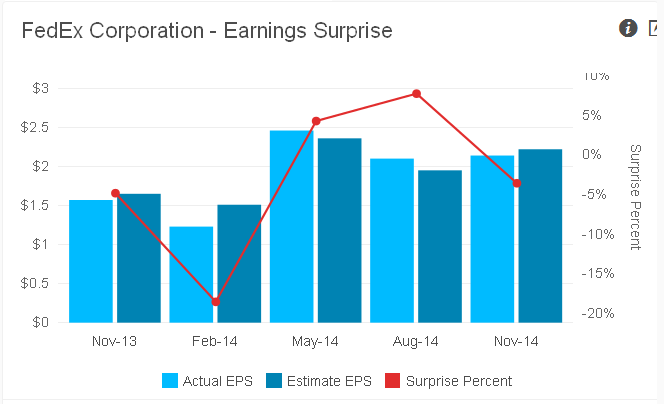

FedEx Corporation’s second-quarter fiscal 2015 (ended Nov 30, 2014) earnings of $2.14 per share fell well short of the Zacks Consensus Estimate of $2.22 per share. The earnings miss was primarily attributable to lower-than-expected revenues in the quarter. Moreover, results were hurt by higher aircraft maintenance expense. The earnings miss resulted in the stock declining in early trading.

The quarterly earnings number, however, increased from the year-ago equivalent by 36.3%. The bottom-line was positively impacted during the quarter by 16 cents per share due to stock repurchases undertaken by the company. The year-over-year improvement was due to growth witnessed across all segments of FedEx.

Total revenue during the second quarter climbed 5% on a year over year basis to $11.9 billion. Revenues, however, fell short of the Zacks Consensus Estimate of $11.97 billion.

Operating income improved 22% year over year to $1.01 billion in the quarter, resulting in an operating margin of 8.5%, up 120 basis points (bps) from 7.3% in the year-ago period. The growth was driven by higher volumes and improved yields at three segments.

Segment Performance

Quarterly revenues of FedEx Express grossed $7.02 billion, up 3% year over year driven by higher volume in U.S. domestic package and growth in international export package base revenues.

U.S. domestic package volume grew 7%. A 2% decline in U.S. domestic revenue per package was primarily attributable to reduced fuel surcharges and lower weight. FedEx International Economy volume climbed 5%, while FedEx International Priority volume inched up 1%.

Operating income was up 36% year over year to $484 million in the second quarter, resulting in an operating margin of 6.9%, up 170 bps from 5.2% in the year-ago period. Operating results were positively impacted by the growth in U.S. domestic and international export package revenue, lower pension costs and a marginal net benefit from fuel. High aircraft maintenance costs, however, hurt segmental results.

FedEx Ground revenues increased 8% year over year to $3.06 billion in the second quarter. Operating income was up 6% year over year at $465 million due to rise in volume and revenue per package. However, operating margin decreased 20 bps to 15.2%.

FedEx Ground average daily package volume grew 5% year over year. Growth in both business-to-business and FedEx Home Delivery services led to the increase. Revenue per package increased 3% given rate hikes and higher residential surcharges. FedEx SmartPost average daily volume declined 4% year over year. Revenue per package increased 7% aided by higher rates and improved customer mix.

FedEx Freight revenues were up 11% year over year to $1.59 billion in the reported quarter, reflecting a rise of 8% in LTL (less-than-truckload) average daily shipment. LTL revenue per shipment climbed 3% on the back of higher weight per shipment, escalated rates and increased fuel surcharges. The segment recorded operating income of $112 million, a rise of 35% from the year-ago quarter. Operating margin was 7.1%, up 130 bps from the year-ago quarter.

Guidance Maintained

Despite the earnings miss, FedEx, which is concentrating on network realignment to match the current demand level and ramping up its performance to gain competitive edge over the likes of United Parcel Service Inc (NYSE:UPS) and Radiant Logistics Inc (AMEX:RLGT), maintained its earnings per share guidance for fiscal 2015.

Earnings per share continue to be projected in the range of $8.50 to $9.00 per share. The Zacks Consensus Estimate of $9.00 per share coincides with the top end of the guidance range. Capital spending estimates have been retained at $4.2 billion.

Zacks Rank

Currently, FedEx carries a Zacks Rank #2 (Buy). However, a downward revision of the rank is not ruled out following the earnings miss. A better- ranked stock in the industry is Atlas Air Worldwide Holdings (NASDAQ:AAWW) with a Zacks Rank #1 (Strong Buy).