The athletic apparel industry is exploding right now, but Dick’s Sporting Goods (NYSE:DKS) stock (-17% year to date) isn’t going through the roof like Nike’s (NYSE:NKE) (+23% ytd) and Under Armour’s (NYSE:UA) (+61% ytd) are. Athletic clothing and equipment sales are booming, but trouble in Dick’s golf and hunting units are holding the retailer back.

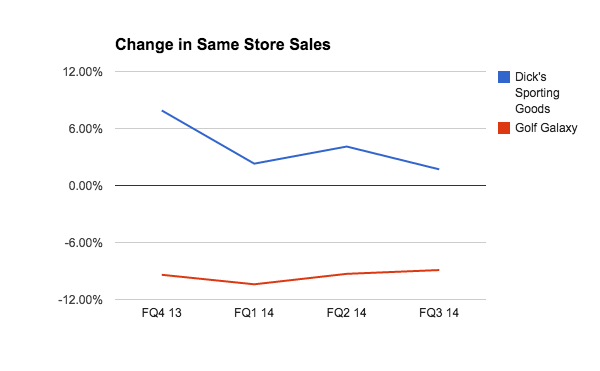

The graph above shows the percent change in same store sales at Dick’s Sporting Goods locations and Golf Galaxy shops, which the company also owns. Over the past year same store sales at Dick’s have been improving by an average of 4.0% each quarter while revenue at Golf Galaxy has dropped an average of 9.5%.

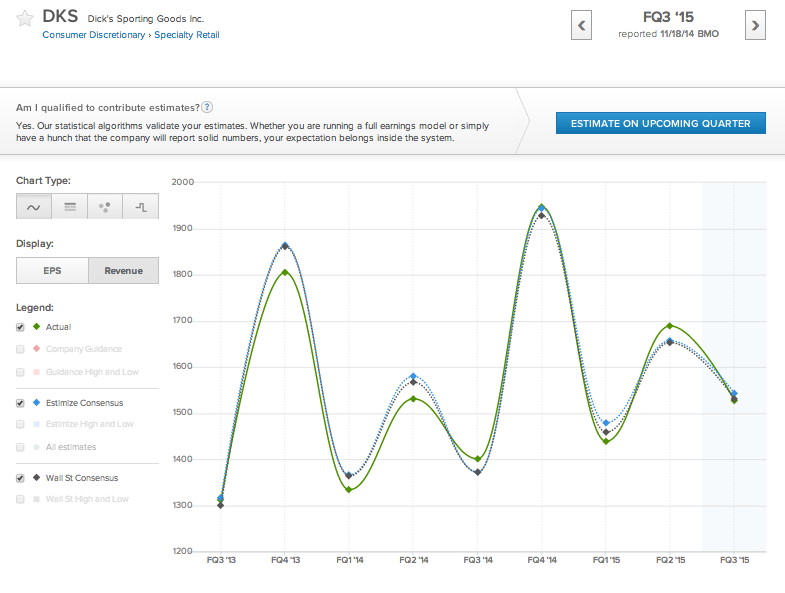

Even though golf and hunting have been under enormous pressure, total revenue at Dick’s has been doing just fine. Throughout the previous 4 quarters total revenue has been up between 8% and 10% compared to the same quarter of one year prior.

Dick’s improvement on the top line is being driven by new store openings and an expanding online presence. Like many other retailers Dick’s is seeing more of its business shift from stores to e-commerce . In the third quarter of the year online sales made up 7.3% of Dick’s total revenue, up from 6.5% in 2013.

This quarter the company also added 24 new Dick’s locations, 1 Golf Galaxy, and 7 Field & Stream stores, which also helped increase total revenue without damaging same store comps too much. Between adding new stores and shifting the business in the favor of online retail, Dick’s 9% total revenue gain has generated lower relative profits.

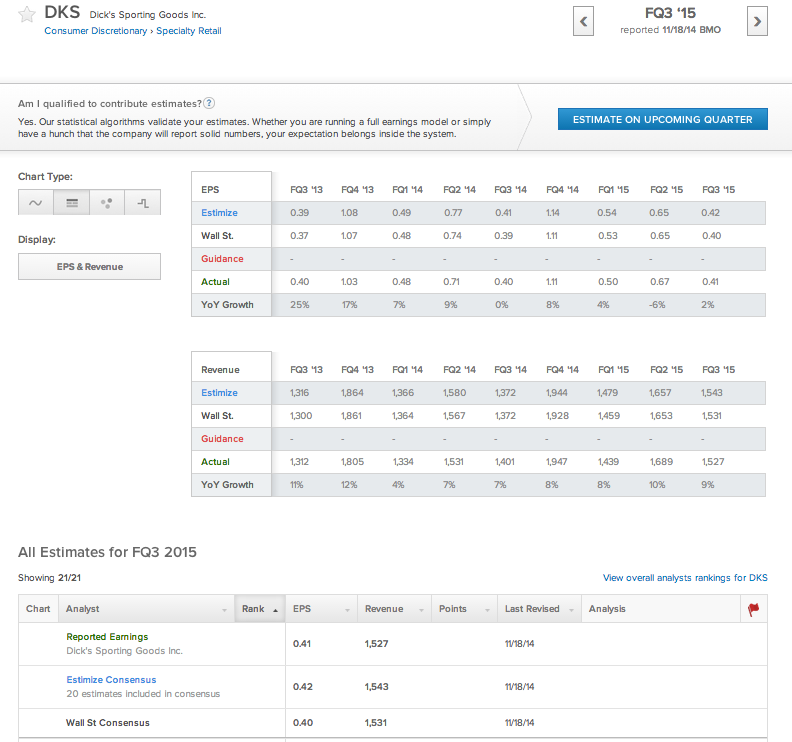

Tuesday Dick’s reported earnings of 41 cents per share and revenue of $1.527 billion missing the Estimize consensus on the top and bottom line by a small margin.

With the third quarter behind it Dick’s will now gear up for the holiday period. Golf and hunting are continuing to drag down profits, but encouragingly same store sales are still positive and the company is continuing its planned expansion.

Going into the holiday quarter Dick’s expects to see more pressure on margins due to promotional pricing and the higher costs associated with e-commerce. As far as golf goes CEO Edward Stack said that Golf Galaxy is still profitable and the company is not exiting the golf business or abandoning its specialty retail chain.

For now the plan is to stay the course with golf. But if golf and hunting continue to weigh Dick’s down, the plan could be subject to change.