By Sarah Roden

Following the annual J.P. Morgan Biotech Napa Forum, analyst Cory Kasimov offered commentary on a handful on biotechnology stocks. From a macro point of view, Kasimov found that other investors’ presentations at the forum were “quite constructive and focused on specific ideas” despite recent volatility in the sector. Although the media continues to highlight the biotech “bubble,” the consensus of the analysts “seemed to be that the notion is generally misplaced.” Here are the primary takeaways Kasimov offered on his top three near-term ideas:

Bluebird bio Inc (NASDAQ:BLUE):

As one of Kasimov’s three top near-term ideas, the analyst focused on the future of BLUE’s LentiGlobin gene therapy for sickle cell disease. Bluebird is currently sponsoring a Phase 1/2 clinical trial for the drug in France as well as initiating a separate study in the United States. Last year, BLUE presented data supporting the safety and efficacy of the drug. After meeting with Bluebird executives, Kasimov noted that the date of the “highly anticipated” sickle cell disease treatment update remains unknown. Going forward with testing, “the impact on blood transfusions will also be important to monitor, but investors must understand that the process of treating [sickle cell disease] can meaningfully differ from a B-Thal,” which has already been proven to help.

Cory Kasimov currently has an Overweight rating on Bluebird bio. He has rated the company 3 times since July 2013, earning a success rate of 67% and a +18.7% average return per BLUE rating.

On average, the top analyst consensus for BLUE on TipRanks is Strong Buy.

BioMarin Pharmaceutical Inc (NASDAQ:BMRN):

Biomarin is also one of Kasimov’s three top picks because he considers the stock to be “uniquely positioned in biotech with an established and growing commercial portfolio, a broad and compelling late-stage pipeline, and an orphan disease focus.” Kasimov’s meeting with executives focused on BMN 111 and drisapersen for muscular dystrophy. BMN 111 is a therapy for achondroplasia, the most common form of dwarfism. The therapy is currently in Phase 2 testing and data should be available later this quarter. Separately from BMN 111, drisapersen should be filed in the U.S. this quarter, in which case there will be a new review timeline for the drug. Kasimov added, “Despite equivocal Phase 3 data, [management] remains optimistic [about drisapersen] given the high unmet need, mechanistic rationale, favorable long-term ambulation data from multiple trials, and regulatory precedent in orphan indications.”

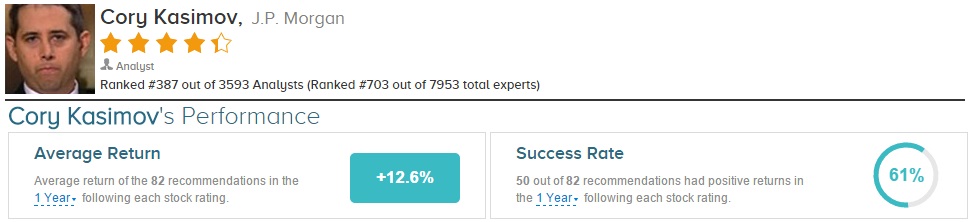

Cory Kasimov currently has an Overweight rating on BioMarin. He has rated the stock 2 times since February 2015, earning a 100% success rate recommending it with a +21.8% average return per BMRN recommendation.

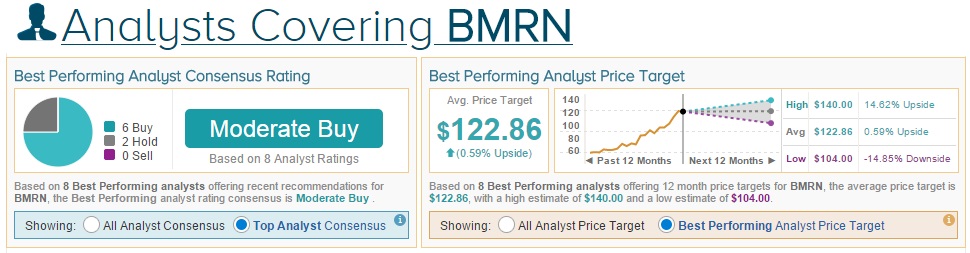

On average, the top analyst consensus for BMRN on TipRanks is Moderate Buy.

Clovis Oncology Inc (NASDAQ:CLVS):

Kasimov highlighted Clovis as one of his top three picks “as the only company of its size with two (wholly owned, late stage) products with [break through designation].” Management was “clearly optimistic” about both rociletinib and rucaparib. Rociletinib, currently being tested for treatment of non-small cell lung cancer, was granted break-through therapy designation by the FDA. For rociletinib, Kasimov noted, “there will be substantially more patients in the [American Society of Clinical Oncology] data (relative to the fall update), but it’s hard to think that anything will change too much from prior presentations.” There has also been a recent interest in rucaparib; a treatment in testing for tumors in ovarian and pancreatic cancer.

Cory Kasimov currently has an Overweight rating on Clovis Oncology. He has rate the stock 3 times since June 2013, earning a 67% success rate recommending it with an 11.6% average loss per CLVS recommendation.

On average, the top analyst consensus for CLVS on TipRanks is Moderate Buy.

Overall, Cory Kasimov has a 61% success rate recommending stocks and a +12.6% average return per recommendation.

To see more rating by Cory Kasimov, visit TipRanks today.

Sarah Roden writes about stock market news. She can be reached at Sarah@tipranks.com.