Annaly Capital Management (NLY -2.28%) is a favorite among dividend investors seeking high yields, and it's easy to see why. The stock currently has a dividend yield higher than 11%, and trades at a substantial discount to its book value.

However, when it comes to dividend investing, high yields aren't the only important factor you need to consider. You should ask yourself how safe the dividend is, and whether or not it's likely to grow in the future.

With that in mind, here are three dividend stocks that our analysts think are better choices than Annaly.

Dan Caplinger: Annaly has one of the highest dividend yields in the market, but the business of leveraged investing in mortgage-backed securities has a lot of interest-rate risk. By contrast, Ford Motor (F -3.01%) is in a very different business, and while it has its own cyclical components, it's firing on all cylinders right now, with the release of its new aluminum-body F-150 pick-up truck going extremely well out of the gate.

Right now, Ford sports a generous yield of 3.8%, but I'm confident that the company will find even more room for dividend growth in the future -- in stark contrast to Annaly's consistent declines in payouts during the past several years. Just earlier this month, rival General Motors (GM -0.91%) found room to boost its dividend by 20%, with the strength of the auto industry giving it the financial latitude to be more aggressive in returning shareholder capital.

If anything, Ford appears to be in an even more promising position, with new product releases that could make it a stronger competitive threat to GM and its other peers. Ford just made its own 20% dividend boost earlier this year, but as long as auto sales keep soaring, the Blue Oval will have a good shot at giving shareholders even more money in the future.

Jason Hall: It may sound like I'm insulting your intelligence to suggest Visa Inc (V -1.70%), which pays a 0.75% yield, while Annaly's is 11%. However, if you're not looking for income today, but getting the best total return, Visa is a superior long-term investment.

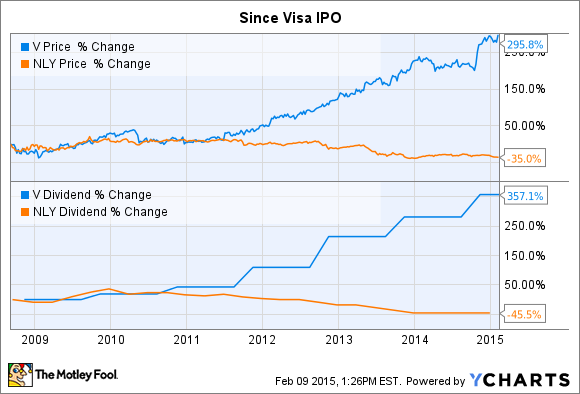

Since Visa went public in 2008, the company has regularly increased its dividend payout, while also seeing its stock price soar:

At the same time, Annaly's stock has fallen 35%, and the dividend has been slashed. Annaly -- and its other mortgage REIT brethren -- are entering into an environment where rising interest rates will create a lot of headwinds. In short, it's possible that Annaly will be forced to further cut its payouts, and this will likely drive its stock price lower at the same time.

Visa, on the other hand, is firmly entrenched as one of the most dominant players in global financial transactions. Factor in a world that's increasingly using technology like mobile phones as ways to make purchases, and Visa's role as the facilitator of moving money from the buyer to the seller is only going to become more important.

While its yield is much lower, Visa has been a much better investment than Annaly during the past five years. The evidence supports that trend continuing for the foreseeable future.

Jordan Wathen: One of the biggest risks with high-dividend stocks, particularly mortgage REITs like Annaly, is that rising rates will cripple their income stream. Mortgage REITs generally finance their mortgages with short-term "repo" financing, the cost of which is hinged directly to short-term interest rates dictated by the Federal Reserve.

If you own a mortgage REIT, it may be wise to hedge your bet on short-term rates. A company like Federated Investors (FHI -1.88%) serves this purpose well.

Federated Investors is an asset manager. It earns fees for managing everything from stock and bond funds to money market funds for institutions and individuals alike. It's a very good business -- as asset prices go up over time, so does its lucrative stream of management fees. But there is only one problem: Because of low interest rates, Federated Investors has been waiving fees on its money market funds, which make up nearly 70% of its managed assets.

Should short-term rates rise, Federated Investors can turn on its profit switch and begin collecting fees on billions of dollars of money market fund assets it currently manages for free. Doing so would send profits surging by more than 55%, or about $85 million, compared to earnings in the last 12 months.

That may be an extreme example; it's more likely that the company would slowly roll back its fee waivers with each uptick in rates. Even still, with a dividend yield of about 3%, you'll get paid to wait, while holding onto an excellent hedge against interest rate risk inherent in the mREIT business model.