In 2008, Warren Buffett and his Berkshire Hathaway bought a large stake in ConocoPhillips (NYSE:COP) at a time when oil prices were climbing past $100 a barrel. When oil topped out at $146 and then dropped, eventually to just over $32 a barrel, Buffett sold his COP shares, losing billions (but getting out). He called it one of his biggest “mistakes of commission.”

In 2013, Buffett went back in the oil business with an even larger stake in Exxon Mobil Corporation (NYSE:XOM). While the price of crude oil has plummeted (though not as much as in ‘09), Exxon shares have held remarkably firm so far. They may fit Buffett’s criteria for long-term value and quality management, but like all energy companies this quarter, it’s losing money and so is Buffett. That hasn’t stopped him from holding a stock before and we may well see him doubling down in the months to come.

Buffett’s advantage is that while falling oil prices hurt his Exxon-Mobil holdings, Berkshire also owns stock in Wal-Mart (NYSE:WMT), NetJets, a major car dealer network, and of course, the largest auto insurer, GEICO. Cheap gas means cheaper shipping costs, cheaper jet fuel, and more people driving. It’s a case study in smart diversification for value investors.

Others are not so well-hedged and are getting out of the oil business. In an ironic twist, the Rockefeller Brothers Fund, a large philanthropic trust, is divesting itself of fossil fuel investments. http://www.newyorker.com/business/currency/rockefellers-give-oil The fund, of course, started with money from Standard Oil, the parent of Exxon and Mobil. They announced the divestment last September, when oil was still $100 a barrel, and it was widely reported that the move was to stop investing in a major cause of global warming. But the timing couldn’t have been better.

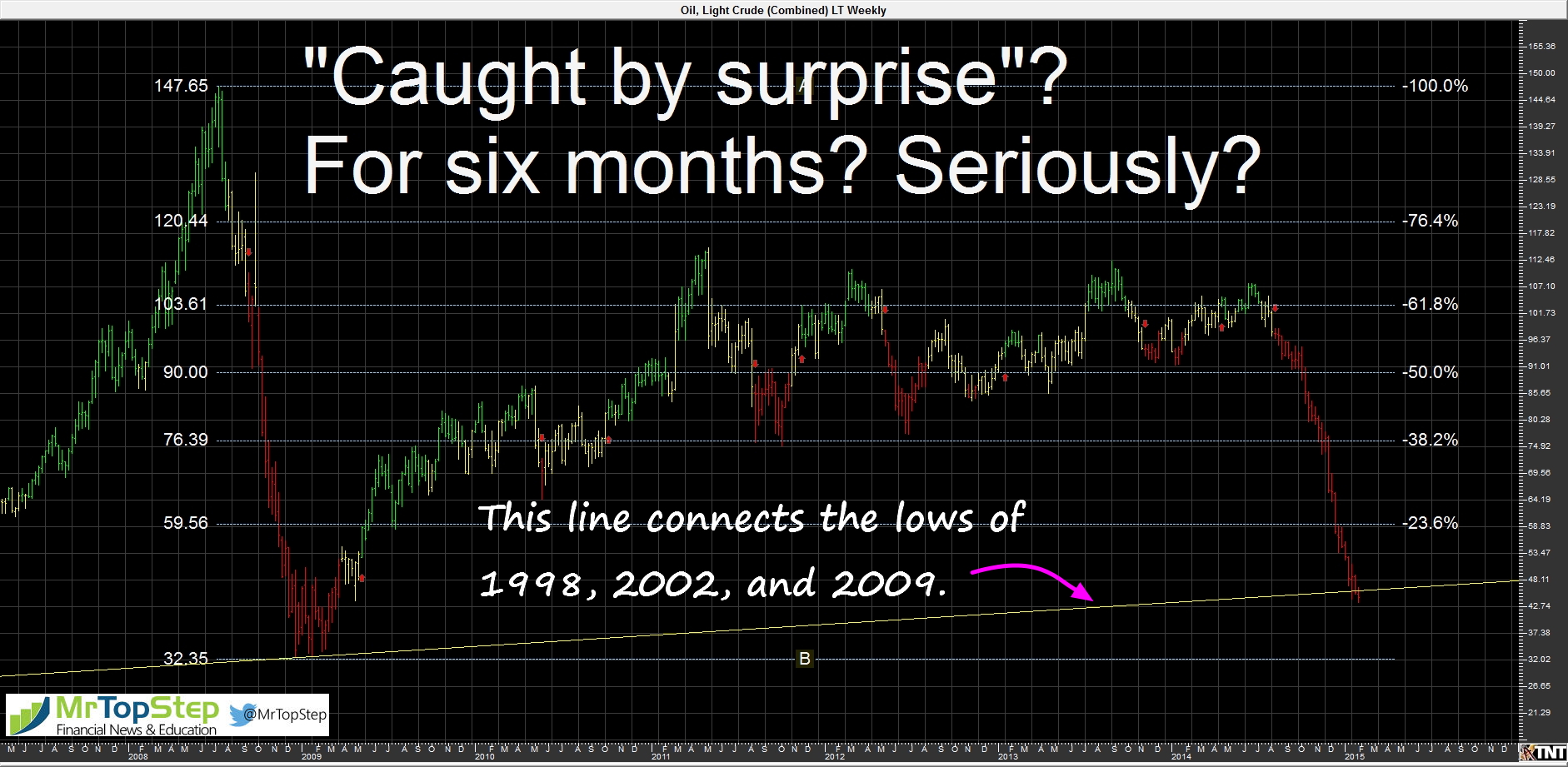

Others with more financial than environmental motives still paid attention to the trend and got out. Danny and I were talking about $50 a barrel back in September. Our friend Jeff Hirsch of Stock Trader’s Almanac called for $40.75 towards the end of 2014. Plenty of people called it and gave good reasons. Bloomberg said yesterday, “The crash caught investors and lenders by surprise,” and gives the example of Energy XXI, an investment firm that sold way too many bonds that would only make money if oil kept gaining, and is now $4 billion in debt. Serves them right. That’s not investing; it’s gambling. Badly.

But some professionals in the energy (no longer fossil fuel) business are smarter. A college buddy of mine, Gerard, runs an oil and gas services company. I asked him if he’s hedged with crude oil puts now that the fields are shutting down. He said no. “We just save up in the good times and ride out the bad.” He’s survived and thrived for two decades that way. And he’s mentally preparing for when solar takes over.

That’s why long-term, I think the oil crash is an opportunity and a help to the rest of the economy. (It’s not even as big a crash as 2009.) Short-term, I sympathize with those who depend on oil prices and even those who closed their eyes for six months and got “caught by surprise.” But that’s why we have put options. Or like my buddy, careful planning and guts.

In Asia 8 of 11 markets closed lower and 7 out of 13 European markets are trading higher this morning. Today’s economic calendar includes GDP, Chicago PMI, Employment Cost Index, Consumer Sentiment, farm prices, and speeches by Fed members James Bullard, Daniel Tarullo, and Eric Rosengren. Earnings are due from Xerox (NYSE:XRX), Mastercard (NYSE:MA), Chevron (NYSE:CVX), Eli Lilly (NYSE:LLY), and Tyson Foods (NYSE:TSN).

The S&P finds support. Will it hold?

Our View:

After a nearly 20-point drop before and at yesterday’s open, the S&P futures (ESH15:CME) found support and rallied nearly 40 points to close up 27.00 at 2018.50. In Globex overnight it dropped and retested a support trendline at 2001, just above the psychological support of the big round number.

Volume was heavier than it has been, with the bulk of the trading coming during yesterday’s early decline. With the number of short sellers who hammered away at the downside yesterday, only to get caught and then pulled into their buy stops, we see the possibility of a turn back upwards. But it won’t be pretty.

We expect a retest of the 1990 level and possibly 1987. If it continues below that, expect a new low. But after that, we may see the return of the Late Friday Rip to the upside. The pickup in volume suggests that funds are making some end-of-month decisions, and we suspect most of those decisions are to buy.

Sell the early rallies, watch for support but don’t be hasty, then buy weakness. But even if we do get another lovely 40-point run up, we suggest you take it in pieces rather than holding through the drawdowns.

As always, please use protective buy and sell stops when trading futures and options.

- In Asia 8 of 11 markets closed lower: Shanghai Composite. -1.59%, Hang Seng -0.36%, Nikkei +0.39%

- Earlier in Europe 7 of 13 markets were trading higher: DAX -0.45%, FTSE -0.18%, MICEX +0.75%, Athens GD.AT +0.48%

- Fair value: S&P 500 -6.27, NASDAQ -7.42, Dow Jones -71.94

- Total volume: 2.13mil ESH and 15.4k SPH traded

- Economic schedule: GDP, Chicago PMI, Employment Cost Index, Consumer Sentiment, farm prices, and speeches by Fed members James Bullard, Daniel Tarullo, and Eric Rosengren. Earnings from Xerox Corporation (NYSE: XRX), MasterCard Incorporated (NYSE: MA), Chevron Corporation (NYSE: CVX), Eli Lilly and Company (NYSE: LLY), and Tyson Foods, Inc. (NYSE: TSN)

- E-mini S&P 5001991.25-27.25 - -1.35%

- Crude56.50+2.39 - +4.42%

- Shanghai Composite0.00N/A - N/A

- Hang Seng24507.051-88.799 - -0.36%

- Nikkei 22517674.391+68.17 - +0.39%

- DAX10694.32-43.55 - -0.41%

- FTSE 1006749.40-61.20 - -0.90%

- Euro1.1285

by Vikram Rangala