There is a trade war between China and the US, which is expressed in the mutual increase in import duties. Can the Japanese economy benefit from this? Will Nikkei prices rise?

It should be noted that China is already ready to make concessions to the US and reduce duties on car imports and improve the protection of intellectual property. On the one hand, this reduces the reciprocal pressure on Chinese imports to the US, but on the other hand, such a statement weakened the Japanese yen previously considered by investors as a safe haven currency amid risks in the region. The emerging weakening of the yen makes the products of Japanese exporting companies more competitive. The possible reduction in import duties on foreign cars to China, on Tuesday, contributed to the growth of stocks of Japanese companies such as Toyota Motor, Honda Motor, Mazda Motor and Komatsu, as well as manufacturers of industrial equipment Fanuc and Okuma. This week, no significant economic statistics are expected to be published in Japan.

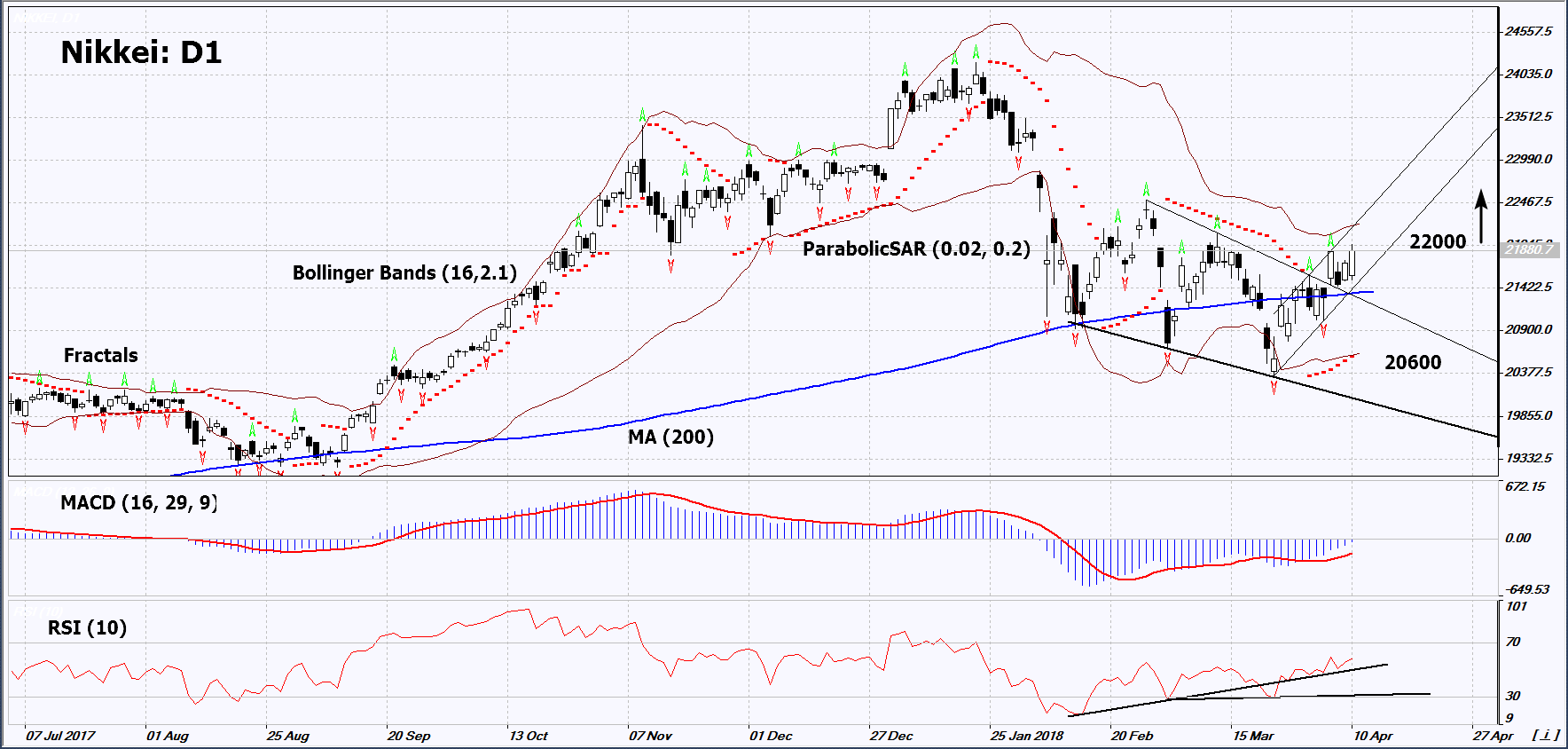

On the daily timeframe, Nikkei: D1 breached above the resistance line of the downtrend. The further price increase is possible in case of the publication of positive data on the economy of Japan and earnings reports.

-

The Parabolic indicator gives a bullish signal.

-

The Bollinger bands have widened, which indicates high volatility. They are titled upward.

-

The RSI indicator is above 50. It has formed a positive divergence.

-

The MACD indicator gives a bullish signal.

The bullish momentum may develop in case Nikkei exceeds the last fractal high and the psychological level at 22000. This level may serve as an entry point. The initial stop loss may be placed below the last fractal low, the lower Bollinger band and the Parabolic signal at 20600. After opening the pending order, we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level at 20600 without reaching the order at 22000 we recommend to close the position: the market sustains internal changes that were not taken into account

Summary of technical analysis

|

Position |

Buy |

|

Buy stop |

Above 22000 |

|

Stop loss |

Below 20600 |

Want to get more free analytics? Open Demo Account now to get daily news and analytical materials.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.