For the fiscal 2014 fourth quarter, Johnson Controls (NYSE: JCI), a global multi-industrial company, reported net income from continuing operations of $311 million, or $0.46per share, on $11.0 billion in revenues. Excluding restructuring and non-recurring items in the 2014 and 2013 fiscal fourth quarters, highlights (non-GAAP) include:

- Net revenues of $11.0 billion vs. $10.7 billion in Q4 2013, up three percent

- Record income from business segments of $983 million compared with$889 million a year ago, up 11 percent

- Record net income from continuing operations of $700 million versus$629 million in Q4 2013, up 11 percent

- Diluted earnings per share from continuing operations of $1.04 versus$0.91 in the same quarter last year, up 14 percent

Non-recurring items that impacted reported Q4 2014 and Q4 2013 income include:

2014 fourth quarter (net charge of $0.58 per share)

- Non-cash mark-to-market and pension settlement losses of $290 million($218 million after-tax)

- Transaction and integration costs of $23 million ($18 million after-tax)

- Restructuring and non-cash impairment charges of $162 million ($135 million after-tax) primarily related to the Building Efficiency reorganization

- Non-recurring net tax expense of $18 million

2013 fourth quarter (net charge of $0.83 per share):

- A $22 million net loss ($22 million after-tax) on the sale of a business

- A $730 million ($666 million after-tax) restructuring and non-cash impairment charge

- A non-cash mark-to-market and pension settlement gain of $474 million($278 million after-tax)

- Tax charges of $165 million primarily related to valuation allowance provisions

“We ended fiscal 2014 with solid contributions from all of our primary businesses, continuing the strong performance we have seen throughout the year,” said Alex Molinaroli, Johnson Controls chairman and chief executive officer. “While the macro-economic environment continues to be challenging in some key markets, each of our businesses generated top line growth in the fourth quarter. Importantly, Building Efficiency orders were higher for the first time in a year. During the quarter, we announced a number of organizational and management changes that we believe will drive further improvements in shareholder value in 2015 and beyond.”

In the fourth quarter, the company announced it was reorganizing its Building Efficiency business, with the North America branch business to operate separately from the global products business to better align with the company’s long-term strategies and accelerate profitable global growth. Bill Jackson, who led the successful effort to return the Automotive Interiors business to profitability in 2014, was named president of Building Efficiency.

R. Bruce McDonald was named vice chairman, a new role designed to drive operational and financial performance within the businesses while also directing specific enterprise functions and strategic initiatives. Brian J. Stief was appointed executive vice president and chief financial officer. These appointments increase executive management bandwidth and are expected to help the company deliver on its short- and long-term commitments.

Johnson Controls also announced its intention to divest the Global Workplace Solutions (GWS) business, reflecting the company’s previously stated intention to invest in businesses that are core to its long-term growth strategy and multi-industrial portfolio.

Business segments, excluding restructuring and non-recurring items (non-GAAP)

Building Efficiency sales in the fiscal 2014 fourth quarter were $3.9 billion, 1 percent higher than the same quarter last year, with growth in Asia and the revenue associated with the Air Distribution Technologies (ADT) acquisition partially offset by lower revenues in North America. GWS sales were slightly lower.

Orders in the quarter, including the incremental contribution of the ADT acquisition and excluding foreign exchange, were 11 percent higher year-over-year. Excluding ADT and the impact of foreign exchange, orders increased 2 percent, marking the first order growth in a year. The backlog of projects at the end of the quarter, adjusted for divestitures and foreign exchange, increased 1 percent, to $4.8 billion.

Building Efficiency segment income was $393 million, up 11 percent from$355 million in the fiscal 2013 fourth quarter, primarily the result of the incremental contribution by ADT and GWS segment income, which more than doubled compared with the 2013 fourth quarter as its business improvement program continued to gain traction.

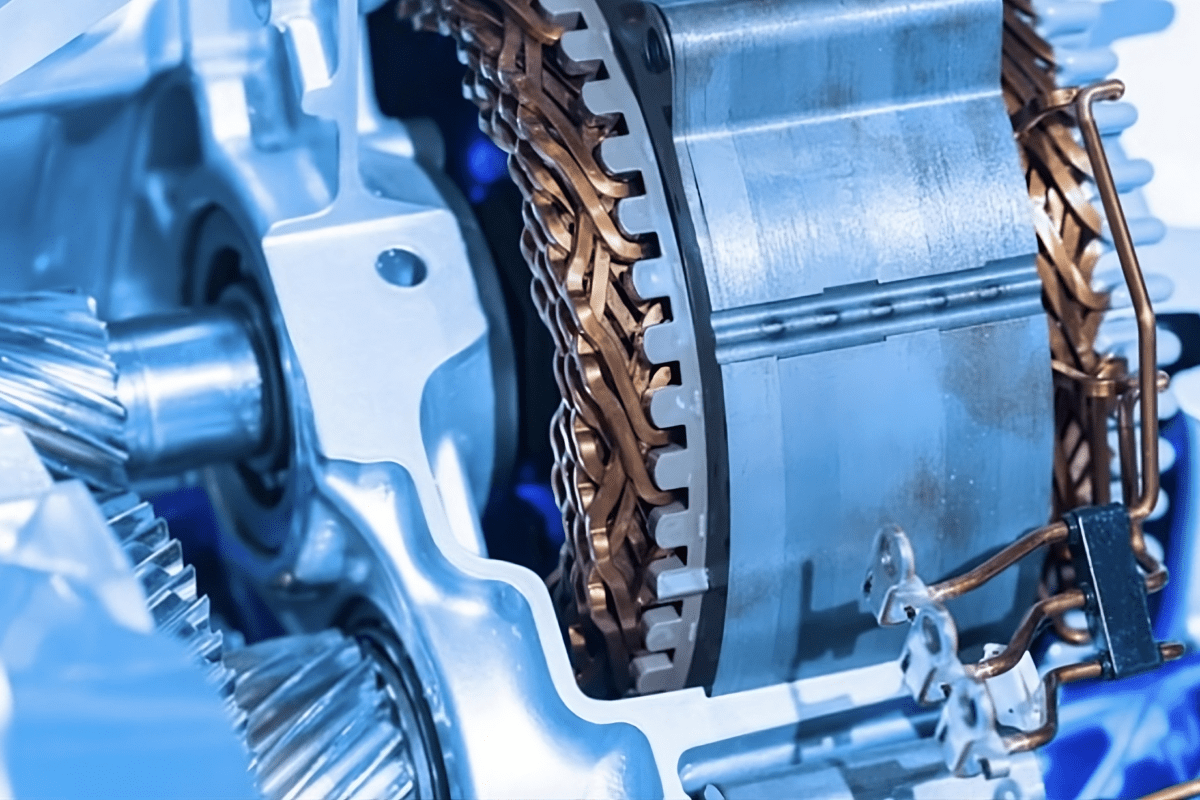

Automotive Experience sales in the quarter grew 3 percent to $5.3 billionversus $5.1 billion last year on industry production growth of 8 percent inNorth America and a 1 percent decline in Europe. Revenues in China, which are primarily generated through non-consolidated joint ventures, increased 17 percent to $1.8 billion, while industry production increased 8 percent versus last year.

Automotive Experience segment income was $261 million, 27 percent higher than the same quarter last year. Seating segment income increased by 8 percent to $218 million while Interiors reported a profit of$43 million versus $3 million last year due to improved operational efficiencies and the benefits of earlier restructuring actions.

Power Solutions sales in the fourth quarter of 2014 increased 5 percent to $1.8 billion versus $1.7 billion in the same period last year. Unit shipments rose 4 percent, with increases in the global original equipment (OE) and replacement markets. Higher unit shipments in the Americas and Asia were partially offset by slightly lower aftermarket demand inEurope. The company said its production of AGM lead acid batteries for fuel-saving Start-Stop vehicles rose 23 percent compared with the fourth quarter of last year.

Power Solutions segment income was level with the fourth quarter of fiscal 2013, at $329 million. Segment margins for the 2014 fourth quarter were 18.4 percent. Segment margins for the 2014 fiscal year increased 60 basis points, to 16.1 percent.

Full year 2014 results

Johnson Controls fiscal 2014 revenues were $42.8 billion, an increase of 3 percent from $41.4 billion in 2013. Income from business segments totaled $3.1 billion, up 20 percent from $2.6 billion last year. Segment income margins for the year improved by 90 basis points.

Several actions intended to improve long-term shareholder value were undertaken in fiscal 2014, including:

- Announced $3.65 billion share repurchase program; $1.2 billioncompleted in Q1 2014

- Increased quarterly dividend by 16 percent

- Implementing the Johnson Controls Operating System to leverage scale, technology and expertise across the enterprise

- Business portfolio activities including:

- Acquisition of ADT, increasing Building Efficiency product breadth and distribution

- Divestiture of the Automotive Electronics business

- Memorandum of Understanding to create a joint venture with Hitachi to expand Building Efficiency product offerings

- Announced joint venture plans for the Automotive Interiors business

- Reorganization of the Building Efficiency business

- Decision to divest Global Workplace Solutions

“We began 2014 with a focus on execution and with an action plan to change our portfolio and our organization. Our earnings performance throughout the year proves our success in driving operational excellence throughout the company, and our progress around portfolio and the organizational changes in just one year exceeded our expectations,” said Molinaroli. “We believe initiatives to improve the profitability of our businesses continue to gain momentum. Our 2014 results provide a foundation that we believe will position us to deliver record sales and earnings in 2015.”

Fiscal 2015 outlook

For the first quarter of 2015, the company expects earnings of $0.74 – $0.77 per diluted share. Johnson Controls will provide full fiscal year 2015 guidance at its annual New York analyst day on Dec. 2, 2014.

Molinaroli added, “We have a good start to fiscal 2015 in all of our businesses and have begun to see recovery in some of our late cycle markets. Through our capital allocation strategies, we’re focusing Johnson Controls on new growth markets with higher returns, and our large and growing China presence in all our businesses continues to be a differentiator. Executing on our strategies and delivering on our commitments remains our highest priority. I would like to thank all Johnson Controls employees across the globe for embracing the continuing changes to our company as we work together to achieve higher levels of success.”