Health Care REIT, Inc. (HCN) reported fourth quarter EPS of $1.03 before the opening bell Friday, compared to the consensus estimate of $1.02. Revenues increased 10.0% from last year to $867.8 million. Analysts expected revenues of $855.28 million. The stock is now up $1.44 to $77.66 on 746,561 shares.

For the year, the firm reported funds from operations of $1.27 billion, or $4.13 per share. Revenue was reported as $3.34 billion.

For FY’15, HCN provided EPS guidance of $4.25-$4.35 versus consensus of $4.34 per share.

On valuation measures, Health Care REIT Inc. shares, which currently have an average 3-month trading volume of 2.2 million shares, trade at a trailing-12 P/E of 86.16, a forward P/E of 17.91 and a P/E to growth ratio of 3.18. The median Wall Street price target on the name is $77.00 with a high target of $86.00. Currently ticker boasts 5 ‘Buy’ endorsements, compared to 13 ’Holds’ and 1 ‘Sell’.

Profitability-wise, HCN has a t-12 profit and operating margin of 10.40% and 27.07%, respectively. The $25.44 billion market cap company reported $998.68 million in cash vs. $10.28 billion in debt in its most recent quarter.

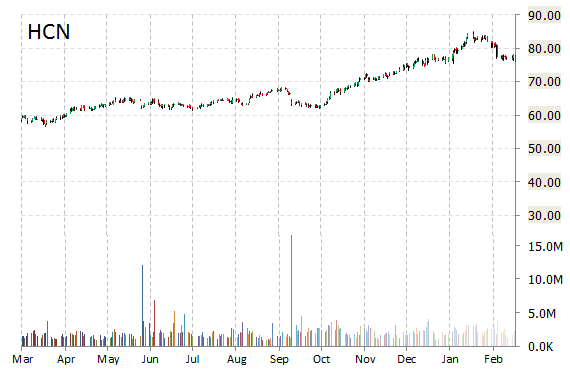

HCN currently prints a one year return of about 39%, and a year-to-date return of 1.75%.

The chart below shows where the equity has traded over the last 52 weeks.

Health Care REIT Inc. is an independent equity real estate investment trust. The firm was founded in 1970 and is based in Toledo, Ohio with additional offices in Brentwood, Tennessee and Dallas, Texas.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply