AT&T and T-Mobile Maintain Customer Bases

Consumer Intelligence Research Partners (CIRP) today released analysis of the results from its research on mobile phone companies for the calendar quarter that ended September 30, 2014. This analysis features findings about consumer trends in mobile phone activations from July-September 2014.

CIRP finds that among major mobile phone companies, Verizon had the best quarter and AT&T the worst, combining retention of existing customers and gaining new customers from other carriers. Sprint performed almost as well as Verizon in the quarter, while T-Mobile did somewhat better than AT&T. Verizon had the highest loyalty rate among the four leading carriers. Sprint had the highest rate of new customer additions.

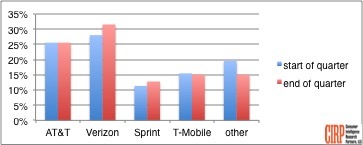

Based on our analysis of customer activations, we identify customers that renewed contracts with a previous mobile carrier, customers that switched carriers, and first-time mobile phone buyers. This analysis shows that Verizon grew its customer base 15% during the quarter, relative to the customers that started with Verizon at the beginning of the quarter (Chart 1).

We analyze loyalty and churn relative to customers at the start of the quarter. Verizon started the quarter with 28% of the consumers in our quarterly survey of phone activators, and ended the quarter with 32%. This 15% increase in share of the this quarter's phone activators suggests that Verizon added close to two million mobile phone customers in the quarter.

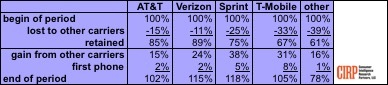

Change in share for the quarter consists of customers that switched to a carrier, minus those that switched away from that carrier. Verizon attracted new customers equal to 24% of the phone-activating customers it had at the start of the quarter. Verizon also lost 11% of its customers that activated a phone during the quarter. Verizon also attracted first-time phone buyers equal to 2% of its customers at the start of the quarter (Table 1).

Table 1: Customer Gains and Losses by Carrier - Q3 2014

Verizon had the most loyal customers in the quarter. As a percent of their base of phone-activating customers during the quarter, it did not attract as many new customers as Sprint or T-Mobile, but still attracted a higher percentage than AT&T. In contrast, Sprint attracted the highest percentage of new customers in the quarter, while also losing a greater percentage of existing customers than Verizon and AT&T. Based on these loyalty rates, we estimate that AT&T added under one-half million mobile phone customers in the quarter.

While the four leading carriers do trade customers, as a group most of their growth comes at the expense of regional and pre-paid carriers. They retained a much smaller percentage of their customer base, while attracting many fewer new customers from other carriers.

CIRP bases its findings on a survey of 500 US subjects, from October 1-13, 2014, that activated a new or used phone in the July-September 2014 period. For additional information, please contact CIRP.