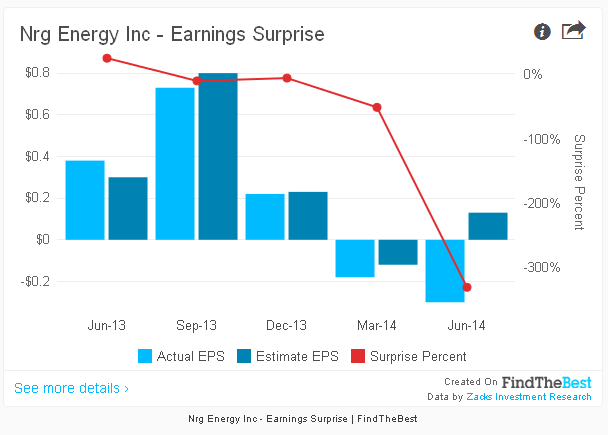

NRG Energy Inc (NYSE:NRG) reported second-quarter 2014 adjusted loss of 30 cents per share as against the Zacks Consensus Estimate of earnings of 13 cents per share. The company posted earnings of 37 cents per share in the prior-year quarter.

A significant rise in total operating costs and expenses and higher shares outstanding primarily led to the unfavorable results.

Revenue

In the second quarter, NRG Energy’s total operating revenues of $3,621 million handily surpassed the Zacks Consensus Estimate of $1,256 million. Quarterly revenues jumped 23.6% year over year primarily due to a rise in retail customer count and higher sales volumes at the thermal business.

Highlights of the Release

In the quarter under review, NRG Energy's adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) were $671 million, up 14.9% year over year on improved results from the Retail, Wholesale - West, NRG Yield and Renewables segments. These were partially offset by lower adjusted EBITDA from Wholesale - Gulf Coast, Wholesale - East and Corporate segments.

Total operating expenses surged 33.7% year over year to $3,532 million, primarily due to higher cost of operations as well as depreciation and amortization expenses.

The company’s quarterly operating income was $89 million, down 69% from $287 million a year ago.

The company incurred $274 million as interest expenses in the reported quarter compared with $206 million a year ago.

NRG Energy's free cash flow (before growth investments) in the first six months of 2014 was $286 million compared with $123 million in the prior-year period.

Business Update

On Jun 30, 2014, NRG Energy completed the first drop-down transaction with NRG Yield, Inc for a total cash consideration of $357 million.

NRG Energy has announced that it will reorganize its retail, residential solar and home product and services businesses into NRG Home and its wind, large scale solar and renewables driven microgrid businesses into NRG Renew.

Financial Condition

As of Jun 30, 2014, NRG Energy had cash and cash equivalents of $1.5 billion compared with $2.3 billion as of Dec 31, 2013.

As of Jun 30, 2014, long-term debt and capital leases were $18.2 billion versus $15.8 billion as of Dec 31, 2013.

In the first half of 2014, NRG Energy’s net cash from/ (used) by operating activities was $0.37 billion compared with ($0.08) million in the year-ago period.

In the first six months of 2014, the company invested $0.5 billion as capital expenditure, lower than the prior-year spending of $1.3 billion.

Guidance

NRG Energy reiterated its 2014 adjusted EBITDA and free cash flow (before growth investments) guidance in the range of $3,200–$3,400 million and $1,200–$1,400 million, respectively.

Other Earnings Releases

Exelon Corporation (NYSE:EXC) announced second-quarter 2014 operating earnings of 51 cents per share, surpassing the Zacks Consensus Estimate by a penny.

PPL Corporation (NYSE:PPL) reported second-quarter 2014 adjusted earnings of 53 cents per share, surpassing the Zacks Consensus Estimate of 44 cents by 20.5%.

Zacks Rank

NRG Energy currently has a Zacks Rank #4 (Sell).