Over a year ago, when we published our large feature on Zynga, it was at a crossroads—so focused on growth that the company was hemorrhaging users, and money. One anonymous principal Zynga engineer told us at the time: "Zynga is destroying Zynga."

On Friday, Zynga announced its quarterly earnings for the third quarter of 2014, and the answer is clear: the company is still losing a lot of money. The San Francisco gaming firm lost over $57 million during the quarter and has lost a total of $180.7 million in 2014—it is now on pace to lose over $200 million in 2014. That would put its annual losses about where they were in 2012 and would mean that Zynga will have lost over $800 million in six years.

Some of that was due to Zynga's acquisition of NaturalMotion earlier this year.

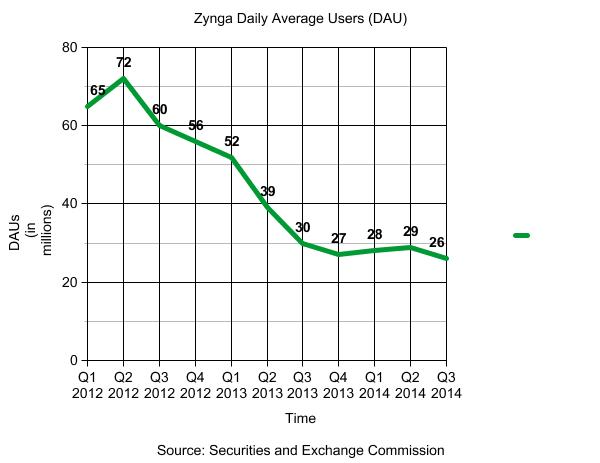

But Zynga's loss of daily average users (DAU), which fell by half from the third quarter of 2012 to the third quarter of 2013 (60 million to 30 million DAUs), has noticeably slowed. That being said, Zynga hasn't had more than 30 million DAUs ever since. That flattening loss rate may have been what kept investors interested: its stock price actually ticked up over 5 percent to $2.50 per share on Friday.

"Last quarter, our core franchises—Casino, Words With Friends, and FarmVille—grew 30 percent year over year in terms of bookings, and we achieved meaningful growth in mobile with a 111 percent increase in mobile bookings annually,” CEO Don Mattrick said in a statement. “We have been operating with purpose and it has taken us some time to transform our business as we faced some execution challenges in the quarter. 2014 has been an investment year for us as we assembled a new leadership team, reorganized the company and reset our product pipeline."

At the end of the day, Zynga still hasn't been able to replicate the success it had a few years ago.

reader comments

45