as Southeast Asia, which attracts the highest number of tourists from the mainland.

Outside the mainland, UnionPay issued 33 million cards as of the end of September and plans to "make a breakthrough" in the coming three years.

The company is cautious about talking numbers while Cai said it was serious about customers' feedback on its services.

"For the cardholders, seeing is believing," he said. "They will tell us what we need to improve."

To vie for a bigger market share outside of China, UnionPay has to understand the overseas banking and commerce sectors as well as the shopping habits of the locals before designing products and services to attract customers.

In the past, the company's focus was to follow Chinese travellers' footsteps to offer them services when they went abroad.

But in recent years, this focus seems to have changed as UnionPay envisions becoming truly internationalised to meet not only Chinese cardholders' demands but also overseas customers' needs.

In its efforts to jump deeper into foreign markets, more investments were said to have been put into areas of daily consumption including supermarkets, dining outlets, culture and entertainment.

"UnionPay garnered experience on the mammoth Chinese market and to a certain extent, we have enjoyed advantages in building the infrastructure work," Cai said.

"We hope the experiences and the technological advantages could benefit us in expanding internationally."