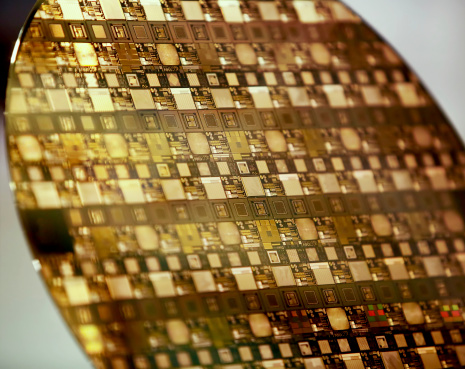

Applied Materials Inc. (NASDAQ: AMAT) will report its fourth-quarter and full-year earnings Thursday after the market close. For the fourth quarter, Thomson Reuters has consensus estimates of $0.27 in earnings per share (EPS) and $2.27 billion in revenue. In the same period of the previous year, it reported $0.19 in EPS and $1.99 billion in revenue. Source: Thinkstock

Source: Thinkstock

Investors should know that Applied Materials is the king of semiconductor capital equipment as it has a market cap of more than $27 billion.

For the full year, the consensus estimates are for EPS of $1.06 on revenue of $9.07 billion, to the previous year’s $0.59 in EPS and $7.51 billion in revenue.

Applied Materials saw its short interest in the most recent period rise slightly to 73.4 million shares from 72.3 million for the October 31 settlement date. The days to cover rose to 4.86 from the previous level of 3.42, because the average daily share volume was 15.1 million compared to the previous 21.1 million.

ALSO READ: The 5 Most Revered DJIA Stocks Since the V-Bottom

Credit Suisse upgraded Applied Materials to Outperform from Neutral less than 24 hours ahead of the earnings report, and it raised its target price to $26 from $22. Credit Suisse’s John Pitzer, explained the upgrade this way:

We are upgrading Applied Materials from Neutral to Outperform to reflect:(1) better than expected for the first half of 2015 Wafer Fab Equipment — specifically, we see >15% half over half Wafer Fab Equipment growth versus Street Consensus of 8% for Applied Materials, (2) solid risk/reward — specifically, we see fair value excluding Tokyo Electron Limited (TEL) of $23 or 16x ex-cash P/E vs. 17.6x for peers and (3) the potential for structural P/E expansion for Semiconductor Capital Equipment as Wafer Fab Equipment profile becomes more consistent/predictable and specifically for Applied as they accelerate cash returns — $908mn in last 18 months vs a potential of $5bn+ in the coming 12-24 months, with or without Tokyo Electron Limited.

Shares of Applied Materials were trading up over 1% at $22.77, approaching the noon hour Thursday. The consensus analyst price target is $24.95, and the 52-week trading range is $16.40 to $23.46.

[protected-iframe id=”95cf4ef2564e8f3aab95682bb354705f-5450697-30366712″ info=”//companies.findthebest.com/w/7Og5Vk29V0F” width=”600″ height=”400″ frameborder=”0″ scrolling=”no”]

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.