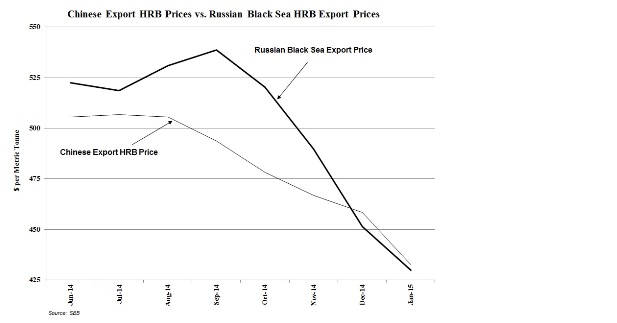

In recent years – at least through November 2014 – the Chinese steel mills’ export price for hot-rolled band (HRB) was consistently the lowest in the world – excluding, of course, the Ukrainian mills whose product had to sell at a sizable discount given the small coil size and less precise tolerances. The Chinese price, FOB the port of export, was often $15-20 per tonne below the Russian price, FOB the Black Sea. In turn, the Russian price FOB the port of export was typically $10-40 per tonne below the price offered by steel mills elsewhere in the world.

Last September, for example, the Chinese export price was about $490 per tonne, FOB China, versus the Russian price of about $535 per tonne, FOB the Black Sea. A typical offering price for the Japanese, South Korean, Indian and Middle Eastern mills was in the $550-600 per tonne range.

Since October 2014, we’ve witnessed: a) the deterioration of HRB export prices; b) the plummeting in value of the Russian ruble per U.S. dollar (to 65/$ from 32/$); and c) far lower crude oil, fuel oil and gasoline prices. The cost to produce hot-rolled band in Russia since June 2014, given operating costs including plant overhead are about 75% denominated in Russian rubles, has fallen $75-100 per tonne to a range of $275-350 per tonne in January 2015 (with the marginal cost on average about $50 per tonne less), based on WSD’s monthly World Cost Curve assessments.

The Chinese steel mills’ operating cost over this period have benefitted greatly from lower prices for iron ore delivered to China. Also, coal prices are down. Hence, the medium- and larger-sized Chinese steel mills are now cost competitive globally for the first time since 2007; although, not nearly as low cost as the Russian mills. Fortunately for the Chinese mills that export wide hot-rolled band, the 9% VAT credit for boron-containing steels (at least 0.0008% boron) was not rescinded as of January 2015 as it was for most other boron-containing steels.

Even though steel demand in Russia is declining at present, apparent demand may have risen the past few months because steel buyers in Russia: a) see that the per tonne price in rubles is extraordinarily depressed on a U.S. dollar basis; and b) expect the HRB costs in Russia on a rubles basis will likely rise at least 20% per annum the next few year as the price paid for workers, steelmakers’ raw materials and other purchased goods rises to be more in line with the dollar price for these goods elsewhere in the world.

No doubt at least through mid-2015, given current exchange rates and the same U.S. dollar prices for iron ore and crude oil, the Russians and the Chinese mills will remain the world’s lowest-priced HRB exporters.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2015 by World Steel Dynamics Inc. all rights reserved