The latest news for the PV inverter industry has been mixed at best. Although SolarEdge is formally going public and Enphase just finished another record quarter, SMA announced more layoffs, Advanced Energy is on the selling block and SolarMax continues to flirt with a buyer after declaring insolvency.

We forecast the global market to grow 15 percent in value in 2015 to $7.3 billion and another 9 percent in 2016, though we recognize that serious market challenges still remain.

However, when you look closely, there are exceptional opportunities for inverter manufacturers to differentiate their products, improve reliability, contribute to falling PV system costs, and expand the scope of what a typical inverter can do in an interconnected PV system.

Here are six companies to watch in 2015 that are looking to capitalize on these opportunities.

1. Huawei: The potential juggernaut

Rising from relative solar obscurity in 2012 to global player in 2015, Huawei is a nightmare come true for much of the PV inverter industry. The world’s largest telecommunications equipment maker has all the right ingredients for success: unquestioned bankability, a global footprint, low prices, and highly rated products. Huawei was the ninth-largest inverter manufacturer in the world in 2013, jumping into the top five in 2014.

However, while the growth path for Huawei may seem unimpeded, there are actually substantial barriers standing in its way.

First, the global market of inverter buyers is exceptionally fragmented. Outside of China and Japan, and especially in the United States, a lack of truly dominant installers and EPCs means that leveraging a brand to build market share takes time.

Second, and we have mentioned this before, there is more to bankability than a company’s balance sheet, and field experience and a proven long-term commitment to the industry must also be weighed. Siemens is the classic example here, in the sense that it had to undergo bankability filters when it first entered the U.S. market in spite of having 3 gigawatts installed in Germany, and in the sense that the company is no longer involved in the market in spite of its global brand.

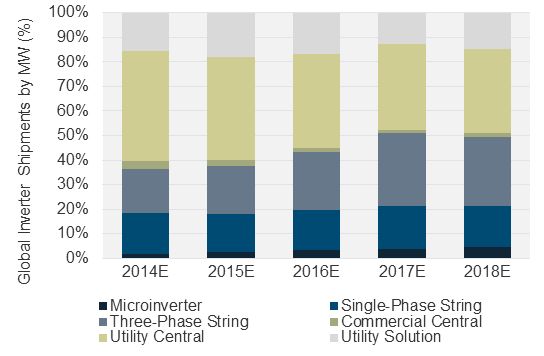

However, an eroding stigma around Chinese inverters and a market shift toward increased three-phase string inverter use will likely help Huawei continue to overcome these barriers.

FIGURE: Global Distribution of Inverter Demand by Product Type, 2014-2018E

Source: The Global PV Inverter Landscape 2015

2. LG: The integrated module champion

Integrated modules, either “smart” modules with embedded DC optimizers or AC modules with pre-attached microinverters, have long been pursued as a way to lower installation costs and increase system performance. To date, most module-level power electronics (MLPE) providers have sought channel partnerships to drive sales. However, for integrated modules, this requires exceptional buy-in from module companies used to selling only PV panels, as well as installers that must trust the reliability and warranties of both the PV modules and associated power electronics.

LG has sought to alleviate these concerns by going it alone, self-designing the power electronics to create its Mono X ACe Module. This strategy brings an AC module marketed by a well-capitalized supplier to the market.

Reliability and uncertainty about module degradation from embedded power electronics will be the primary concern for integrated modules in the near future. However, the market excitement for LG’s AC module and the first installer/smart-module partnership between Trina and Vivint, as well as the potential for SunPower to leverage its dealer network to make use of its acquisition of SolarBridge Technologies, are all positive signs for integrated modules.

FIGURE: PV Distributed Optimization Partnerships

Source: The Global PV Inverter Landscape 2015

3. SolarEdge: The (soon-to-be-public) differentiator

SolarEdge’s impending IPO will do much to improve its access to capital and help the company continue its rapid growth. SolarEdge differentiates itself as the only DC optimization company with a paired proprietary inverter. The design simplicity and safety features of its system, including, notably, arc fault detection and rapid shutdown that enables compliance with NEC 2014, have helped the company gain significant U.S. market share. It has also helped SolarEdge win the favor of SolarCity, which it supplied with inverters for 27 percent of company installations from Q1 to Q3 2014, according to the GTM Research U.S. PV Leaderboard.

In the short term, SolarEdge has an exceptional rival in Enphase, as both look to take a greater share of the 2 gigawatts of MLPE shipments expected globally in 2015. In the long term, the next version of the National Electric Code, NEC 2017, is likely to be a further boon for MLPE providers, as the code will likely include requirements for rapid shutdown capability to be within 1 foot of the array, compared to the current requirement of 10 feet. This will essentially require module-level shutdown for all rooftop systems in the U.S. upon adoption.

SolarEdge has much to compete with in the residential and commercial markets, though commercially, new P600/P700 dual optimizers should help SolarEdge lower hardware costs and close the gap between SolarEdge prices and standard three-phase string systems.

4. Enphase: Eyeing world domination, one module at a time

Enphase had a record year in 2015, shipping 575 megawatts of microinverters and growing revenue 48 percent on a year-over-year basis. Three years removed from its IPO, Enphase has expanded well beyond sales of microinverters and monitoring for residential PV systems. In the last year alone, Enphase has introduced a modular storage device and a home energy management system, acquired an O&M provider, and released a commercial microinverter.

While there are barriers to exploiting these new ventures, such as falling string inverter prices, a need for an auto-transformer to step up voltage in its commercial systems, and minimal immediate residential storage demand, Enphase is well positioned to capitalize in the short term on its leading U.S. residential market share, while preparing for medium-term expansion into new markets.

5. SMA: The fallen leader recrafting its vision

Much has been written about SMA’s ongoing troubles. The company’s dependence on European demand and disappointing ventures into China and Japan simply have not been made up for by growth in other markets. The demand shift has forced SMA to make difficult decisions regarding its staff and its strategy, and 2014 was another difficult year due to lower-than-expected European demand and unexpected policy changes.

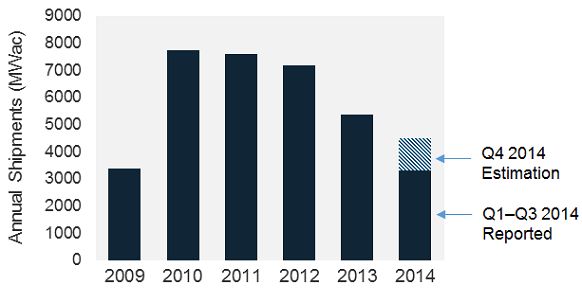

FIGURE: SMA Annual Global Shipments, 2009-2014E (MWac)

Source: SMA Investor Relations, GTM Research

However, SMA has grown exceptionally strong in North America in all market segments, and that market now serves as a foundation for its revenues. Additionally, while growth in secondary markets such as Latin America and Southeast Asia has not made up for lost revenue back home, the sales and service infrastructure in place positions SMA, perhaps more so than any other manufacturer, to capture growing global demand for solar.

Like Enphase, SMA also has a vision for its inverters to operate as more than just boxes converting direct current to alternating current. This includes capabilities for energy management to maximize self-consumption, load control for battery storage systems, dispatchable power and ramp control for utility-scale solar, and long-term asset management and O&M.

While these technologies and strategies are not distinctly unique to SMA, few can claim to be as globally positioned to deploy such capabilities as can this firm.

6. General Electric: A player with 1,500 Vdc capabilities

General Electric fits the mold for the type of company that could take a major hold of the inverter market if it chose. So far, though, GE has been largely opportunistic in its approach. Though the company demands respect due to its history, financials and brand, GE does not have the same reach in solar as do its major global industrial competitors Schneider and ABB.

However, due to its 2011 acquisition of Converteam, General Electric was the first to market with a 1,500 Vdc rated inverter, and remains the only company with a three-stage inverter capable of switching at that voltage.

We expect the utility PV market to rapidly evolve from 1,000 Vdc systems to 1,500 Vdc systems in the coming year, a shift that enables lower system costs due to longer string lengths. At the moment, the market for 1,500 Vdc systems is still small due to limited component availability, particularly modules and inverters. Additionally, in the United States, testing standards limit product certification to 1,000 Vdc, though we expect this to change.

Many remain wary of GE due to its nascent track record in solar, but by being an early mover in the shift to higher-voltage DC systems, the company could well be carried to solar stardom.

***

Scott Moskowitz is a solar analyst with GTM Research and the author of the recently published report, The Global PV Inverter Landscape 2015: Technologies, Markets and Prices. For more information on the report, visit http://www.greentechmedia.com/research/report/the-global-pv-inverter-landscape-2015 or contact Zack Munsell at [email protected].