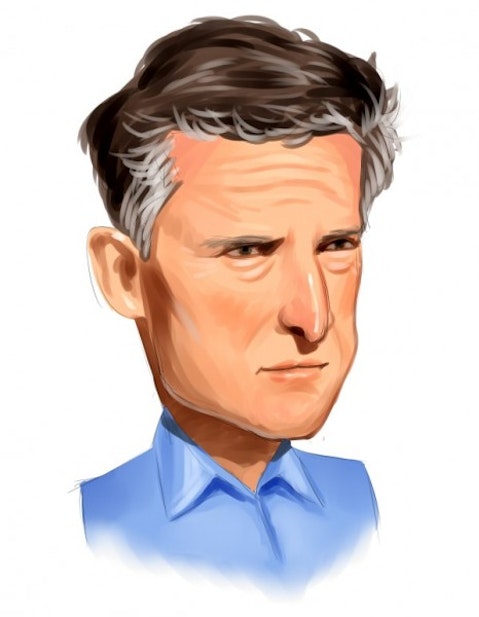

Billionaire Andreas Halversen‘s Viking Global has generated outstanding returns for its investors ever since its inception in 1999, ranking as one of the most successful pure long/short hedge funds today. However, the first quarter of 2016 turned out to be terrible for the Connecticut-based hedge fund, just like it was for most of the other large hedge funds. Although the 8.8% loss that Viking Global suffered during the period was comparatively less than what several of its peers did, it wasn’t something that the fund or its founder Mr. Halversen were proud of. In a first quarter letter to his investors, Mr. Halversen wrote that he was “unhappy” with how the fund performed during the first three months of 2016, but assured them that the investment team at Viking Global remained confident of its investment approach.

To bounce back from the hit it took at the beginning of the year, Viking Global made numerous changes to its portfolio during the first quarter, which included bringing down its leverage to 160% at the end of March from 182% in January and initiating a new stake in 22 stocks. Although those changes didn’t make a lot of difference in the fund’s performance during the second quarter, they did help Viking narrow its year-to-date losses to 5.8% by the end of June, according to Bloomberg. In this post, we will take a look at the top five new stakes that Viking Global initiated during the first quarter (excluding Broadcom Corporation, which was delisted at the end of January following the completion of its merger with Avago Technologies, with the two combining to form Broadcom Ltd (NASDAQ:AVGO)) and see how they performed during the second quarter.

We track prominent investors and hedge funds because our research has shown that historically their stock picks delivered superior risk-adjusted returns. This is especially true in the small-cap space. The 15 most popular small-cap stocks among a select group of investors delivered a monthly alpha of 80 basis points between 1999 and 2012 (see the details here).

#5 DaVita HealthCare Partners Inc (NYSE:DVA)

– Shares Owned by Viking Global (as of March 31): 1.74 million

– Value of Holding (as of March 31): $128 million

Let’s start with DaVita HealthCare Partners Inc (NYSE:DVA), whose shares have been on a slow but consistent upward journey since March. Shares of the kidney care services provider ended the second quarter with a gain of 5.37% and are currently trading up by 10.7% year-to-date. The company was recently featured in a list released by Wells Fargo of 20 S&P 500 companies that the firm believes have more upside potential versus the consensus estimates. Though most analysts expect DaVita HealthCare Partners Inc (NYSE:DVA)’s stock to continue its upward trajectory going forward, a few of them are concerned about the high trailing P/E multiple of almost 35 at which it currently trades at. DaVita HealthCare is expected to report its second quarter financial figures early next month and analysts project it to report EPS of $0.98 on revenue of $3.67 billion for the quarter. For the same quarter of last year, the company had reported EPS of $0.95 on revenue of $3.43 billion. Warren Buffett‘s Berkshire Hathaway didn’t make any change to its stake in DaVita HealthCare during the first quarter and continued to remained the largest shareholder of the company in our system, with ownership of 38.56 million shares.

Follow Davita Inc. (NYSE:DVA)

Follow Davita Inc. (NYSE:DVA)

#4 Newell Brands Inc (NYSE:NWL)

– Shares Owned by Viking Global (as of March 31): 4.73 million

– Value of Holding (as of March 31): $210 million

Newell Brands Inc (NYSE:NWL) was another new addition to Viking Global’s portfolio that has performed well since March. Owing largely to the 9.66% gain it saw during the second quarter, Newell Brands Inc (NYSE:NWL)’s stock is currently trading up by 10.42% year-to-date. At the start of this month, the global consumer goods company announced that it had closed the sale of its Levolor and Kirsch window coverings brands to Hunter Douglas for around $270 million. Though Newell Brands’ stock is currently trading very close to its lifetime high, which it made recently, it still sports a respectable annual dividend yield of 1.57%. On July 14, analysts at Jefferies Group reiterated their ‘Buy’ rating and $59 price target on the stock, though the price target represents potential upside of just 2.12%. Billionaire Ken Fisher‘s Fisher Asset Management initiated a stake in Newell Brands during the second quarter, purchasing 45,431 shares.

Follow Newell Brands Inc. (NYSE:NWL)

Follow Newell Brands Inc. (NYSE:NWL)

The second quarter performance of Andreas Halvorsen’s favorite new stocks is analyzed on the next page.