By: Richard Cox

In currency markets, the driving factor continues to be the changing policy stance that we have seen in the US Federal Reserve. Broad economic data in most regions of the world (with China and the Eurozone being notable exceptions) has been positive and stable. In the US, this means that the Fed has been given increased flexibility to start removing monetary stimulus. Commentaries made by voting members at the Fed have essentially confirmed that this will continue to the case, and that the central bank’s historic quantitative easing (QE) programs will soon be completely phased-out.

For forex traders, this is a positive scenario for the US Dollar. For investors looking to gain exposure to Dollar-backed assets, long views can also be expressed using instruments like the PowerShares DB US Dollar Index Bullish ETF (UUP).

Potential Scenarios in the Euro, British Pound

Of course, currency traders that are looking to obtain long exposure in the greenback will need to find currencies to short in order to fund the position. From a contrarian standpoint, two of the best options here can be found in the Euro, and in the British Pound. Both currencies have seen significant rallies so far this year and whether or not this sizable momentum can continue is highly questionable. Additionally, both of these currencies (as measured in the EUR/USD and GBP/USD forex pairs) have risen to significant long-term highs that should start to stall gains in coming weeks.

This does not suggest that we will not see additional gains in both of these pairs -- or even an advance to new highs for the year. But it does mean that potential upside remains limited, and that there are much better values out there for traders that are looking to establish new long positions. “In recent weeks we have started to see a more protective stance from the European Central Bank,” said Rick Bartlett, markets analyst at CornerTrader. “Ultimately this means we could continue to see further policy easing at a time when the Federal Reserve is actually moving in the opposite direction.” Most directly, these divergent policy moves should begin to create bearish momentum in the EUR/USD and in the CurrencyShares Euro Trust ETF (FXE), as traders start to favor the US Dollar and Dollar denominated assets.

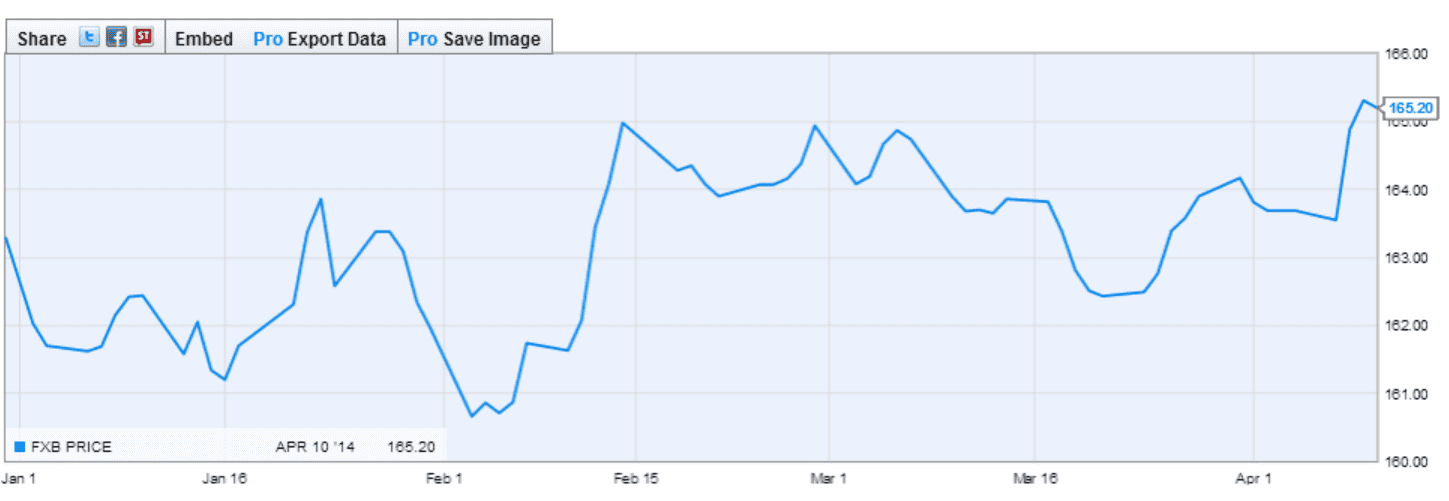

Chart Perspective: FXB

For those with more of a strategy that is based on technical analysis some of the best selling opportunities might be found in the British Pound. The Guggenheim CurrencyShares British ETF (FXB) tends to be one of the best ways to gauge the Pound’s performance relative to most of its commonly traded counterparts. Recent moves here have risen firmly into oversold territory as measured by a number of key indicators and the GBP/USD should start to meet psychological selling pressure as we start to move into the 1.70 handle. In terms of risk to reward ratios, assets tied to the British Pound offer some of the best opportunities for bearish traders -- both from a technical and fundamental standpoint.