Business News of Tuesday, 24 November 2015

Source: B&FT

Gold Fields to review future of Damang Mine next year

Gold Fields logo

Gold Fields logo

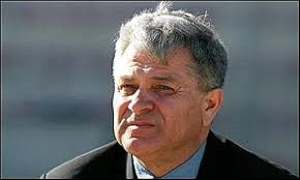

Gold Fields is reviewing options around the future of its Damang Mine in the country, which is struggling with a weakening dollar gold price and expected to announce a decision early next year, the Chief Executive Officer of Gold Fields Nick Holland said in its September quarter results, which showed increased gold output and higher earnings.

“As the gold price continues to languish we constantly review our portfolio; while the weaker currencies offer some respite in most regions, Ghana is fully exposed to further declines in the dollar gold price.

“In particular, Damang is challenged in the current environment; and, as such, we are considering various options for Damang which include a recapitalisation of the mine to expose the higher grade ore, or whether it would be more appropriate to preserve the inherent value of Damang until gold prices recover,” Mr. Holland said.

Damang had an improved quarter with production up by 7 percent on higher volumes and grade. Despite the lower production, the region reported a 7 percent decrease in All-In-Cost (AIC) to US$962/oz (Q2 2015: US$1,029/oz), with net cash flow for the quarter of US$32million.

The exceptional quality of Tarkwa was again highlighted in the quarter, with the mine producing 150koz, at AIC of US$872/oz.

Gold Fields posted attributable net earnings of US$18m for the three months to September 30, compared with US$12m in the June quarter and US$19m a year ago.

It reported headline earnings of US$21m for the September quarter, up from US$19m in the previous quarter.

Gold Fields achieved an average gold price of US$1,103/oz for the quarter, which was 6% lower than the price it realised in the June quarter.

The standout performance in the quarter after an extended period of difficulties was South Deep in SA, the last remaining Gold Fields’ asset in the country and one that is still in development.

Gold output at the mine shot up 42% to nearly 55,000oz compared with the previous quarter, as a result of higher yield and increased milled tonnages.

Full-year production is forecast to be as high as 193,000oz, with the second half’s production 50% higher than the first half, as renewed management focus on the mine and a fresh approach to the way the mine is being developed take effect.

Other mines contributing to the group’s higher total gold production were Damang and three mines in Australia, all of which offset lower production from the Cerro Corono Mine in Peru, Tarkwa in Ghana, and St. Ives in Australia.

The lower gold price offset the 2% increase in gold sales of 576,000oz in the quarter, pushing revenue down 4% to US$635m. Operating profit fell 3% to US$269m compared with the June quarter.

The Group generated US$75 million in net cash flow from operations for the September quarter (Q2 2015: US$30million) despite the lower US dollar gold price. This enabled us to reduce our net debt balance further by US$50million to US$1,427million at the end of September 2015 (June 2015: US$1,477million).

The net debt/EBITDA ratio at the end of the quarter was 1.41x, compared with 1.44x at the end of the June quarter. Group attributable equivalent gold production increased by 4 percent to 557koz (Q2 2015: 535koz), with most operations producing more gold in the September quarter.

Encouragingly, all-in sustaining costs (AISC) decreased by 8 percent to US$948/oz (Q2 2015: US$1,029/oz) and total all-in cost (AIC) decreased by 9 percent to US$961/oz (Q3 2015: US$1,059/oz).

In addition to the increase in production, weaker currencies and the lower oil price are favourably impacting costs. The Group realised a FCF margin of 11 percent at a gold price of US$1,103/oz in Q3 2015, compared with 9 percent at a gold price of US$1,174/oz in the June quarter. “We are pleased to report that our ongoing efforts to improve safety allowed us to achieve a fatality-free quarter,” he said.