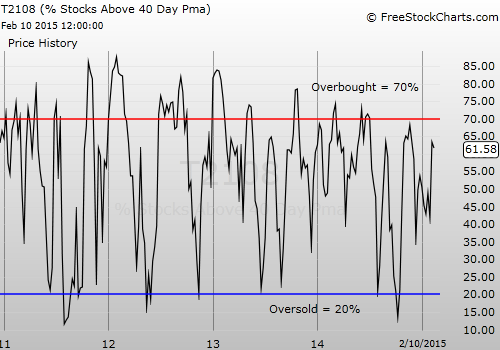

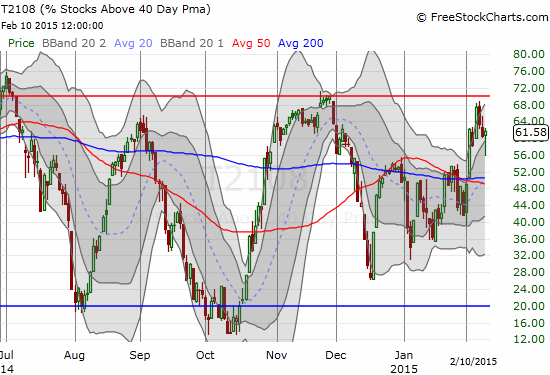

T2108 Status: 61.6%

T2107 Status: 48.2%

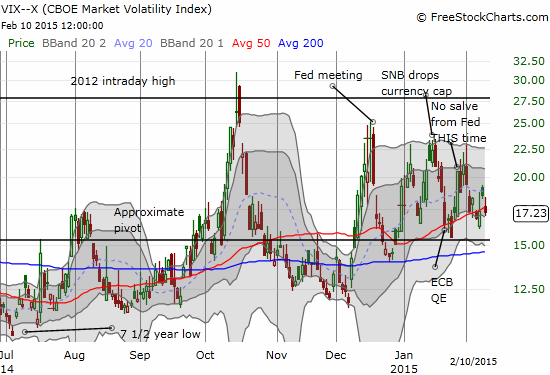

VIX Status: 17.2

General (Short-term) Trading Call: Bearish until T2108 goes overbought AND the S&P 500 closes at a new all-time high

Active T2108 periods: Day #78 over 20%, Day #37 above 30%, Day #17 over 40%, Day #6 over 60% (overperiod), Day #148 under 70%

Commentary

As I like to say, it is HARD being bearish on the market when Apple, Inc (NASDAQ:AAPL) is trading bullishly.

Apple, Inc. (AAPL) achieves a fresh all-time high, finally invalidating all previous bearish signals

AAPL became the first company ever to surpass $700B in value yesterday. The chart above shows that AAPL has now invalidated the previous bearish chart signals that worried me. The perfect bounce off the first Bollinger® Band (BB) opens up the strong potential for a fresh run-up. The Apple Trading Model (ATM) predicted the opposite direction for the day unfortunately. So, I will be playing some catch-up assuming AAPL does indeed launch into a fresh uptrend.

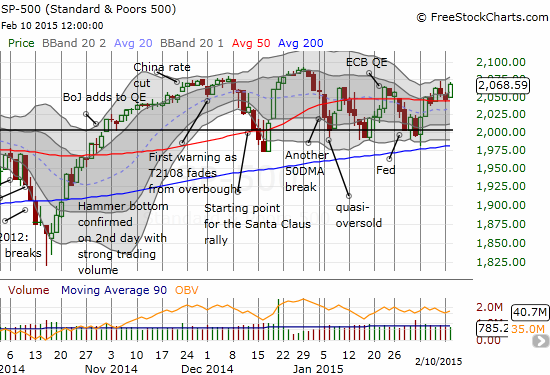

My trading bias remains bearish on the overall market because the rally for the S&P 500 ETF (ARCA:SPY) failed to break the top of the trading range yesterday:

The S&P 500 launches back into the top of its trading range

…and T2108 barely managed to eke out a gain after spending most of the day in negative territory.

Although the S&P 500 was up for the entire day, T2108 was negative most of the day. It only closed with a slight gain thanks to an intraday rally.

This divergence implies that yesterday’s rally was led by a small group of stocks. Bulls and buyers still have a lot to prove beyond putting AAPL firmly back into bullish territory.

The volatility index (VIX) is still hanging tough as it pivots around its 50DMA. It is still in position to launch off approximate support at any time.

The VIX is still pivoting around its 50DMA

All this means it makes plenty of sense to press my bet on my favorite hedge on bullishness, Caterpillar (NYSE:CAT). I doubled down on my March puts yesterday, right after trading opened for the day.

Caterpillar, Inc. (CAT) has already filled its post-earnings gap down but failed to make further progress yesterday

While we wait to see whether the market can finally break out or whether we will need to endure yet more chop, here are some charts of interest. These are all bullish and will be even MORE interesting once/if the market finally breaks out and launches an extended overbought rally.

Conn’s

Conn's Inc (NASDAQ:CONN) has amazingly gained another 20% since I sold my call options. I of course wish I had been more patient but suffering through that fade in December on the previous CONN trade really made me extra eager to lock in profits this time around.

Conn’s Inc. (CONN) has continued its post-earnings surge, now including a bullish 50DMA breakout and a fresh post-December earnings high

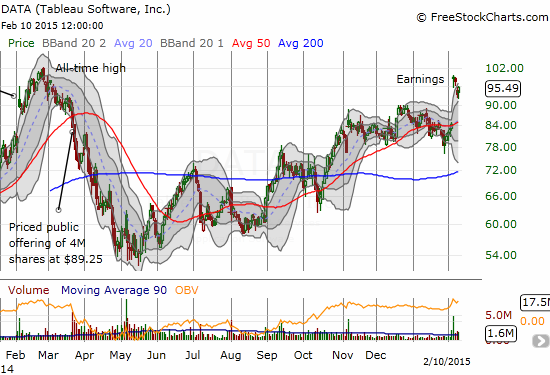

Tableau Software

In my last T2108 Update, I discussed the pre-earnings trade set-up in Splunk (NASDAQ:SPLK) after it gapped up in sympathy with bullish earnings from Tableau Software (NYSE:DATA). SPLK has now sold off the last two days back to its 50DMA. It suddenly occurred to me to check on DATA and, sure enough, the stock was also pulling back from its post-earnings gains. I did not hesitate to make a bullish bet with call options as DATA neared its first Bollinger® Band.

So far, so good, as DATA smartly bounced off support. I am looking for DATA to resume its upward momentum past its post-earnings high.

Tableau Software (DATA) pulled back to the first Bollinger Band (BB) before resuming post-earnings momentum

A rough road, but a general uptrend from last year’s low

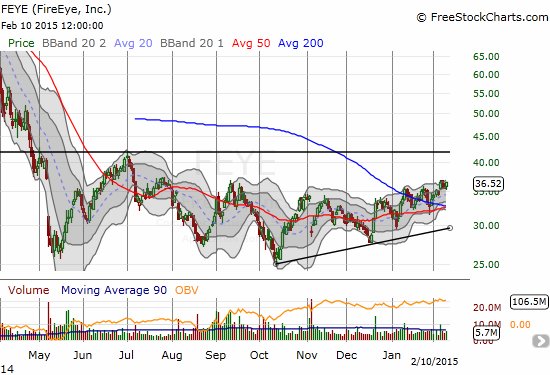

FireEye

Fireeye Inc (NASDAQ:FEYE) will be reporting earnings Wednesday evening. I will be watching closely as the chart below shows the stock has been trending upward into a potential breakout.

FireEye (FEYE) is slowing trending up from recent low into a potential bullish breakout

I just discussed a change in my oil-related trades that involved locking in profits in call options on Linn Energy (NASDAQ:LINE). It was well-timed precaution as LINE smartly pulled back from resistance. Near the close, I decided to use some of those profits to buy back a few March call options.

I do not plan on expanding the position although I might consider a new one if LINE crumbles all the way back to $10 or so (depending on the dynamics in the oil market at that time of course).

Linn Energy (LINE) falls back from resistance – this rejection is not nearly as violent as the last one!

First Solar

First Solar (NASDAQ:FSLR) continued a theme on the day of smart bounces off support and lows. I doubled down on FSLR call options as it approached its 50DMA support. This is part of my new hedged trade on solar stocks (a separate piece still to come on this!). Going into the close, FSLR rallied smartly on news that Apple (AAPL) will partner with FSLR on an $850M solar farm. This news should work wonders for sentiment in solar stocks which have slumped in parallel with energy and commodities. Now it looks like the latest bounce in late January might actually hold.

First Solar (FSLR) stages a big comeback off 50DMA support thanks to news about a partnership with Apple (AAPL)

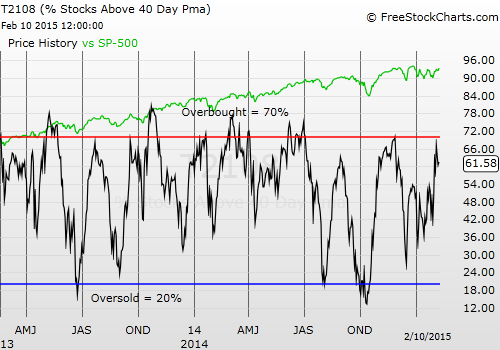

So, overall, there are PLENTY of reasons to get constructive on the market again, but I still want to see the S&P 500 and T2108 partner up to prove the bullishness.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Disclosure: long DATA calls, long SPLK calls and puts, long AAPL puts, long LINE calls,