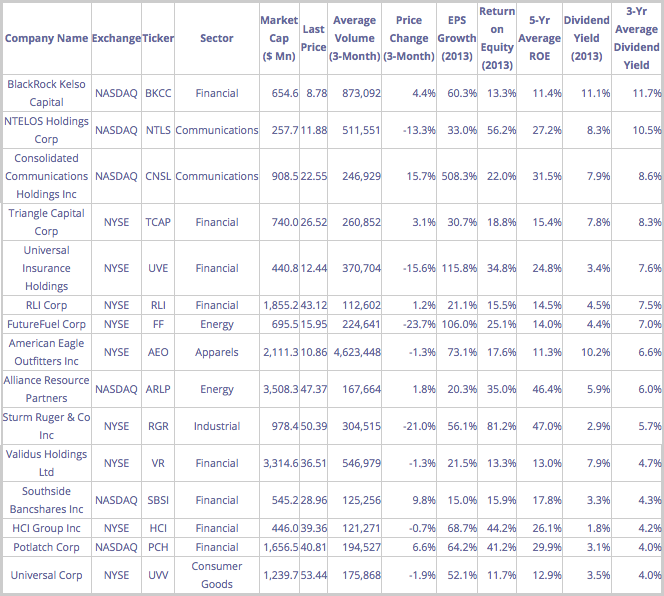

Today we have shortlisted 15 U.S. stocks across sectors with high Return on Equity (ROE) and a good dividend yield, offering a safe and sound investment opportunity. We have shortlisted companies which have a track record of offering attractive dividend yields and high ROE over the past several years. These stocks have registered an average ROE of more than 10% over the past five years and have offered average dividend yields of more than 4% in the past three years. Moreover, these stocks have recorded strong EPS growth in 2013. We note that a majority of these stocks have recorded significant price gains during the past three months with average traded volume in excess of 100,000.

Source: Bloomberg

Company Description:

- BlackRock Kelso Capital Corporation (NASDAQ:BKCC)

BlackRock Kelso Capital Corporation is an externally-managed, non-diversified closed-end management investment company that provides middle-market companies with a wide range of financing solutions. The company's solutions include senior and junior secured, unsecured and subordinated debt securities and loans, and equity securities. - NTELOS Holdings Corp (NASDAQ:NTLS)

NTELOS Holdings Corp. is a regional provider of digital wireless communications services to consumers and businesses primarily in Virginia and West Virginia, as well as parts of Maryland, North Carolina, Pennsylvania, Ohio and Kentucky. The company's primary services are wireless voice and data digital personal communications services. - Consolidated Communications (NASDAQ:CNSL)

Consolidated Communications Holdings, Inc. offers telecommunications services. The company offers local and long distance telephone, digital telephone, high-speed Internet access, and digital television services to individuals and businesses in Illinois, Pennsylvania, and Texas. - Triangle Capital Corporation (NYSE:TCAP)

Triangle Capital Corporation is a finance company that provides financing solutions to lower middle market companies located throughout the United States, with an emphasis on the Southeast. The company invests primarily in senior subordinated debt securities secured by second lien security interests in portfolio company assets, coupled with equity interests. - Universal Insurance Holdings Inc (NYSE:UVE)

Universal Insurance Holdings, Inc. operates as an insurance holding company specializing in homeowners' insurance products. The company, through its subsidiaries, offers insurance underwriting, distribution, and claims processing. - RLI Corp (NYSE:RLI)

RLI Corp., through its subsidiaries, underwrites selected property, casualty, and surety insurance products. The company's principal subsidiary, RLI Insurance Group, provides specialty property and casualty coverages for primarily commercial risks. - FutureFuel Corp (NYSE:FF)

FutureFuel Corporation produces biobased products, including biofuels, (biodiesel, bioethanol and lignin/biomass solid fuels) and biobased specialty products (biobased lubricants, solvents and intermediates). FutureFuel also has a chemicals and lithium ion business. - American Eagle Outfitters Inc (NYSE:AEO)

American Eagle Outfitters, Inc. retails men's and women's casual apparel, footwear, outerwear, and accessories. The company's products include jeans, khakis, T-shirts, and other similar apparel. American Eagle operates in the United States. - Alliance Resource Partners LP (NASDAQ:ARLP)

Alliance Resource Partners, L.P. produces and markets coal to United States utilities and industrial users. The company operates its facilities in Kentucky, Illinois, and Maryland. - Sturm Ruger & Company Inc (NYSE:RGR)

Sturm Ruger & Company Inc. designs, manufactures, sells, and exports firearms. The company produces rifles, shotguns, pistols, and revolvers. The company also manufactures titanium and ferrous investment castings utilized in a wide variety of markets including sporting goods and other military uses. - Validus Holdings Ltd (NYSE:VR)

Validus Holdings, Ltd. is a Bermuda-based reinsurer. The company concentrates on property risks and other reinsurance lines. - Southside Bancshares Inc (NASDAQ:SBSI)

Southside Bancshares, Inc. is a holding company for Southside Bank. The Bank offers a full range of financial services to commercial, industrial, financial, and individual customers, including loans, equipment financing, real estate lending, trust services, and other services through offices in eastern Texas. - HCI Group Inc (NYSE:HCI)

HCI Group, Inc. offers property/casualty insurance. The company offers homeowners', condominium owners', and tenants' insurance. - Potlatch Corporation (NASDAQ:PCH)

Potlatch Corporation is a company that owns timberlands in Arkansas, Idaho, Minnesota and Wisconsin. The company grows and harvests timber, as well as manufactures and sells wood products, printing papers, and other pulp-based products. Potlatch Corporation files as a REIT for Federal Income Tax purposes. - Universal Corporation (NYSE:UVV)

Universal Corporation is an independent leaf tobacco merchant. The company has additional operations in agri-products and the distribution of lumber and building products. Universal sells primarily flue-cured and burley tobaccos to manufacturers located throughout the world.