Is Polkadot a good investment now? Let’s check up on its potential in the Web3 landscape.

The Polkadot (DOT 5.55%) cryptocurrency is having a tough time. The official blockchain ecosystem of the Web3 Foundation uses this digital token for governing functions, staking, and parachain operations. Although the crypto is properly known as DOT, most investors just use the Polkadot name, instead.

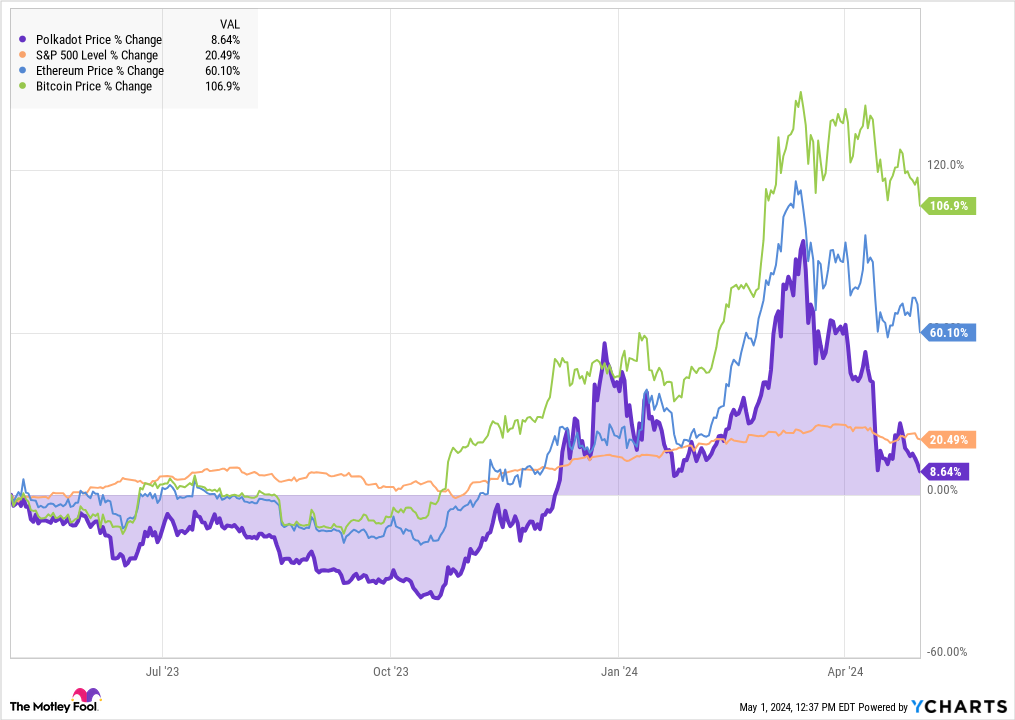

Either way, the token’s price has only increased by 9% over the last year. Over the same period, Ethereum gained 20% and Bitcoin soared 107% higher. Even the S&P 500 stock market index outperformed Polkadot, with a 21% increase in the last 52 weeks:

Polkadot Price data by YCharts.

The picture doesn’t get any brighter in a longer time frame. Polkadot’s price dove more than 80% lower in the last three years, while every alternative I mentioned earlier delivered positive returns:

Polkadot Price data by YCharts.

Does the Polkadot system have a future anymore, given the recent token-price headwinds?

The Web3 conundrum

Long story short, Polkadot’s future depends on where the Web3 vision is going from here.

The decentralized next-generation model of online content management and interaction has been slow out of the starting blocks. So far, leading Web3 apps include the privacy-focused Brave web browser, Decentraland‘s digital real estate platform, and the OpenSea trading system for non-fungible tokens (NFTs).

If none of those names ring a bell, you may conclude that Web3 is going nowhere and Polkadot will be worthless in the long run. And it’s true that even these relatively popular solutions face significant challenges. Brave’s market share is a rounding error next to Alphabet‘s Google Chrome, and NFTs aren’t popular anymore.

However, they could also be early signs of a broader Web3 surge. The social media focus of the current Web2 model seems overdue for a redesign, and Web3 ideas offer firm solutions for many real-world issues.

I see Polkadot’s price cuts as a wide-open buying window. I expect Web3 to make a heavy impact in 2024 and beyond, and Polkadot looks like a great buy today.

Anders Bylund has positions in Bitcoin, Ethereum, and Polkadot. The Motley Fool has positions in and recommends Bitcoin and Ethereum. The Motley Fool has a disclosure policy.