Harman International Industries shares soared last Thursday, thanks to better-than-expected Q2 results.

The announcement sent the stock rocketing more than 23.7% higher on heavy volume, making it one of the top gainers in the S&P 500.

Shares of Harman closed the day at $125.01, an increase of $24 over its closing price last Wednesday. And volume exploded to more than 4.8 million shares (seven times the stock’s typical daily volume).

But before you begin scooping up shares, you should find out if this audio equipment maker is worthy of your attention right now, or if you should turn a deaf ear.

High Expectations Following Q2

The Connecticut-based company raised its forward guidance for the year, saying it expects demand to remain strong through the end of the company’s fiscal year at the end of June.

The company raised its earnings forecast to $5.85 per share, an 11.4% increase from its prior forecast of $5.25 per share. And the firm expects its annual revenue to remain steady at $6 billion.

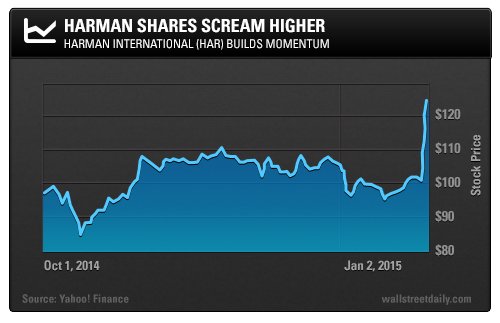

As you can see from the chart below, as of Thursday, the stock was up more than 47.9% since hitting a 52-week low of $84.48 on October 14, 2014.

Here’s why the company has such a positive outlook: The total revenue for the second quarter of 2015 was more than $1.58 billion, and represents a 19% increase over the $1.3 billion in the year-ago period.

Harman has benefited from an industry trend toward cars that provide users with internet-connected audio and entertainment options, which has spurred improved sales in its infotainment segment (+12%), lifestyle segment (+26%), and professional segment (+29%). (The percentage increases compare to the same quarter in the year-ago period.)

The company earned $116.2 million, or $1.65 per diluted share, a 61% increase over the $71.6 million, or $1.03 per share, in the same quarter a year ago.

Equity, Debt, and Risk…

In the reported quarter, the company’s adjusted gross margin expanded 155 basis points year over year. This was due to higher sales volume on fixed production costs and a favorable mix of products.

The company also reported that selling, general, and administrative (SG&A) expenses, as a percentage of revenue, declined 59 basis points to 20%. The quarterly improvement came on the back of improved operating leverage due to higher sales.

Harman has been able to realize these gains without the use of debt, too. The company’s debt-to-equity ratio is very low at 0.24, and is currently below that of the industry average.

Yet its quick ratio of 0.86 is relatively weak and could be a cause for concern in the future.

It should be noted that the company faces one other potential risk for the future that could significantly impact current and future shareholders.

You see, approximately 50% of Harman’s revenue is concentrated with its top four automaker customers without the use of long-term contracts.

In other words, the company’s revenue stream could suffer a catastrophic blow with the loss of any one of the four core customers. The loss of two or more would send the company to the brink of bankruptcy.

Bottom line: Despite the risks associated with such a small core customer base, Harman’s growing product pipeline and solid patent portfolio will boost the top and bottom lines for FY 2015 and beyond.

And with growing partnerships with Apple Inc (NASDAQ:AAPL) and Google (NASDAQ:GOOGL), the company is singing a pitch-perfect tune for investors.

Good investing,