With the stock market rallying continuing for the fifth year in a row and the major indexes hitting new highs almost daily, you might think that there's few stocks left that are truly a bargain.

Valuations trended higher throughout 2014 even as earnings rose. The S&P 500 is trading with a forward P/E of 18 which isn't exactly "cheap." In fact, many would consider it down right expensive.

But even in a hot market, there are always stocks that are left behind. Some are ignored by investors because there is business trouble brewing at that particular company so they stay away. Others are in an out of favor industry or sector.

No matter the reason, a new year is always a good time to poke around in the bargain bin looking for deals. You might have to sort through a bunch of companies that aren't pretty to find the gems, but they are there.

What's a Bargain?

According to Dictonary.com, "bargain" is defined as: "an advantageous purchase, especially one acquired at less than the usual cost."

To be a "stock bargain", I looked for stocks trading with a forward P/E (that's looking at future earnings) which was under the average of the S&P 500, which would be stocks with P/Es under 18.

If it has a cheap price-to-sales ratio or price-to-book ratio, even better. I consider "cheap" to be a P/S under 1.0 and a P/B under 3.0.

I also only looked at Zacks Rank #1 (Strong Buy) and #2 (Buy) stocks. Because, after all, why not buy companies where earnings estimates are rising into 2015? We want to own companies that are growing their earnings.

Top Bargain Stocks for 2015

1. Republic Airways Holdings Inc.(NASDAQ:RJET)

2. Meritor, Inc. (NYSE:MTOR)

3. Blount International, Inc. (NYSE:BLT)

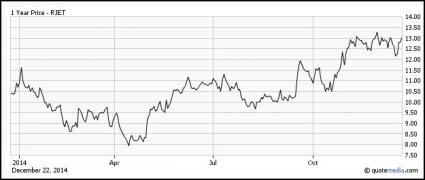

1. Republic Airways Holdings (NASDAQ:RJET)) is an airline that owns Chautauqua Airlines, Republic Airlines and Shuttle America.

Most people would know its partner brands as it operates American Eagle, Delta Connection, United Express and US Airways Express.

It flies about 1,300 flights daily to 100 cities in the US, Caribbean and Canada.

Airlines are hot and most of them have soared as oil prices have plunged. But it's not too late to find bargains in the airline industry.

Republic's shares are trading near 52-week highs like many of its peers, but, believe it or not, it's still a bargain. In fact, it's dirt cheap compared to the overall market.

Not only is its forward P/E of 9.4 way below the average of the S&P 500, which is 18, it also has an attractive price-to-sales ratio of just 0.5 and a price-to-book ratio of only 1.1. A P/S under 1.0 and a P/B under 3.0 usually indicates value.

Everyone thinks the airlines group is overheating, but if you dig deep enough, you can still find a good bargain.

- Forward P/E = 9.4

- Price-to-Book = 1.1

- Price-to-Sales = 0.5

- Expected 2014 earnings growth = 16.2%

- Expected 2015 earnings growth = 5%

- Zacks Rank #1 (Strong Buy)

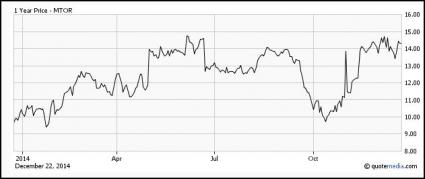

2. Meritor (NYSE:MTOR) supplies drivetrain, mobility, braking and aftermarket solutions for commercial vehicle and industrial markets, especially to trucks and trailers.

The company has been in business making axles and brakes since 1909. Headquartered in Michigan, it now has operations in 18 countries worldwide.

In fiscal 2014, sales rose 3% to $3.8 billion on higher sales in North America. South America and Defense were still soft, however.

Meritor is focusing on its 3-year turnaround plan, called M2016, which is supposed to grow revenue and margins and reduce debt.

As the global economy recovers, so will the trucking and transportation industries.

Shares are undervalued compared to the S&P 500. Meritor has a forward P/E of just 10.5 but is also expected to grow earnings this fiscal year by the double digits. What's not to like?

- Forward P/E = 10.5

- Price-to-Sales = 0.4

- Expected F2015 earnings growth = 32.9%

- Zacks Rank #2 (Buy)

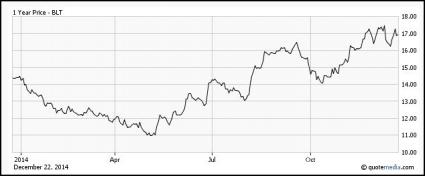

3. Blount International (NYSE:BLT) may not be a household name but its products are used in 115 countries.

It makes replacement parts, equipment and accessories for the forestry, lawn and garden, ranch and agriculture industries as well as the concrete cutting and finishing markets.

It is the industry leader in making saw chain and guide bars for chain saws.

In the third quarter, sales rose 6.3% on improving end markets. In early November, the company saw no slowdown in Europe, which includes Russia, but that was before the Ruble went into a free fall.

Still, the analysts haven't been cutting estimates. Blount is expected to see double digit earnings growth this year and next.

While not as cheap as Republic or Meritor, it trades with a forward P/E of 16.2. That's still under the average of the S&P 500 which is 18.

Blount also has a price-to-sales ratio of 0.9, which puts it in the value category.

- Forward P/E = 16.3

- Price-to-Sales = 0.9

- Expected 2014 earnings growth = 44%

- Expected 2015 earnings growth = 15%

- Zacks Rank #1 (Strong Buy)

Dig Deeper for Bargains

With the major indexes at new all-time highs, it's going to be tougher to find the high quality bargains.

Look beyond the well known names and look in industries that might not seem as glamorous. Truck parts and chain saw guide bars may not seem like obvious places to find investment ideas.

But also don't rule out the hot sectors. Nothing has been as hot as the airline stocks in the last 3 months of the year yet I was still able to find a dirt cheap airline stock with rising earnings estimates.

These three stocks are just a start of the bargains I managed to find with a Zacks Rank of #1 or #2. If you dig deeper next year, you'll be able to find others.

Who doesn't like a good bargain to start the new year?