Over the course of his hockey career, Wayne Gretzky repeated several variations of a truly fantastic quote: “I skate where the puck is going to be, not where it has been.”

Gretzky attributed the quote to his father, and he credits the advice with making him the hockey legend we remember today.

Not all of us can have Gretzky’s instincts or athletic prowess, of course. But the same insights apply to the more mundane world of dividend investing. In you want to fund your retirement with a steady stream of dividends that will keep pace with inflation, you have to look beyond the current dividend yield to what the payout will be in 5 or 10 years’ time.

Inflation -- even the modest variety we have today -- is death to long-term bond returns. Your semiannual coupon payments do not change in dollar terms over the life of the bond, even as the value of those dollars declines every year. At the Fed’s target 2% inflation rate, your income would effectively shrink by nearly 22% after 10 years due to the compounding effects of inflation.

The same holds true of other income-paying securities, such as dividend-paying stocks, REITs, and Master Limited Partnerships. Current dividend income is an important part of your total return, but the rate at which the company boosts the payout over time will be what determines the sort of lifestyle you’ll be able to afford in retirement.

Today, we’re going to take a look at five safe, reliable REITs with a long history of raising their dividends.

Realty Income

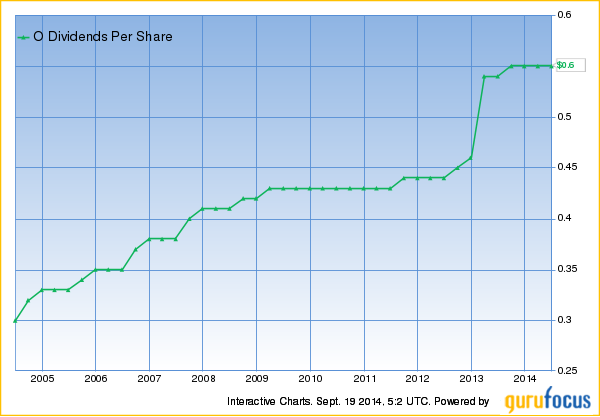

I’ll start with a REIT that I own personally and that—in the interests of full disclosure -- I intend never to sell in my personal account. If my children take my advice, they will gift my shares to their own children someday. Realty Income Corporation (NYSE:O) is a “triple-net” retail REIT, meaning that its tenants are responsible for paying all taxes, insurance and maintenance. Realty Income only responsibility is to collect the rent -- and to acquire new properties, of course.

Realty Income is known as the Monthly Dividend Company, and for good reason. At current prices, it yields an attractive 5.3%. It has paid 530 uninterrupted monthly dividends and has raised its dividend 77 times since 1994. It’s grown its dividend at a 5.3% annualized clip over the past three years, and its 10-year “yield on cost,” (i.e. the current payout divided by a hypothetical purchase price ten years ago) is a whopping 8.6%.

Realty Income’s track record has proven it to be a reliable payer with a long history of keeping pace with inflation. The fact that the REIT pays its dividend monthly rather than quarterly is a nice bonus as well, as most of our living expenses in retirement will come on a monthly schedule.

National Retail Properties

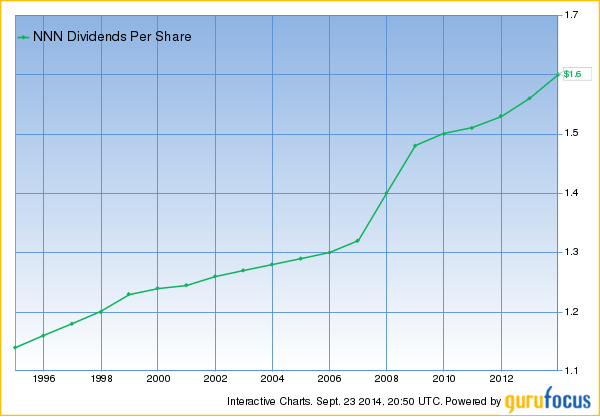

Next on the list of retirement REITs is a close competitor of Realty Income, National Retail Properties (NYSE:NNN). Like Realty Income, National Retail is a triple-net retail REIT, hence its ticker symbol. “NNN” represents “triple net.”

Also like Realty Income, NNN has been a serial dividend raiser over the years. The REIT has raised its dividend for 24 consecutive years and counting -- the 4th longest run among public REITs. NNN sports a current dividend yield of 4.7%, and its payout is plenty safe. Its five-year annualized dividend growth rate is modest, at 1.6%. But remember, that time period includes the aftermath of the 2008-2009 meltdown, a period in which a lot of REITs actually cut their dividends.

National Retail Properties and Realty Income invest in the same basic types of properties. Your local Walgreen (NYSE:WAG) pharmacy is a perfect example: a free-standing building in a high-traffic area rented under a long-term lease by a high-quality tenant. These are properties that you can safely bet your retirement on.

LTC Properties

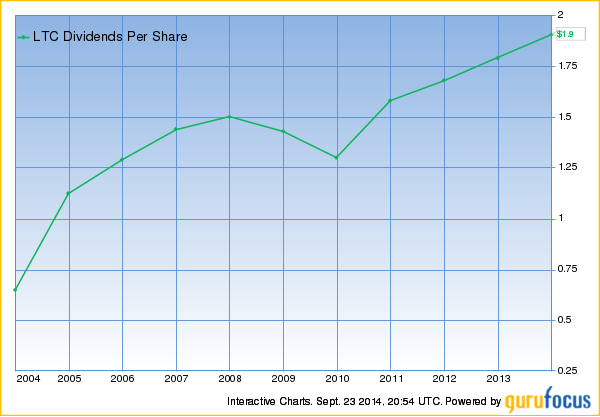

Next up: LTC Properties Inc (NYSE:LTC), a REIT I highlighted in Retirement REITs Poised To Profit From The Graying Of America. is a real estate investment trust that invests primarily in the long-term care sector of the health care industry, including long-term care provider properties, skilled nursing properties, assisted living properties, independent living properties and memory care properties. LTC also invests in first-lien mortgages secured by long-term care properties.

LTC’s monthly dividend works out to a current yield of 5.4%, making it competitive with other medical REITs. LTC is also a relatively small REIT with a market cap of just $1.34 billion. I like that because smaller REITs can generally grow their portfolios -- and their dividends -- at a faster rate than their lumbering, large-cap cohorts.

LTC has raised its dividend at an annualized 9.3% clip over the past five years, and its five-year yield on cost is a mouth-watering 8.4%.

Retail Opportunity Investments

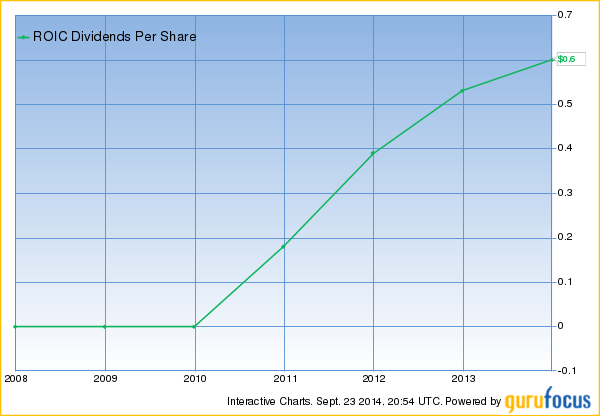

Another young REIT showing excellent dividend growth is Retail Opportunity Investments (NASDAQ:ROIC).

ROIC has a simple enough business model: The company buys neighborhood shopping centers, generally anchored by a “necessity-based” retailer such as a major grocery store. The REIT currently owns and operates fifty-nine shopping centers encompassing approximately 6.9 million square feet.

ROIC has been a dividend-raising monster over its short life. Since initiating a $0.06 quarterly dividend in 2010, ROIC has raised its dividend eight times to $0.16. Its three-year annualized dividend growth rate is an incredible 49.4%, and its three-year yield on cost is an almost too-good-to-be-true 14.0%.

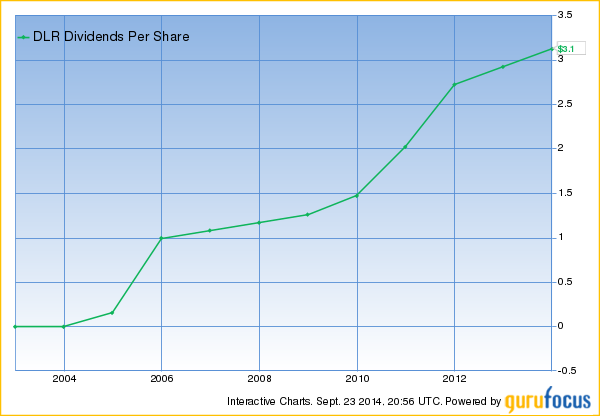

Digital Realty Trust

Finally, we come to datacenter REIT Digital Realty Trust (NYSE:DLR). If you don’t know what a “datacenter REIT” is, here is a nice, concise explanation: They charge rent to companies to house their servers. The popularity of smartphones and tablets and the rise of “the cloud” for data storage and processing will continue to boost demand for server resources. I am reluctant to recommend a long-term position in Facebook (NASDAQ:FB) or Twitter (NYSE:TWTR) because social networking is changing quickly and it’s impossible to know in advance who the ultimate winners will be. But with an investment in a datacenter REIT like Digital Realty, it doesn’t matter. You stand to profit from the underlying trend -- the increased need for remote computing power in the age of hyperconnectivity.

Digital Realty yields an attractive 5.2% and has been growing its payout at an annualized 20.6% clip over the past five years. Your yield on cost here would be 13.3% over the past five years…and a mind-blowing 61.9% over the past 10.

This article first appeared on InvestorPlace.

Charles Lewis Sizemore, CFA, is the chief investment officer of the investment firm Sizemore Capital Management.