Amazon, Microsoft, IBM and the cloud gang: Comparing the revenue

Amazon's disclosure of its Amazon Web Services financials fills in a big piece of the cloud financial picture that revolves around a bevy of tech giants all claiming to be the biggest as-a-service kid on the block.

Unfortunately, it's difficult to declare a winner since every cloud player has its own math. So much for standards kids. But given I can't really resist an apples and oranges cloud face-off I'm going to give this a shot.

For our purposes, we'll look at the four biggest hyperscale cloud providers. Amazon, Google, Microsoft and IBM. We'll toss in some over-the-top cloud players such as Salesforce, which is a bit hard to ignore, with Oracle, which also breaks out its various as-a-service cloud efforts nicely and includes infrastructure and platform. For simplicity, this back-of-the-envelope effort is focused on the various flavors of as-a-service revenue.

Given those moving parts, here's what we know so far.

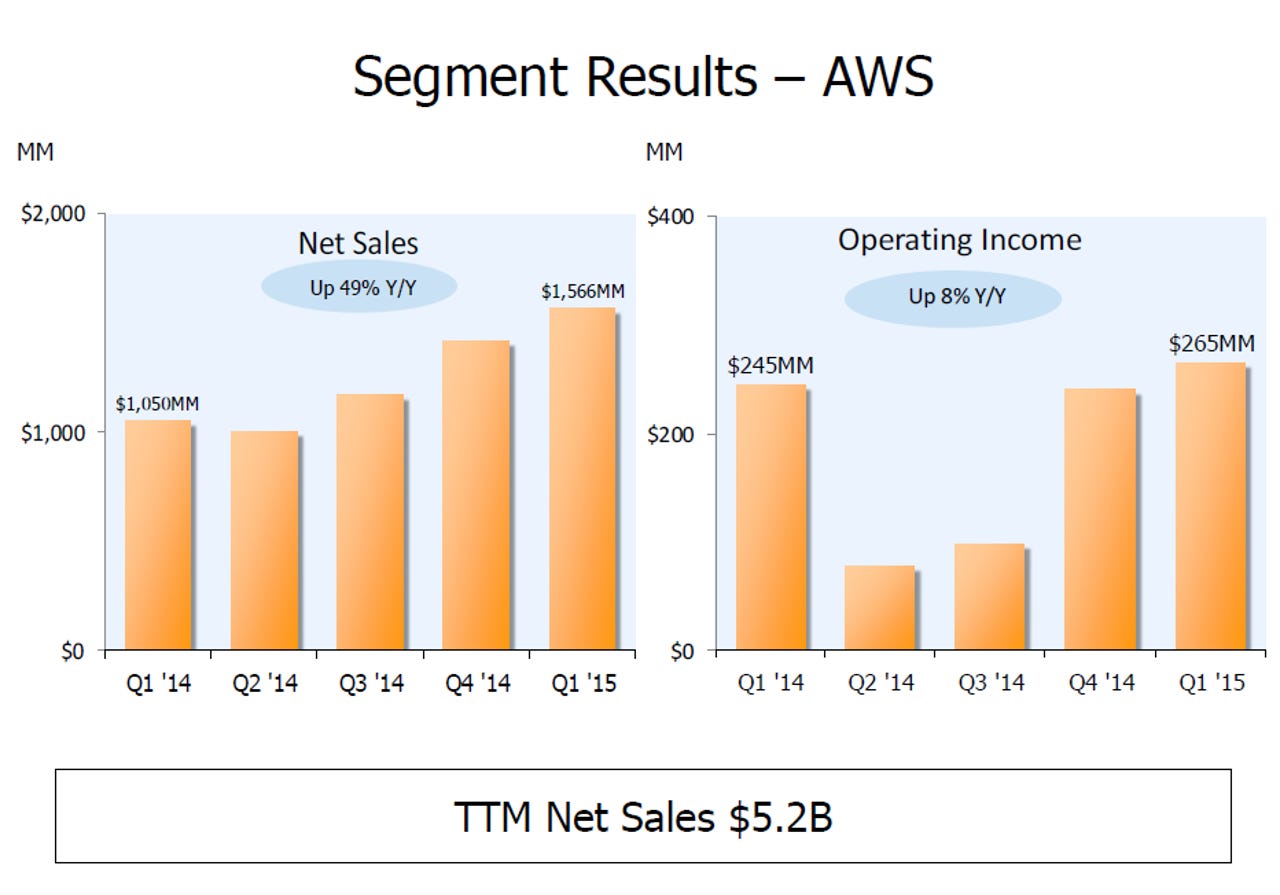

Amazon Web Services is on an annual run rate of $6.26 billion, but that figure is low unless you assume that the cloud vendor isn't going to grow in the quarters ahead. Amazon reported AWS sales of $1.566 billion in the first quarter, up from $1 billion in the same quarter a year ago. Operating income for AWS was $265 million. For context, Amazon's North American sales were $13.4 million with an operating profit of $517 million. It's safe to say that all the margin power within Amazon resides with AWS. In terms of profit potential, Amazon is a cloud infrastructure provider disguised as an e-tailer. For 2014, AWS was a $5 billion business.

Microsoft said that its commercial cloud business is on a $6.3 billion run rate. That sum includes things like CRM Online, Office 365 and Azure. As Mary Jo Foley reports, it's not so easy to figure out Azure's financials based on the way Microsoft delivers its results. Azure is the most direct AWS competitor, but it's safe to say that it's smaller than Amazon's cloud business on the infrastructure side.

IBM claims that its 12-month rolling revenue is now on a more than $7.7 billion run rate. The catch? IBM's big cloud number includes everything from services to gear to managed services. It's a hybrid cloud world so IBM may have a point with its $7.7 billion figure. However, I chose to look at what IBM calls its "as a service revenue," which is now on a $3.8 billion run rate. That as-a-service figure includes software as a service as well as platform and infrastructure.

Google's enterprise cloud revenue is a mystery. Google has an "over" revenue category that includes Google for Work, but also contains Google Play, Nexus devices and gadgets like Chromecast. Google's other revenue was $6.94 billion for 2014 and $1.75 billion in the first quarter. Other revenue in the first quarter was up 23 percent from a year ago. The cloud component of the other revenue category is likely dominated by Google for Work.

Salesforce.com fortunately has a clean cloud number given that it has been an as-a-service player from the beginning. For the fiscal year ending Jan. 31, Salesforce had $5 billion in subscription and support revenue. All of that sum could be attributed to cloud. Professional services tacked on $359.8 million in revenue to the total.

Tech Pro Research

Oracle's fiscal third quarter results, reported last month, featured cloud software-, platform- and infrastructure-as-a-service revenue of $527 million. Annualize that sum and Oracle will top $2 billion in annual cloud revenue assuming no growth ahead. Oracle is usually rolling software and cloud subscriptions together in one item.

SAP has a similar path with its cloud and software line, but in the first quarter delivered €503 million in cloud subscriptions and support. Annualize SAP's first quarter cloud and support revenue and you get a bit more than €2 billion for the year, or $2.16 billion at current exchange rates.

Below that $2 billion run rate mark a bevy of smaller players that via APIs can add up to a juggernaut. For instance, Workday is expected to deliver fiscal 2016 revenue of $1.14 billion for the year ending Jan. 30.