With first quarter 2015 earnings yet to take center stage in the airline space, news flow was spare over the past week. Nevertheless, American Airlines (MX:AAL) grabbed headlines with the U.S. Department of Transportation (DOT) approving its planned operations on the Los Angeles-Mexico City route, replacing Alaska Air (NYSE:ALK).

Moreover, according to data released by the Bureau of Labor Statistics, average airfares in the U.S. for the month of March decreased 5% over Mar 2014. The March figure was down 1.7% from Feb 2015 on a seasonally adjusted basis.

Low-cost carrier Save (MILAN:SAVE) was also in the news for its launch of non-stop flights to ten new destinations and expanded service to 18 summer routes. Meanwhile, European low-cost carrie Ryanair (NASDAQ:RYAAY) announced its intention to launch three new routes from October this year.

On the price front, the NYSE ARCA Airline index gained 2.4% over the past week.

(Read the last ‘Airline Stock Roundup’ here: Delta Q1 Earnings Top, Virgin America Named Top Airline in US.)

Recap of Most Important Stories of the Last 5 Trading Days

1. American Airlines Group received encouraging news when the DOT approved the request filed by American Airlines and Alaska Air, thus allowing the former to take over a route between Los Angeles and Mexico City from the latter. American Airlines intends to start operating on the route from June 4, 2015, replacing Alaska Airlines. Delta Air Lines (NYSE:DAL) had also been looking to operate flights on the route, operations on which were restricted by the U.S.-Mexico treaty (read more: American Airlines to Connect LA-Mexico Instead of Alaska Air).

2. Data released by the Bureau of Labor Statistics suggest that average airfares in the U.S. for March declined 5% on a year-over-year basis. Weak oil prices over the period and increased competition contributed to the decline. The March figure was down 1.7% from Feb 2015 on a seasonally adjusted basis reflecting weak oil prices.

3. In a bid to expand further and improve customer convenience, Spirit Airlines introduced non-stop flights to ten new destinations and expanded service to 18 summer routes such as Cleveland, Boston, Denver, Los Angeles, Houston and Chicago.

However, according to the 2015 American Customer Satisfaction Index (ACSI) by customer service, Spirit Airlines secured the lowest score for airlines. JetBlue Airways (NASDAQ:JBLU) topped the list according to the survey, which also considered hotels and online travel agencies apart from airline companies.

4. Ryanair Holdings declared, as a part of its winter schedule, that it will start three new routes from its base at Copenhagen. The carrier stated that it will operate flights between Copenhagen and Alicante, Budapest and Malaga from Oct 2015. Following the new additions, Ryanair will operate on twelve routes from Copenhagen starting from the coming winter.

Performance

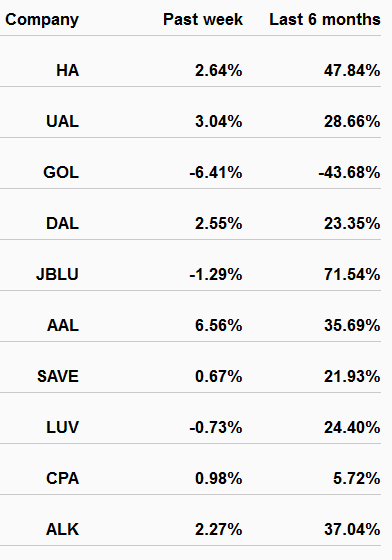

The following table shows the price movement of the major airline players over the last 5 trading days and during the last 6 months.

As the chart above suggests, quite a few airline stocks gained over the past week. American Airlines Group emerged as the biggest gainer with its shares rising 6.56% on the back of the approval gained from the DOT. JetBlue Airways witnessed the highest upside (71.54%) over the last six months.

What’s Next in the Airline Biz?

It will be all about earnings in the airline space over the next five trading days. Big names in the space like Southwest Airlines (NYSE:LUV), American Airlines and United Continental Holdings (NYSE:UAL), the parent company of United Airlines), are scheduled to unveil their first quarter 2015 earnings numbers over the said period. We expect investors to keep a close eye on the quarterly performance of these key players, along with the business guidance provided by them for the year.