EGPC receivables issue resolved

TransGlobe Energy Corporation (NASDAQ:TGA) has announced a raft of measures aimed at seeing it through the current weak oil price environment, reducing capital investment for 2015 and focusing on costs. From an operational perspective, the focus near term shifts from exploration drilling to highgrading the prospect inventory; processing of the group’s large Egyptian 3D seismic survey is ongoing. The effective resolution of TGA’s EGPC payment issue adds material strength to the balance sheet. Having received US$140m in cash payments from EGPC in the fourth quarter, TGA now holds c US$140m in cash at an opportunistic time to carry out deals.

EGPC makes significant receivables reduction

TGA received several payments amounting to US$140.1m from EGPC in Q414, taking the total for payments received in 2014 to US$233.5m, reducing the receivables balance owed by EGPC to US$120m. On the basis of recent progress we expect this balance to be fully paid within the near-term. In addition, TGA has agreed a self-marketing agreement with EGPC, ensuring payments are received direct by the company going forward.

Focus in Egypt shifts from seismic to drilling

TGA has announced a reduced capital budget of US$37m for 2015, with just US$7m of this to be spent on drilling wells. Emphasis of operations in Egypt now shifts to high-grading of the prospect inventory, with gathering of seismic and interpretation operations ongoing. In addition to conserving cash flow, this strategy ensures the group has a commercial drilling inventory in preparation to restart investment in response to any stabilisation in the macro environment.

Valuation: EGPC payment partly offsets weak macro

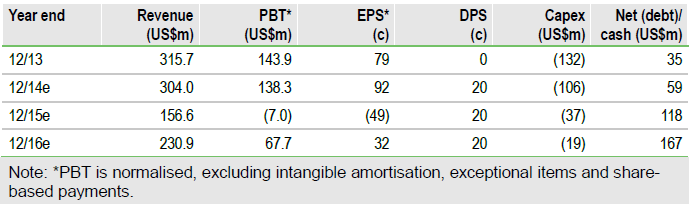

Based on our DCF analysis we reduce our valuation for TGA from US$7.5/share to US$6.0/share (RENAV) reflecting the group’s lower production estimates for 2014 and the weaker macro environment. In a sense check to this DCF valuation we assess the company’s value on an absolute basis as at year-end 2014. Based on this analysis we see the shares as well supported with the group holding US$177.5m in net cash and receivables (US$2.4/share). Also, we see TGA as a solid value opportunity to those with a constructive view on long-term oil prices, trading at under 1x cash flow (0.84x) under our long-term US$80/bbl oil price

scenario.

To Read the Entire Report Please Click on the pdf File Below