Chinese Investments In U.S. Businesses Rising Fast

Despite competition, Chinese investments in the U.S. businesses are surging. A recent study said nearly billion of Chinese investments are active now and the investment may grow to billion by 2020. The study tracked the uptick in Chinese investments in America and also probed its reasons.

Global research firm Rhodium Group and the nonprofit National Committee on U.S.-China Relations conducted the study and noted that the rising energy and labour costs are one of the factors forcing Chinese individuals and companies to look for investments in the U.So, more so, in the last five years. It also studied the money flowing into Hong Kong, the semi-autonomous Chinese city and studied how much of it is translating into investments. Among the Chinese investments in the U.S, it noticed a rising appetite for U.S real estate. The residential real estate in California and elsewhere are already the staple of many Chinese millionaires.

California Investments

In California alone, Chinese investors have invested billion in almost 370 businesses and they are supporting 8,300 jobs. This is mostly in the Los Angeles and San Francisco metropolitan areas. Some of the Chinese investments in Los Angeles include online video-game producer Riot Games, of the popular "League of Legends" game, where at least 1000 U.S employees have been hired. In 2011, Chinese Internet company Tencent Holdings picked up a majority stake in the firm for million.

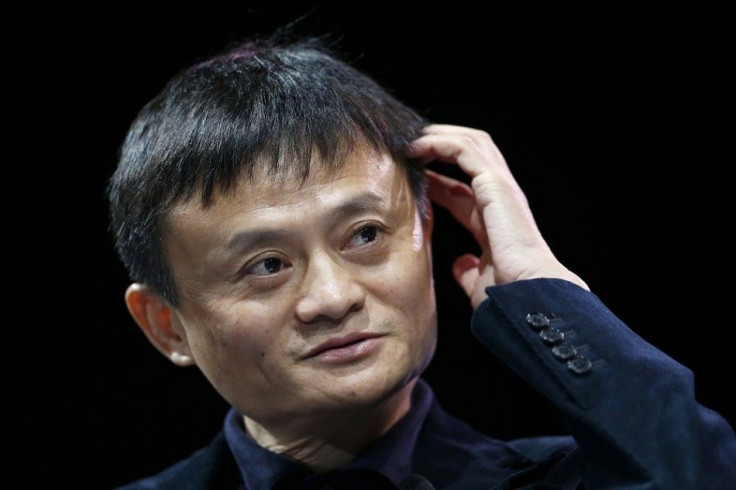

In eastern Virginia, Shuanghui International Holdings of Hong Kong spent billion to buy Smithfield Foods, the largest U.S. pork producer, which has 3,700 employees on its payroll. In California’s Chico, Chinese e-commerce giant Alibaba Group has employed 130 people at its online U.S. retailer, 11 Main Street.

“Chinese purchases and start-ups should deepen ties in ways that mere purchases of foreign products cannot do”, noted Stephen A. Orlins, the National Committee president. He also observed that investments have the potential to bring people together more than what trade does.

However, Jeffrey Towson, an investment professor said Chinese outbound direct investment activity is still at its infancy and the pace will pick up. The slowing economy, coupled with the curbs on over-investment in ports and roads are forcing many state-owned enterprises to go abroad, looking for investment opportunities.

FDI In US

According to the U.S. statistics, the U.S. companies and entrepreneurs have attracted nearly trillion in total foreign direct investments. This is far above what China has gained as FDI with its billion. Meanwhile, Financial Times in a report said, Chinese investments are supporting 80,000 full-time jobs in the US, which showed a fivefold increase in the past five years, and reversed the trend which forced Americans to complain in the past that manufacturing jobs are being outsourced to China.

(For feedback/comments, contact the writer at k.kumar@ibtimes.com.au)