Consumers are obsessive beings.

For proof, look no further than the way we fixate on visible, tangible advancements in mobile phone technology.

Front- and rear-facing cameras… HD-quality displays… ultra-responsive touchscreens… fingerprint sensors… and smooth, shiny metal cases to protect all this precious technology.

Regrettably, investors are obsessive in much the same way. That is, we become fixated on what can be seen.

This narrow-minded view leads us into obvious, overcrowded – and sometimes fatal – investments. The now-defunct sapphire display maker, GT Advanced Technologies, is the perfect example.

It’s unfortunate… because the most lucrative mobile investments often reside in what’s invisible to the naked eye.

Case in point: this triple-digit growth trend that’s just heating up…

Big Data, Big Problems Opportunity

Mobile devices aren’t simply cool gadgets anymore. They’ve become vital extensions of ourselves.

Case in point: 91% of us are within arm’s length of our smartphones at any given moment, according to Morgan Stanley data. We’re constantly texting, checking email, surfing the internet, tweeting, gaming, streaming video… The list goes on.

Now, aside from whatever social and cultural issues this mobile obsession throws up, there’s another huge problem…

Our beloved smartphones use 24 times more data than old-school feature phones.

Consequently, our always-connected, high-bandwidth, data-intensive lifestyles are putting an immense strain on the mobile communications network.

And there’s no end in sight.

Cisco Systems Inc (NASDAQ:CSCO) predicts that on a compounded-annual-growth-rate basis, worldwide mobile data traffic will soar by 57% from 2014 to 2019.

The solution? Add more bandwidth – stat!

If not, we’ll be unable to handle all of our data demands.

Unfortunately, though, it’s not as simple as flipping a switch. Why?

Well, first, we need more radio spectrum to be made available.

Then, the components inside phones need to be developed so that they can communicate on the new frequency bands.

How do we do this?

In its simplest terms, this is accomplished with things like filters and amplifiers – technology that makes up what’s known as the radio frequency (RF) front end.

As Christopher Bowick says in his book, RF Circuit Design, “This is arguably the most critical part of the whole receiver.”

Agreed. It’s what enables phones to communicate wirelessly. And the bottom line is that in order to meet our exploding data demands, more radio frequencies need to be supported in each smartphone.

Therein lies the opportunity…

Rising Costs = Rising Opportunity

Not long ago, the typical smartphone only needed to operate on three or four different frequency bands.

Nowadays? That number is quickly approaching three or four dozen bands.

Translation: Today’s smartphones require a lot more RF parts.

Sure enough, the total dollar amount of RF content in high-end phones keeps rising.

Take the latest iPhone 6, for example. Total RF front-end content costs checked in at $15.89 per phone, according to Barclays’ analysis. That’s up a staggering 324%, compared to a typical 3G phone.

For mobile phone makers, these rising costs keep cutting into margins. But for RF component suppliers, the exact opposite is true – the trend represents a tremendous opportunity.

Or as MKM Partners put it, we’re living in “a golden age for smartphone suppliers.”

Sounds gimmicky. But it’s not.

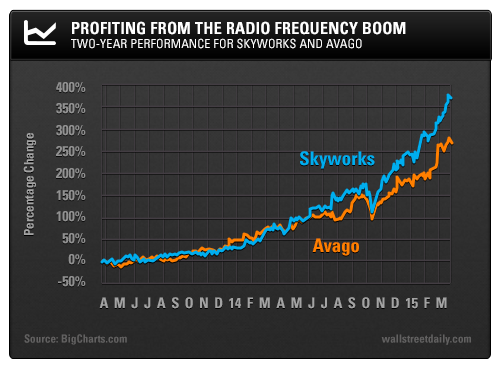

Just look at the two-year chart for the market’s top RF front-end suppliers – Skyworks Solutions Inc (NASDAQ:SWKS) and Avago Technologies Limited (NASDAQ:AVGO).

With each company’s business booming, it’s no surprise that the stocks are up roughly 375% and 275%, respectively.

Take, Skyworks, for example…

A Growth Explosion

On the back of what CEO David Aldrich described as “an explosion in analog complexity,” the company reported a 59% sales increase to $805 million, and an 88% increase in earnings per share to $1.26 in the most recent quarter.

“We’ve been successfully executing with higher and higher dollar content with each successive [smartphone generation],” says Aldrich.

I’ll say!

This isn’t an anomaly, either. Skyworks has reported nine straight quarters of earnings growth and double-digit sales growth.

But even after the impressive growth and run-up in stock prices, we’re still early in the boom.

After all, the three key drivers behind it aren’t going to let up any time soon. What are those drivers?

Simply… the growing number of mobile users, runaway data usage, and more advanced wireless standards (3G, 4G, etc.). Factor them all in, and you can see why this trend is so ingrained and set to last.

The Boom Is Here to Stay

The savviest way to gauge the growth is to track global long-term evolution (LTE) – or 4G – adoption. Why?

Because it’s the fastest and most robust wireless communication network. Enabling phones to communicate on it not only requires more RF content, but also more complex (read: more expensive) RF content.

While a just-released report from GSMA Intelligence shows that LTE connections blasted 145% higher last year to about 490 million, it only translates to 7% market penetration.

In other words, the RF boom still has another 93% to go. So the go-go days for companies like Skyworks and Avago promise to endure for years to come.

Bottom line: Very few investors think about what it takes on the inside of mobile phones to enable them to work properly. But they should, because it’s an incredibly lucrative business for the companies behind such technology – which, in turn, means incredibly lucrative investments. And it’s not too late to profit from the boom.

Ahead of the tape,