Commodity-based companies and associated ETFs are critically important as a gauge of economic health and demand, inflation and should be important additions to most investment portfolios. Underlying commodity prices can be affected by many factors including the level of the U.S. dollar which can depress prices when strong.

With inflation pressures waxing and waning, many believe it’s important to have exposure to commodity oriented stocks and ETFs. Nevertheless, even if underlying commodity prices rise, commodity related common stocks and linked ETFs may or may not follow suit. This makes investment timing that much more important.

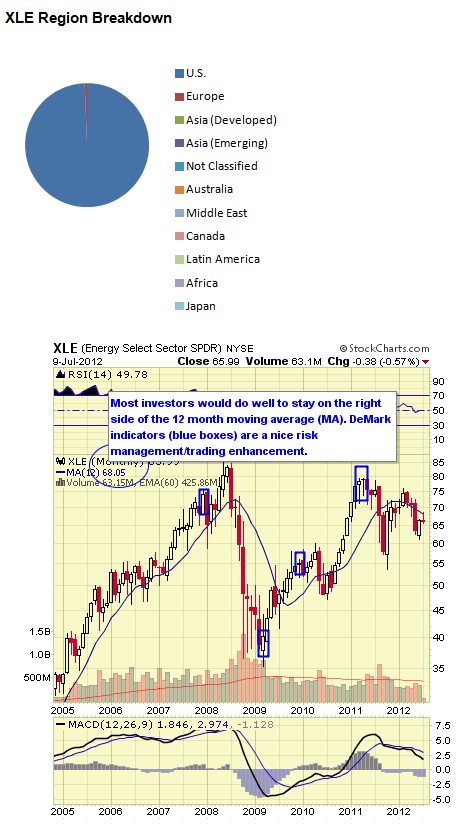

We feature a technical view of conditions from monthly chart views. Simplistically, we recommend longer-term investors stay on the right side of the 12 month simple moving average. When prices are above the moving average, stay long, and when below remain in cash or short.

Some more interested in a fundamental approach may not care so much about technical issues preferring instead to buy when prices are perceived as low and sell for other reasons when high; but, this is not our approach. For traders and investors wishing to hedge, leveraged and inverse issues are available to utilize from ProShares and Direxion and where available these are noted.![]()

CU follows the ISE Global Copper Index which is a linear weighted index following public companies in the copper mining industry based on analysis of revenue derived from the sale of copper. The fund was launched in March 2010. The expense ratio is 0.70%.

AUM equal $43M and average daily trading volume is 18K shares. As of July 2012 the annual dividend yield was 4.04% and YTD return was -11.98%. The one year return was -38.35% which makes for a year of zero returns.

Data as of July 2012

CU Top Ten Holdings and Weightings

. Xstrata PLC (XTA): 6.53%

. Southern Copper Corporation (SCCO): 6.52%

. Rio Tinto PLC ADR (RIO): 6.34%

. Jiangxi Copper Company Limited H Shares (00358): 6.07%

. Freeport-McMoRan Copper & Gold Class B (FCX): 6.01%

. Antofagasta PLC (ANTO): 5.92%

. First Quantum Minerals Ltd. (FM): 4.69%

. KGHM Polska Miedz SA (KGH): 4.33%

. Oz Minerals Limited (OZMLF): 4.32%

. Inmet Mining Corp: 4.30%

![]()

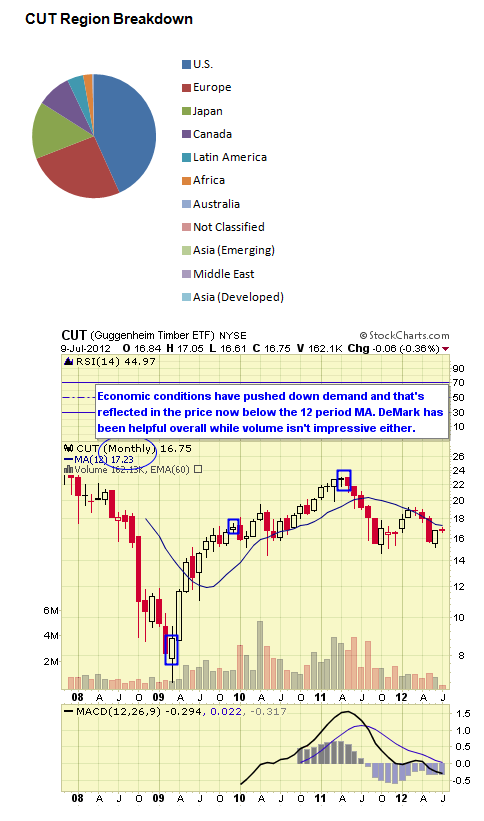

CUT which follows the Beacon Global Timber Index consisting of companies who own or lease forested land and harvest timber for commercial use of wood-based products including paper, packaging, lumber and pulp. The fund was launched in November 2009. The expense ratio is 0.65%.

AUM equal $118M and average daily trading volume is 42K shares. As of July 2012 the annual dividend yield was 2.27% and YTD return was 1.21%. The one year return was -20.37%.

Data as of June 2012

CUT Top Ten Holdings and Weightings

. Rayonier, Inc. (RYN): 5.22%

. Weyerhaeuser Co (WY): 5.04%

. Plum Creek Timber Co Inc (PCL): 4.94%

. MeadWestvaco Corporation (MWV): 4.87%

. West Fraser Timber (WFTBF): 4.86%

. Greif, Inc. Class A (GEF): 4.71%

. International Paper Co. (IP): 4.49%

. Morgan Stanley Pnote 6/23/14: 4.44%

. Domtar Corp (UFS): 4.44%

. Svenska Cellulosa AB (SCA B): 4.40%

![]()

WOOD follows the S&P Global Timber & Forestry Index which includes companies primarily engaged in ownership, management or upstream supply chain of forests and timberlands. The fund was launched in June 2008. The expense ratio is 0.48%.

AUM equal $149M and average daily trading volume is 19K shares. As of July 2012 the annual dividend yield was 2.32% and YTD return was 1.96%. The one year return was -14.87%.

Data as of June 2012

WOOD Top Ten Holdings and Weightings

. Rayonier, Inc. (RYN): 8.87%

. Weyerhaeuser Co (WY): 8.55%

. Plum Creek Timber Co Inc (PCL): 8.10%

. West Fraser Timber (WFTBF): 5.46%

. MeadWestvaco Corporation (MWV): 4.76%

. Potlatch Corp. (PCH): 4.65%

. Packaging Corporation of America (PKG): 4.27%

. Sonoco Products Company (SON): 4.21%

. Golden Agri-Resources Ltd. (E5H): 3.93%

. International Paper Co. (IP): 3.90%

![]()

HAP follows the Van Eck Hard Assets Producers Index which consists of companies engaged in the discovery, production and distribution of hard assets and related products. The fund was launched in August 2008. The expense ratio is 0.49%.

AUM equal $138M and average daily trading volume is 41K shares. As of July 2012 the annual dividend yield was 1.93% and YTD return was -0.30%. The one year return was -16.86%.

Data as of June 2012

HAP Top Ten Holdings and Weightings

. Exxon Mobil Corporation (XOM): 5.68%

. Monsanto Company (MON): 4.28%

. Potash Corporation of Saskatchewan, Inc. (POT): 3.94%

. Deere & Co (DE): 3.51%

. Syngenta AG (SYENF): 3.49%

. Chevron Corp (CVX): 2.96%

. Archer-Daniels Midland Company (ADM): 2.29%

. BHP Billiton Ltd (BHPLF): 2.21%

. BP PLC (BPAQF): 1.87%

. Mosaic Co (MOS): 1.66%

![]()

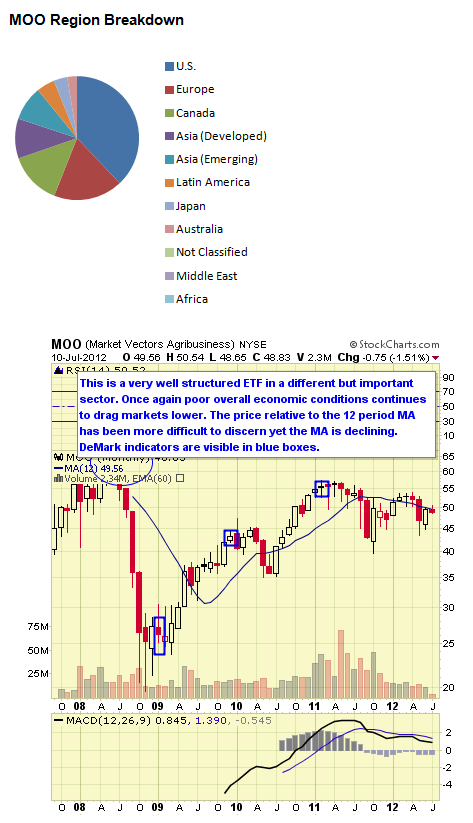

MOO follows the DAXglobal Agribusiness Index which consists of companies that derive at least 50% of their revenues from the business of agriculture. The fund was launched in August 2007. The expense ratio is 0.59%.

AUM equal $5.4Bwith average daily trading volume of 530K shares. As of July 2012 the annual dividend yield was 0.61% and YTD return was 5.45%. The one year return was -8.43%.

Data as of June 2012

MOO Top Ten Holdings and Weightings

. Monsanto Company (MON): 7.54%

. Potash Corporation of Saskatchewan, Inc. (POT): 7.39%

. Deere & Co (DE): 7.15%

. Syngenta AG (SYENF): 7.05%

. Wilmar International Ltd (F34): 5.89%

. Archer-Daniels Midland Company (ADM): 5.21%

. Mosaic Co (MOS): 4.22%

. Yara International ASA (YRAIF): 4.10%

. Agrium Inc (AGU): 4.03%

. BRF - Brasil Foods SA ADR (BRFS): 3.92%

![]()

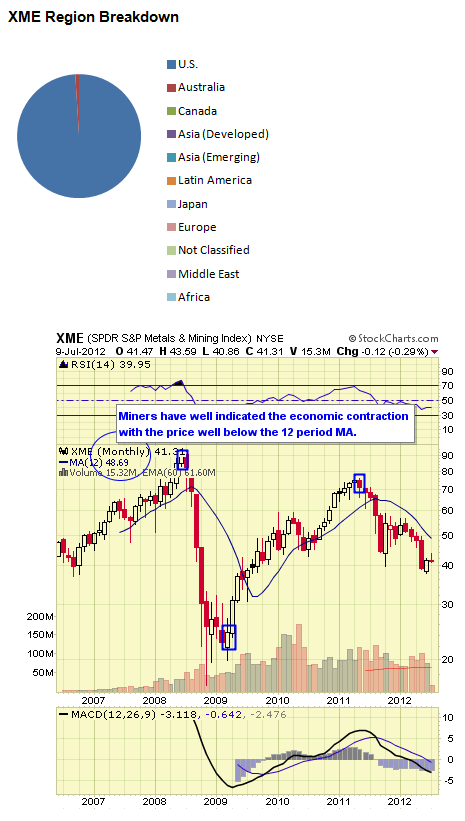

SME follows the S&P Metals & Mining Select Industry Index which includes the metals and mining sub-sector of the S&P TMI index. The fund was launched in June 2006. The expense ratio is 0.35%. AUM equal $810M and average daily trading volume is 3.8M shares. As July 2012 the annual dividend yield was 1.07% and YTD return was -14.09%. The one year return was -40.47%.

An alternative choice given similar trending characteristics is Van Eck Steel ETF (SLX) which follows the NYSE Arca Steel Index featuring companies primarily involved in the production, manufacturing, fabrication and extraction of iron ore. The fund was launched in October 2006. The expense ratio is 0.55%. AUM equal $114M and average daily trading volume is 69K shares As of July 2012 the annual dividend yield was 2.54% and YTD return was -5.51%. The one year return was -34.70%.

Data as of June 2012

XME Top Ten Holdings and Weightings

. Royal Gold, Inc. (RGLD): 3.67%

. Compass Minerals International, Inc. (CMP): 3.59%

. SunCoke Energy Inc (SXC): 3.57%

. Cloud Peak Energy Inc (CLD): 3.28%

. Reliance Steel and Aluminum (RS): 3.19%

. Carpenter Technology Corporation (CRS): 3.18%

. Alcoa Inc (AA): 3.17%

. Commercial Metals Company (CMC): 3.16%

. Hecla Mining Company (HL): 3.12%

. RTI International Metals, Inc. (RTI): 3.09%

![]()

FCG follows the ISE-Revere Natural Gas Index which is an equal-weighted index comprised of exchange-listed companies that derive a substantial portion of their revenues from the exploration and production of natural gas. The fund was launched in May 2007. The expense ratio is 0.60%. AUM equal $403M and average daily trading volume is 644K shares.

As of July 2012 the annual dividend yield was 0.50% and YTD return was -9.97%. The one year return was -24.87%.

Data as of June 2012

FCG Top Ten Holdings and Weightings

. Comstock Resources, Inc. (CRK): 4.31%

. EXCO Resources, Inc. (XCO): 3.95%

. Encana Corp (ECA): 3.94%

. Forest Oil Corp (FST): 3.93%

. Range Resources Corporation (RRC): 3.93%

. Noble Energy Inc (NBL): 3.85%

. Newfield Exploration Company (NFX): 3.78%

. Cabot Oil & Gas Corporation Class A (COG): 3.76%

. Questar Corp (STR): 3.75%

. SandRidge Energy Inc (SD): 3.65%

![]()

GDX follows the NYSE Arca Gold Miners Index which provides exposure to publicly traded companies worldwide involved primarily in the mining for gold, representing a diversified blend of small-, mid- and large- capitalization stocks. The fund was launched in May 2006. The expense ratio is 0.53%. AUM equal $8B and average daily trading volume is 16M shares. As of July 2012 the annual dividend yield was 0.34% and YTD return was -13.61%. The one year return was -20.79%.

Newer ETFs in the sector include Van Eck Junior Miners ETF (GDXJ) and Global X Silver Miners ETF (SIL). Both are interesting but need just a little more seasoning.

Data as of June 2012

GDX Top Ten Holdings and Weightings

. Barrick Gold Corporation (ABX): 18.10%

. Goldcorp, Inc. (GG): 14.08%

. Newmont Mining Corporation (NEM): 10.64%

. Anglogold Ashanti Limited ADR (AU): 5.95%

. Buenaventura Mining Company Inc. ADR (BVN): 5.25%

. Eldorado Gold Corp (EGO): 4.74%

. Yamana Gold, Inc. (AUY): 4.57%

. Gold Fields Ltd ADR (GFI): 4.48%

. Silver Wheaton Corporation (SLW): 4.40%

. Kinross Gold Corporation (KGC): 4.29%

![]()

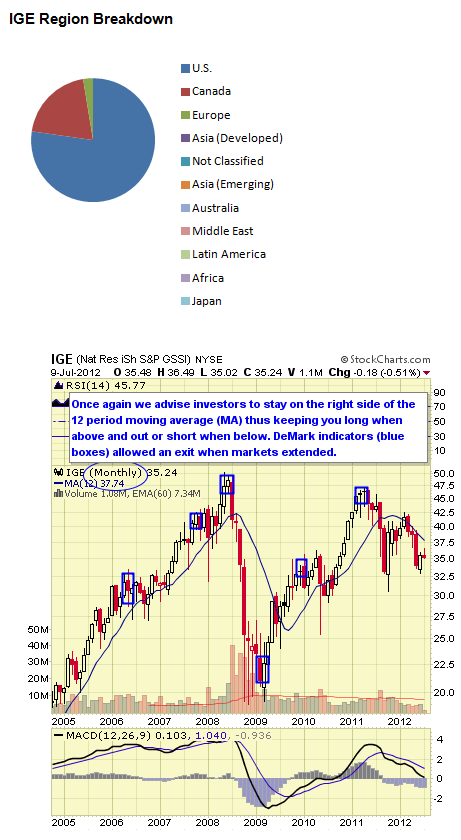

IGE follows the S&P North American Natural Resources Sector Index which measures the performance of U.S.-traded natural resource related stocks. The fund was launched in October 2001. The expense ratio is 0.48%.

AUM equal $1.6B and average daily trading volume is 185K shares. As of July 2012 the annual dividend yield was 1.14% and YTD return was -6.40%. The one year return was -20.33%.

Data as of June 2012

IGE Top Ten Holdings and Weightings

. Exxon Mobil Corporation (XOM): 8.28%

. Chevron Corp (CVX): 8.16%

. Schlumberger NV (SLB): 5.48%

. ConocoPhillips (COP): 4.34%

. Occidental Petroleum Corporation (OXY): 4.18%

. Suncor Energy Inc (SU): 2.74%

. Barrick Gold Corporation (ABX): 2.54%

. Canadian Natural Resources Ltd (CNQ): 2.04%

. Apache Corporation (APA): 2.03%

. Anadarko Petroleum Corp (APC): 1.98%

![]()

XLE follows the Energy Select Sector Index which includes companies in oil, gas, consumable fuels and energy equipment and services. The fund was launched in December 1998. The expense ratio is 0.18%. AUM equal $7.4B and average daily trading volume is 15M shares. As of July 2012 the annual dividend yield was 1.27% and YTD return was -3.65%. The one year return was -13.40%.

A long list of others in this category include:

XLE follows the Energy Select Sector Index which includes companies in oil, gas, consumable fuels and energy equipment and services. The fund was launched in December 1998. The expense ratio is 0.18%. AUM equal $7.4B and average daily trading volume is 15M shares. As of July 2012 the annual dividend yield was 1.27% and YTD return was -3.65%. The one year return was -13.40%.

A long list of others in this category include:

. VDE

. IXC

. OIH

. XOP

. IYE

. IEZ

. IEO

. PXI

. XES

. RYE

. PXE

Both ProShares and Direxion shares have inverse and leveraged products available.

Data as of June 2012

XLE Top Ten Holdings and Weightings

. Exxon Mobil Corporation (XOM): 19.51%

. Chevron Corp (CVX): 15.48%

. Schlumberger NV (SLB): 6.87%

. Occidental Petroleum Corporation (OXY): 4.38%

. ConocoPhillips (COP): 3.85%

. Apache Corporation (APA): 2.81%

. National Oilwell Varco, Inc. (NOV): 2.80%

. Anadarko Petroleum Corp (APC): 2.76%

. Halliburton Company (HAL): 2.59%

. EOG Resources (EOG): 2.54%

Note on Rankings

We rank the top 10 ETF by our proprietary stars system as outlined below. However, given that we’re sorting these by both short and intermediate issues we have split the rankings as we move from one classification to another.

Strong established linked index

Excellent consistent performance and index tracking

Low fee structure

Strong portfolio suitability

Excellent liquidity![]()

Established linked index even if “enhanced”

Good performance or more volatile if “enhanced” index

Average to higher fee structure

Good portfolio suitability or more active management if “enhanced” index

Decent liquidity![]()

Enhanced or seasoned index

Less consistent performance and more volatile

Fees higher than average

Portfolio suitability would need more active trading

Average to below average liquidity![]()

Index is new

Issue is new and needs seasoning

Fees are high

Portfolio suitability also needs seasoning

Liquidity below average

This sector overall responds to perceived and real economic conditions. Should investors sense an economic slowdown demand for base commodities will decline and so too will associated stocks. Conversely, should investors believe an economic expansion is underway then products and stocks should rally. Uniquely, the level of the U.S. dollar is also another important determinant as to price action given commodities overall are priced in dollars. A strong dollar in the current environment should mean a decline in commodity prices and vice versa. It’s important to remember also when the overall stock market declines so too may this sector even if commodity prices are rising.

It’s also important to remember that ETF sponsors have their own competitive business interests when issuing products which may not necessarily align with your investment needs. New ETFs from highly regarded and substantial new providers are also being issued. These may include Charles Schwab’s ETFs and Scottrade’s Focus Shares which both are issuing new ETFs with low expense ratios and commission free trading at their respective firms. These may also become popular as they become seasoned.

Disclosure: No current positions in the featured ETFs.

(Source for data is from ETF sponsors and various ETF data providers.)

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Top 10 Commodity Producer ETFs

Published 07/12/2012, 05:03 AM

Updated 05/14/2017, 06:45 AM

Top 10 Commodity Producer ETFs

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.