Bakken Shale | E&P | NGI All News Access | Utica Shale

Hess Trims Budget 16%, with Most Onshore Capex Set for Bakken

Hess Corp. plans to spend 16% less this year than it did in 2014 for capital expenditures (capex), with most of the unconventional budget directed to Bakken Shale oil reserves and a slice for Utica Shale liquids.

The New York City-based producer plans to spend $4.7 billion in 2015, versus $5.6 billion in 2014. Most of the budget, $3.1 billion, is earmarked for U.S. projects onshore and in the deepwater Gulf of Mexico (GOM). About 45% ($2.1 billion) is budgeted for unconventionals, with 26% ($1.2 billion) for production, 21% ($1 billion) for development and 8% ($400 million) for exploration.

“Our company is well positioned to manage through the current price environment, with a strong balance sheet and resilient portfolio,” said CEO John Hess. “Our 2015 budget reflects a disciplined approach to maintaining our financial strength and flexibility while preserving our long term growth options.”

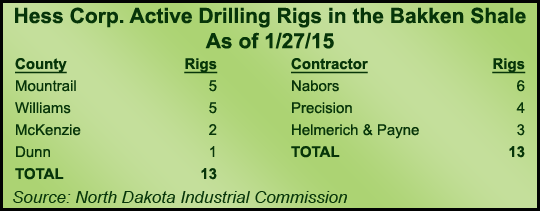

The Bakken is to receive the bulk of the onshore money, $1.8 billion, which is down from $2.2 billion a year ago. This year the company would run on average 9.5 rigs and bring online 210 operated wells, versus 17 rigs and 238 wells in 2014.

“Hess has some of the best acreage in the Bakken, and we will continue to drill in the core of the play, which offers the most attractive returns,” COO Greg Hill said. “Substantially all our core acreage is held by production, which allows us to defer investment in the short term while maintaining the long term value and optionality of this important asset. As oil prices recover we will increase activity and production accordingly.”

In the Utica, capex has been trimmed to $290 million from $500 million “as we transition to early development at a measured pace in this price environment and as infrastructure builds out,” Hill said. A joint venture with Consol Energy Inc. is planning to use two rigs in the wet gas window to drill 25-30 wells, versus last year when it ran four rigs and 39 wells were ramped up.

Also scheduled this year is GOM drilling in the Tubular Bells and Shenzi fields, as well as several overseas locations. In addition, development would continue at the Stampede field in the deepwater, with exploration also planned.

About $250 million is budgeted for Tubular Bells (57.1% interest), which Hess operates, to complete one production well and one water injection well, as well as for facilities work. Another $200 million is to be spent to complete drilling production, appraisal and water injection wells at the Shenzi Field (28% interest), which BHP Billiton operates, and for small-scale well-related activity elsewhere in the deepwater. In the Stampede field, Hess (25% interest and operator) has earmarked $300 million to progress hull and topsides fabrication, and to begin drilling.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |