By Carly Forster

Apparel retailer Urban Outfitters (NASDAQ:URBN) (NASDAQ: URBN) plummeted almost 17% in trading on Tuesday, May 19 after the company posted disappointing first quarter earnings.

Prior to its Q1 results, investors were starting to gain hope in Urban Outfitters as its sales for the company’s name brand were beginning to pick up after three quarters of profit declines. In its Q4 results, the Urban Outfitters brand had a 4% growth in comparable sales in addition to an increase in sales at its sister brands; 6% at Anthropologie and 18% at Free People.

Urban Outfitters missed Q1 expectations all across the board. The retailer posted $0.25 earnings per share, missing Wall Street’s consensus of $0.30 by five cents. Revenue was about $20 million below Wall Street’s expectations, coming in at $739 million.

Urban Outfitters struggled to maintain name brand sales in the past because the company’s core customer base consists of shoppers ages 14 to 17, who cannot always afford premium pricing. The company has been diligently working to expand the age range of its core customers from 18-28 in an effort to improve sales. However, now it seems that premium pricing on all of Urban Outfitters clothing brands is driving its core customers between the ages of 18-28 away to its competitors like Forever 21 and H&M, which both have lower prices.

The company’s Anthropologie brand also had a surprising slowdown in sales in the month of April, with its comparable sales only increasing 1%. Comparable sales for the Urban Outfitters brand and Free People increased 5% and 17%, respectively. Urban Outfitters said it is unsure of what level of markdowns Anthropologie will receive in the second quarter.

In its Q1 conference call, Urban Outfitters CFO Francis Conforti addressed the company’s premium pricing and said they “insufficiently address[ed] [their] more casual customer.” Conforti said Urban Outfitters’ insufficiency is “certainly correctable, if not downright avoidable.” He added “In comparison to the styling misses in dresses, accessories has underperformed to the sizeable opportunity we have to participate in our customer’s purchasing of accessories. We have adjusted the team and the strategy and look for improvement in the back half of the year and continued expansion of accessories in the future.”

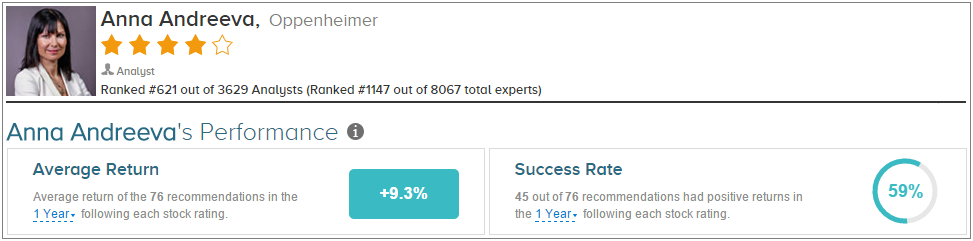

According to Smarter Analyst, Oppenheimer analyst Anna Andreeva weighed in on Urban Outfitters on May 19, downgrading her rating on the stock from Outperform to Perform and cutting her price target from $44 to $35. Andreeva believes the nice increase in Urban Outfitters’ comparable sales was “offset by fashion misses at [Anthropologie] causing both sales and margin miss in 1Q15.” She added “While May improved… this is likely driven by step-up in promotions/marketing shift; given top-line misses at department stores, backdrop for women’s apparel is becoming more competitive.”

Overall, Andreeva has a 59% success rate recommending stocks and a +9.3% average return per recommendation.

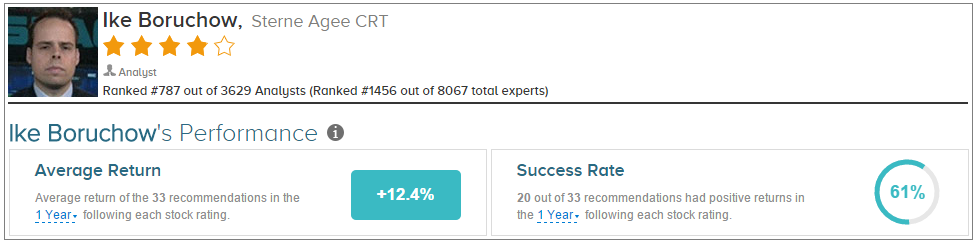

Stern Agee analyst Ike Boruchow also weighed in on Urban Outfitters on May 19 with a Neutral rating while lowering his price target from $46 to $34. The analyst noted, “While the UO turn is gaining more credibility, the market is likely to focus on the sudden slowdown at the high-margin Anthro business, and with 2H guidance implying a meaningful improvement in margins, it is difficult to get comfortable with the direction of EPS here.”

On average, Boruchow has a 61% success rate recommending stocks and a +12.4% average return per recommendation.

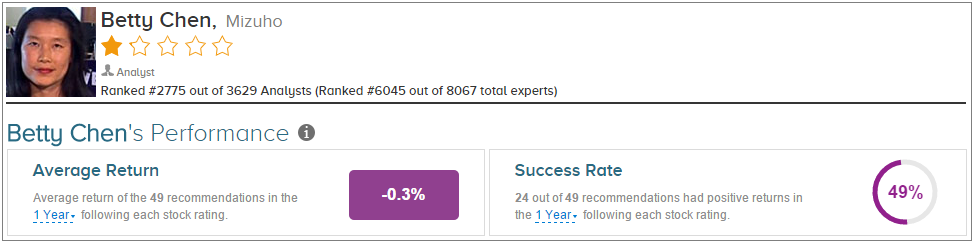

On the other hand, Mizuho analyst Betty Chen reiterated a Buy rating on Urban Outfitters with a price target of $36. Overall, Chen has a 49% success rate recommending stocks and a -0.3% average loss per recommendation.

On average, the top analyst consensus for Urban Outfitters on TipRanks is Hold.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Urban Outfitters Stock Plummets 17% on Earnings Miss

Published 05/20/2015, 08:35 AM

Updated 05/14/2017, 06:45 AM

Urban Outfitters Stock Plummets 17% on Earnings Miss

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.