Rumors have been circulating for a while that KFC, Pizza Hut, and Taco Bell owner Yum! Brands (NYSE:YUM) will spin off its China division as it is still recovering from an expired meat scandal which took place in August of last year.

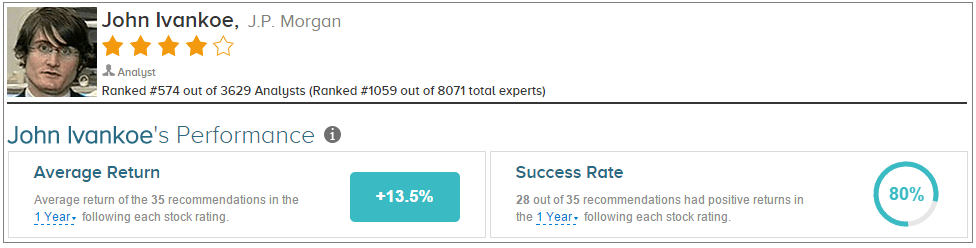

After attending a YUM investor conference in China last week, J.P Morgan analyst John Ivankoe believes these rumors are turning from a “possibility” to a “probability.” On May 15, the analyst upgraded his rating on Yum! Brands from Neutral to Overweight and raised his price target from $83 to $108.

Ivankoe believes that due to current market conditions, spinning off the China division of Yum Brands! will create both short term and long term share-holder value. The analyst noted, “Perhaps timing starts in 2H15 when Yum China’s sales performance should allow investors to see recoverability from last year’s crisis.”

John Ivankoe has rated Yum! Brands 10 times since April 2009, earning an 80% success rate recommending the company and a +13.5% average return per YUM recommendation. Overall, the analyst has an 80% success rate recommending stocks and a +14.6% average return per recommendation.

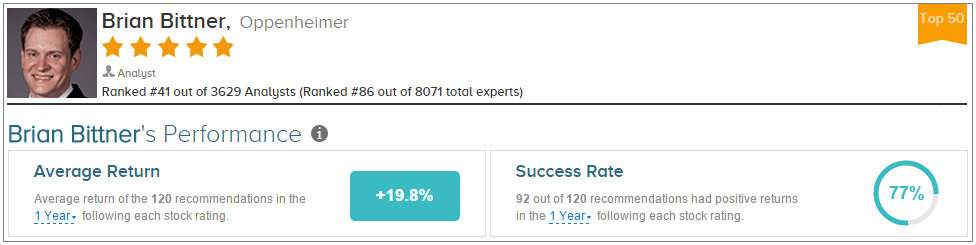

On May 18, Oppenheimer analyst Brian Bittner maintained an Outperform rating on Yum! Brands and raised his price target from $90 to $105 following the company’s investor conference in China, noting that he is “more excited that fundamental upside lingers.” The analyst commented that “the business operated like a standalone with self-funding abilities.” Furthermore, Bittner was happy that YUM management “reiterated its commitment to restoring top-to-bottom fundamentals” and “the potential of separating the China business.”

Brian Bittner has rated Yum! Brands 13 times since January 2013, earning a 92% success rate recommending the stock and a +16.2% average return per YUM recommendation. Overall, he has a 77% success rate recommending stocks and a +19.8% average return per recommendation.

On average, the top analyst consensus for Yum! Brands on TipRanks is Hold.