Marcellus | E&P | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Appalachia Natural Gas Output Still On Pace to Increase, Despite Lower Capex, Shut-Ins

The combination of lower capital spending, shut-ins and even a shift to other plays won’t deter natural gas production from escalating in the Appalachian Basin this year, according to data compiled by NGI’s Shale Daily.

Gas drilling in the U.S. onshore has been on a downward trend for about three years, off to date this year about 25% from a year ago. For the week ending March 13, there were about 257 gas rigs total operating across the country, versus 344 in 2014. The Marcellus Shale by itself has lost about 15 active gas rigs.

However, production growth from the Marcellus, and to a lesser extent the Utica Shale, highlights how efficiencies in drilling techniques and low operating costs are overcoming the energy industry downturn.

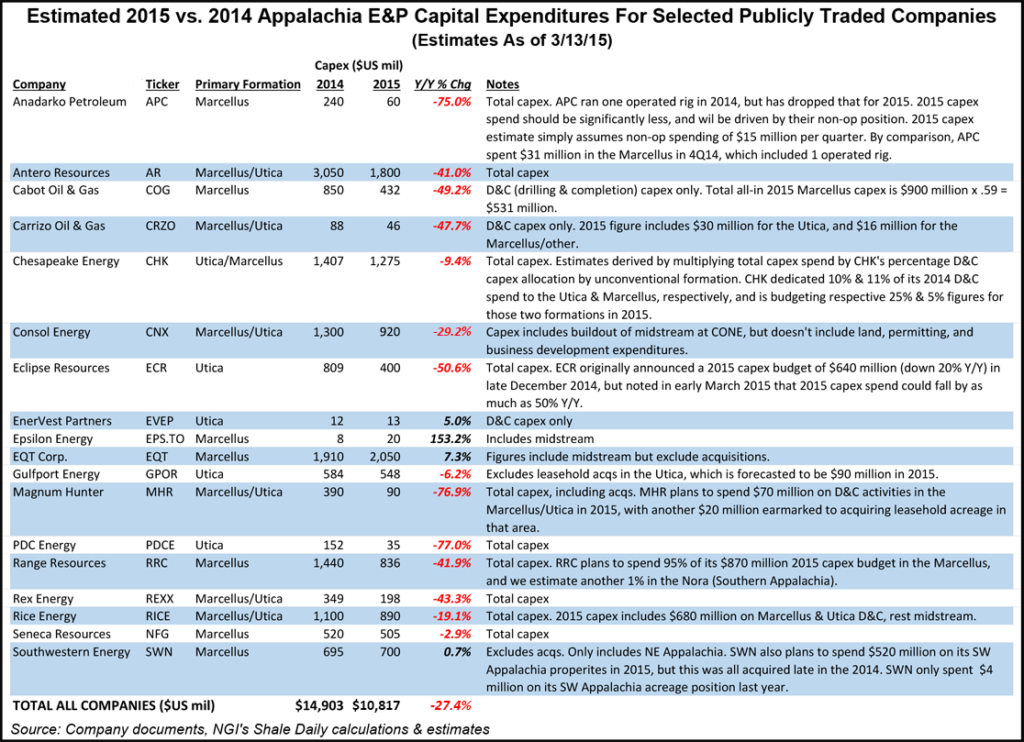

NGI’s Shale Daily research shows capital expenditures (capex) this year by 18 of the biggest independent producers in Appalachia are going to decline by an estimated 27.4% from 2014. Range Resources Inc., one of the biggest producers in the Marcellus, has cut its capex by almost 42%. Cabot Oil & Gas Corp. has knocked 49% from its spending plans.

Producers also are reining in output. Chesapeake Energy Corp., which has shut in 250 MMcf/d through this year, plans to spend an estimated 9.4% less in the combined Utica/Marcellus (see Shale Daily, Feb. 25). National Fuel Gas Supply Corp.’s exploration arm Seneca Resources Corp. also has shuttered around 200 MMcf/d in the Northeast, said Genscape Inc.’s Randall Collum, managing director of supply analytics.

“We have seen drilling declining but production is still growing quite a bit,” Collum told NGI’s Shale Daily. By Genscape’s estimates, producers have shut in close to 500 MMcf/d from the Marcellus region since December, production that isn’t expected to return before the end of this year. However, “we’re not seeing a decline in production whatsoever.”

Genscape tracks close to a dozen producers in the Northeast, which together have indicated they “are growing plus-3 Bcf/d from the Marcellus and the Utica this year, year-on-year,” Collum said. That pace is strong, but “we do have it slowing down toward the end of the year from the Marcellus.”

Lower 48 gas production — anchored by Appalachia — is expected overall to peak in the second quarter and early into the third quarter, then slightly decline through the rest of this year, with a bigger impact into 2016, according to Genscape. For the rest of the country, one reason for the slower growth is going to be a decline in associated gas from oil drilling. Associated gas, however, isn’t much of a factor in Appalachia, which allows Genscape to clearly see the gas growth trend. “Gas in the Marcellus was driven by liquids pricing, but that’s not associated gas,” Collum said.

Rig Count Spirals Lower

The production boost is coming even on a steep gas rig decline, according to Tudor, Pickering, Holt & Co. (TPH). The Marcellus had 91 gas rigs running last August, and as of March 15, there were 60. Utica drillers had 40 rigs in operation, but there were 33 running in mid-March. Gas production still won’t take much of a hit.

The dropped rigs may impact the rate of growth, but it’s still there. TPH is projecting full-year 2015 Marcellus output of about 14,550 MMcf/d, versus 12,793 MMcf/d in 2014. Utica gas output is seen escalating to around 2,789 MMcf/d from 1,613 MMcf/d. In 2016, production in Marcellus is forecast to be 15,854 MMcf/d, while the Utica bumps up to about 3,586 MMcf/d.

Through the first nine months of this year, Northeast gas is on the rise, TPH analysts said. “Names we track account for approximately 80-85% of supply. We are factoring in moderate amounts of shut-in production, in line with company guidance, but bias is to the downside as producers may curtail additional volumes.”

Another way to look at the growth in Appalachia is through permitting, said Wunderlich Securities Inc. analyst Irene Haas. The Marcellus is holding steady permit-wise, and the Utica appears to be making a comeback in gas drilling.

“The surprising thing is, the Marcellus is holding up really well and the Utica is coming back a little bit,” she told NGI’s Shale Daily. “This pullback hasn’t really impacted the pure-plays, the dry gas, wet gas in Marcellus, partly because people are so used to low prices.”

Permits on the Rise?

Wunderlich analysts tallied permits for the Utica-Point Pleasant trend of Ohio in Belmont, Carroll, Guernsey, Harrison, Monroe and Noble. Permits in those counties increased to 95 in February from 79 in December.

“The new player in town, privately held American Energy Partners, continues to permit the heaviest, especially in Belmont, Guernsey and Harrison counties,” Haas said of the Aubrey McClendon-led enterprise. A “significant number of permits” also were pulled by Chesapeake, Antero Resources Corp., Eclipse Resources Corp., Consol Energy Inc. and Gulfport Energy Corp. “Missing from the picture is Rice Energy. Back in December, Rice was one of the most permitted Utica companies, but we haven’t seen anything in the last two months.”

Permitting figures also were tallied in Pennsylvania’s Greene and Washington counties, as well as West Virginia’s Doddridge, Marshall, Tyler and Wetzel counties “to capture the Marcellus wet gas epicenter,” Haas said. “We also looked at Susquehanna County, PA, which represents the Marcellus dry gas in Pennsylvania. The wet gas play has stayed remarkably stable and is even slightly up with 123 permits in February compared with 115 in November.

“In the West Virginia portion of the wet gas play, we’re seeing strong permitting by EQT Corp. and Noble Energy Inc. as well as Antero Resources, Consol, Southwestern Energy Co. and American Energy-Marcellus, although in lesser numbers. In the Pennsylvania portion of the Marcellus wet gas, we’re seeing strong permitting activity from a number of companies including Range Resources, EQT, Rice Energy, and Vantage Energy Inc.”

Capex Decline Does Not Equal Production Drop

NGI‘s Patrick Rau, director of strategy and research, said there are several reasons Marcellus/Utica production won’t decline.

“Companies are still guiding to robust natural gas production growth for 2015 out of the Marcellus and Utica, despite lower capex in the region,” he said. Based on some “back of the envelope calculations…it looks like Antero Resources, Cabot Oil & Gas, Chesapeake, Consol Energy, Eclipse Resources, EQT, Gulfport Energy, Range Resources, Rex Energy, Rice Energy, Seneca Resources and Southwestern Energy are all guiding to higher production out of the Marcellus and Utica for 2015.”

Many operators indicated in 4Q2014 conference calls that Appalachia gas production would increase this year. Rau, who based his calculations also on total company guidance as a group, said producers expect to increase gas output in the region by at least double-digits from 2014.

“I estimate that the group combined for more than 60% of total natural gas production out of the Marcellus and Utica in 2014, so it’s hard to envision 2015 Appalachia production falling in this scenario.”

Even with a dramatic cut to capex, the exploration and production companies “are well hedged for 2015,” Rau said. “Typically, companies hedge 40-50% of their production, but some heavy hitters in the Appalachia are pretty well hedged for 2015. For example, Antero Resources is 94% hedged for its 2015 production guidance, Rice Energy has 84% of its 2015 expected production hedged at a weighted average floor of $3.50/MMBtu, and Range Resources has more than 60% of its 2015 expected natural gas production at a weighted average floor of $4.00/MMBtu.

“Second, there’s always a lag between rigs falling and production declines,” and a lot of wells still are coming online. “Third, current prices may be deterring drilling and completion activity, but the cash costs for production in the Marcellus in particular are pretty low. For example, I estimate that Range Resources’ cash cost of production during the 4Q2014 in the Marcellus was just $1.20/Mcfe, and many companies have enough firm transportation to move gas out of the Marcellus into higher-priced regions, thus enhancing their short-term returns.”

Rau said “simple math shows that 2015 Marcellus/Utica production should be up” from 2014 in part because production is tracking to grow more than 20% y/year through April. “It should take several more months to start seeing any y/y declines in 2015, if we see any at all, so in aggregate, 2015 production should be higher than 2014.”

Appalachia Supply Could Decline into 2016

Teri Viswanath, who directs natural gas strategy for BNP Paribas, isn’t as sure about how much gas growth there will be from Appalachia. A lot of supply still waits tie-ins to infrastructure, which means producers could increase gas output without drilling any wells. Large infrastructure projects completed over the course of 2014 led to “a lot of enthusiasm about production toward the end of last year,” she told NGI’s Shale Daily. Output in the region was up more than 7 Bcf/d in December y/y. Since then, production “has begun to trend down based on pipeline receipts.” It’s a cat-and-mouse game, dependent on infrastructure — and prices.

Going into 2016, gas production growth from Appalachia “looks dicier,” Rau said. “No. 1, we’ll start seeing the impact of dropped rigs in the second half of 2015, and second, since the first half of 2015 at least should continue to see healthy production growth, that means y/y growth will be that much more difficult to achieve in 2016.” In addition, “there’s going to be another round of bank revolving credit facility redeterminations in October 2015, and many producers won’t be nearly as well hedged going forward at that point; the amount that companies in aggregate have hedged two years out is typically lower than one year out.

“Absent a meaningful rally in natural gas prices between now and then, redeterminations will likely lower the borrowing bases on these revolvers, which in turn would reduce the amount of available capital…to deploy to the Marcellus and Utica, everything else being equal,” Rau said. First-year decline rates in unconventional wells, including in Appalachia, “are so high, oftentimes more than 50-60%,” and that means new wells would need to be drilled to keep total growth on an upward trend.

“Not enough of those new wells may get drilled because of relatively poor drilling economics,” Rau warned. He referred to a Barclays Capital analysis this month that indicated the mid-cycle breakeven cost for wells across the Marcellus today is about $3.00-3.50/MMBtu, depending on liquids content, estimated ultimate recovery rates and basis differentials (See Shale Daily, March 12). “That means a lot of the Marcellus may be uneconomic to drill both today and into next year, based on current forward prices for Columbia Gas [TCO] and Dominion. Neither TCO nor Dominion prices are expected to rise above $3.00/MMBtu through the end of 2016…”

Similar to forecasts by other analysts, Rau expects to see Appalachia gas production to continue to escalate into next year, albeit at a slower rate. “Oil service costs should come down in the next few quarters, to reflect the new lower commodity price reality, and that should lower breakeven mid-cycle well costs, everything else being equal,” he said. “Second, basis differentials out of the Appalachia may improve by more than what is currently being reflected in the forward curve, as more pipeline takeaway capacity comes online.

“Third, there should be a growing backlog of drilled but uncompleted wells that producers could bring on line relatively quickly, assuming natural gas prices rebound.” Antero, for example, plans to defer 50 Marcellus well completions into 2016 “to achieve higher price realizations.” Those wells could add more than 350 MMcf/d of gross production by the end of next year, according to the company’s latest investor presentation.

Weather, as usual, is a wildcard, but gas prices may be boosted by coal-to-gas switching for power generation.

“Many pundits are predicting a wave of coal-to-gas switching this summer, and the current futures curves certainly support that,” Rau said. “If nothing else, this would help keep storage in check going into the winter, at which point cold weather could take over and help drive up prices, thus enticing Appalachia producers to hook up already drilled wells. Their incremental spending needs would be much less for these wells because they are already drilled.”

A big portion of gas production in Appalachia is driven by publicly traded independents “that still have pretty aggressive long-term growth plans…Absent any real ability to control prices, the way for these operators to grow their cash flows to satisfy both equity investors (assuming they grow their cash flows while at least earning their costs of capital) and debt investors (to stay in compliance with debt covenants) is to grow production.”

Appalachia to Haynesville Migration

Viswanath noted that “a bunch of processing projects, pipeline projects this year that suggest we should be able to grow production” from Appalachia. “But you see a more cautious stance on behalf of these producers,” with one of the biggest, Chesapeake, finding “better opportunities” in the Haynesville Shale. Chesapeake is increasing its rig count in the gassy Haynesville this year because refracturing wells is proving less costly than drilling new ones in the Marcellus.

Haynesville gas production, however, “likely falls short of offsetting that slower build in the Marcellus,” Viswanath said. “Last year we were averaging almost four times the growth that we’re expecting to see this year in Marcellus.” In any case, for gas producers, it’s “definitely more of a controlled-growth story.”

Genscape’s Collum said Chesapeake would be one of the few operators that might benefit from the shift from the Northeast to Louisiana. “Chesapeake…is stating that its best economics are in the Haynesville,” Collum said. “The reason they’re saying that is because they have all that transport cost. They’ve locked in those costs and they’re paying those no matter what. So when they look at Haynesville on a forward basis, the economics are better for them. But that is not a general, blanket statement for everyone. That’s specific to Chesapeake.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |