Form DEFA14A PROCTER & GAMBLE Co

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material under Rule 14a-12 | |

The Procter & Gamble Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

On September 20, 2017, The Procter & Gamble Company (“P&G”), posted the following material to the P&G website voteblue.pg.com and may in the future send or use the same or substantially similar communications from time to time:

HOW TO VOTE A Profoundly Different P&G Today P&G is a stronger, more focused company with a strengthened portfolio of leading brands in ten highly attractive, daily-use categories that respond to innovation, where products solve problems and performance drives purchase. We are implementing significant productivity improvements to fuel growth and substantially simplifying our organization. We are on the right track and returning value to shareholders. Read more about our progress and our winning plans in the sections below. PERFORMANCE STRENGTHENED PORTFOLIO PRODUCTIVITY & ORG. DESIGN CORPORATE CITIZENSHIP WORLD-CLASS BOARD

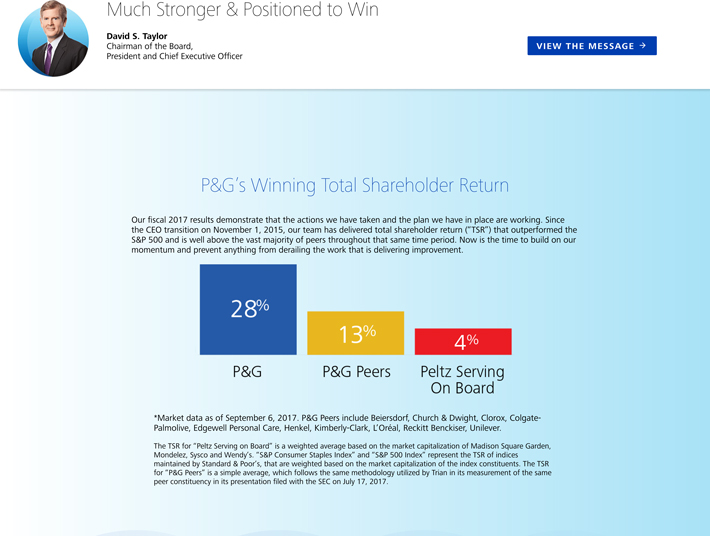

Much Stronger & Positioned to Win David S. Taylor Chairman of the Board, VIEW THE MESSAGE President and Chief Executive Officer P&G’s Winning Total Shareholder Return Our fiscal 2017 results demonstrate that the actions we have taken and the plan we have in place are working. Since the CEO transition on November 1, 2015, our team has delivered total shareholder return (“TSR”) that outperformed the S&P 500 and is well above the vast majority of peers throughout that same time period. Now is the time to build on our momentum and prevent anything from derailing the work that is delivering improvement. *Market data as of September 6, 2017. P&G Peers include Beiersdorf, Church & Dwight, Clorox, Colgate-Palmolive, Edgewell Personal Care, Henkel, Kimberly-Clark, L’Oréal, Reckitt Benckiser, Unilever. The TSR for “Peltz Serving on Board” is a weighted average based on the market capitalization of Madison Square Garden, Mondelez, Sysco and Wendy’s. “S&P Consumer Staples Index” and “S&P 500 Index” represent the TSR of indices maintained by Standard & Poor’s, that are weighted based on the market capitalization of the index constituents. The TSR for “P&G Peers” is a simple average, which follows the same methodology utilized by Trian in its measurement of the same peer constituency in its presentation filed with the SEC on July 17, 2017.

Now is the time to build on our momentum and prevent anything from derailing the work that is delivering improvement. “We met or exceeded each of our going-in objectives for the Fiscal Year 2017 in a challenging macro and competitive environment. We made significant progress on our key priorities ... now is the time to accelerate our efforts to execute and deliver on the plans we’ve put into action.” DAVID TAYLOR, P&G CHAIRMAN, PRESIDENT & CHIEF EXECUTIVE OFFICER VIEW OUR RESULTS How to vote the Blue Card VOTE ONLINE VOTE BY MAIL VOTE BY PHONE HOW TO VOTE

HOME OUR RESULTS Vote Blue FROM THE CEO OUR PLAN OUR BOARD FAQ Discard White HOW TO VOTE

HOW TO VOTE From The CEO CEO David Taylor talks with CNBC’s Jim Cramer about P&G’s recent transformation into a stronger, more focused and more profitable company with an innovative, market leading portfolio of brands that is creating shareholder value ahead of industry peers. Mr. Taylor also discussed the ongoing proxy contest and explains why Nelson Peltz does not have the requisite skills nor the experiences the Company seeks for membership on P&G’s Board. P&G CEO David Taylor on CNBC’s Mad Money. WATCH VIDEO

We strongly recommend you vote the BLUE Proxy Card to maintain our momentum and continue advancing our plan for the following reasons: P&G is delivering growth and shareholder value with a strategy and plan that is working. P&G has transformed itself with a streamlined and focused portfolio of brands and categories. P&G is fueling growth and value through significant productivity improvements. P&G has simplified its organization design to drive clear ownership and accountability for decisions and results by category. P&G is raising the bar to a new standard of excellence to meet the needs of consumers. P&G has a highly diverse and experienced Board that was carefully selected to bring the right balance of fresh perspectives and strong institutional knowledge. We believe Mr. Peltz initiated the proxy contest to satisfy his own agenda and to meet the expectations of his limited partners. What’s best for P&G right now is balance and focus, with the Board and employees continuing a steady commitment to a plan that is working. P&G will not benefit from change for the sake of change. Click here to learn how to vote the BLUE Proxy Card today. To learn more about how we are continuing to deliver on our goal of balanced growth, value creation and total shareholder return, please view the following letters.

Messages From Chairman, President and CEO David Taylor Much Stronger & Positioned to Win September 20, 2017 P&G is well-positioned with the right portfolio, the right plan, the right structure, and the right Board in place to deliver results and shareholder value for the short-, mid-and long-term. READ LETTER Our Diverse, Experienced Board August 28, 2017 P&G has a world-class Board with the experience and insights to deliver growth and shareholder value, and is executing a winning strategy that is working. Trian is focused on an outdated view of P&G, not the P&G of today. READ LETTER Delivering on Commitments August 1, 2017 Fiscal 2017 was a success – we met or exceeded our objectives despite slowing market growth and volatile currency and commodity environments around the world. READ LETTER Facts on Our Progress & Plan September 11, 2017 P&G is a profoundly different, much stronger, and more profitable company than it was just a few years ago. Our focused portfolio of market leading brands is creating consumer and shareholder value. READ LETTER P&G is on the Right Track August 14, 2017 Since the CEO transition on November 1, 2015, our team has delivered total shareholder return of 27%—well above the 8% weighted average return during the same period for companies where Nelson Peltz serves as a Board member. READ LETTER

VOTE THE BLUE PROXY CARD TODAY Online Voting Is Quick And Easy To Use Find your unique control number in the box located next to the arrow ( ) on your blue proxy or blue notice card. HOW TO VOTE HOME OUR RESULTS Vote Blue FROM THE CEO OUR PLAN OUR BOARD FAQ Discard White HOW TO VOTE Touching lives, improving life.© 2017 Procter & Gamble | Discl

HOW TO VOTE

Much Stronger & Positioned to

Win

SEPTEMBER 20, 2017

David S. Taylor

Chairman of the Board,

President and Chief Executive Officer

Dear Fellow Shareholders:

P&G is a profoundly

different, much stronger, and more profitable Company than it was just a few years ago. P&G people are transforming the Company, and working with passion, ownership and commitment to create value for consumers and shareholders. The Company is

successfully executing a strategy that is working. To avoid the risk of derailing this progress, the P&G Board of Directors strongly recommends that you elect ALL of P&G’s Directors by voting on the enclosed BLUE Proxy Card

today.P&G people are transforming the Company, and working with passion, ownership and commitment to create value for consumers and shareholders. The Company is successfully executing a strategy that is working. To avoid the risk of derailing

this progress, the P&G Board of Directors strongly recommends that you elect ALL of P&G’s Directors by voting on the enclosed BLUE Proxy Card today.

P&G Today Has a Much Stronger Portfolio, Positioned to Win

P&G has

transformed its portfolio into 65 brands and 10 core categories where products solve problems and performance drives purchase. The new portfolio is focused on daily-use household and personal care categories

that leverage P&G’s core strengths in consumer understanding, branding, product and package innovation, and go-to-market execution. They are faster-growth,

higher-margin businesses than those we exited over the past four years.

P&G’s Innovation Drives Brand Leadership

P&G is the innovation leader in these categories with leadership market share positions.

Market P&G Share vs. Market P&G Share vs. P&G Brand Rank 1 P&G Brand Rank 1 Share #2 Competitor Share #2 Competitor

#1 54% 3.0x #1 40% 3.0x

#1 44% 5.5x #1 66% 5.0x

#1 64% 3.0x #1 34% 2.0x

#1 28% 2.0x #1 49% 2.5x

#1 36% 1.0x #1 41% 4.0x

#1 50% 2.5x #1 47% 3.0x

In its largest market, P&G has led the industry with more top 25 innovations over the last 20 years than the next six competitors combined. 2 Recent innovation winners include Always Discreet, Always Radiant, Tide PODS, Ariel PODS, Gain FLINGS, Downy Unstopables, Fairy Platinum, Cascade Action Pacs, Pampers Swaddlers, Pampers Pants, Venus Swirl, and Oral B Genius… just to name a dozen.

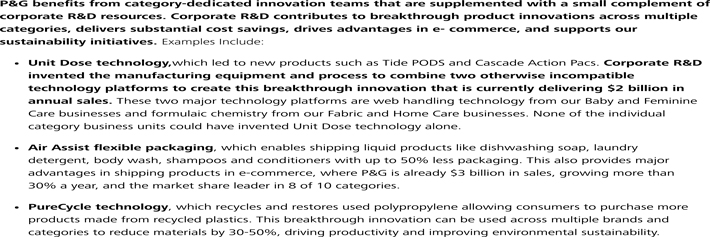

P&G benefits from category-dedicated innovation teams that are supplemented with a small complement of corporate R&D resources.

Corporate R&D contributes to breakthrough product innovations across multiple categories, delivers substantial cost savings, drives advantages in e- commerce, and supports our sustainability initiatives.

Examples Include:

Unit Dose technology,which led to new products such as Tide PODS and Cascade Action Pacs. Corporate R&D invented the manufacturing equipment

and process to combine two otherwise incompatible technology platforms to create this breakthrough innovation that is currently delivering $2 billion in annual sales. These two major technology platforms are web handling technology from our

Baby and Feminine Care businesses and formulaic chemistry from our Fabric and Home Care businesses. None of the individual category business units could have invented Unit Dose technology alone.

Air Assist flexible packaging, which enables shipping liquid products like dishwashing soap, laundry detergent, body wash, shampoos and conditioners with up to 50% less packaging.

This also provides major advantages in shipping products in e-commerce, where P&G is already $3 billion in sales, growing more than 30% a year, and the market share leader in 8 of 10 categories.

PureCycle technology, which recycles and restores used polypropylene allowing consumers to purchase more products made from recycled plastics. This breakthrough

innovation can be used across multiple brands and categories to reduce materials by 30-50%, driving productivity and improving environmental sustainability.

P&G Builds Brands That Win

P&G brands are

consistently ranked #1 in market share because they are the best. In the categories in which we compete, consumers seek trusted, familiar brands that solve problems and perform better than others.

Large, leading brands grow when they deliver noticeable superiority. P&G’s largest brands are the fastest growing. P&G’s top 10 brands grew organic sales two

percentage points faster than the Company in fiscal 2017. Nearly half of P&G’s top 25 brands grew organic sales by 4% or more, with four of those brands growing 10% or more. For example, Head & Shoulders is the largest shampoo

brand in the world and is one of the fastest growing (up 5% last year and each year for the past decade). Tide is the largest laundry detergent brand in the U.S. and is growing market share and sales (up 5% last year and the year before).

This is as true today as it has always been. Among millennials, numerous top-selling P&G brands such as Always, Tide,

Downy, Dawn, Bounty, Charmin, Gillette, and Crest hold the #1 market share position.

Channel trends across household and personal care categories favor the big,

leading brands. Among the fastest-growing formats are limited assortment channels such as discount clubs, small convenience stores, and e-commerce. Retailers need leading brands because they drive category

growth. According to data from Nielsen, a leading market research company, big brands (over 20% share) have grown at an average rate of 2.2% annually for the past 3 years, while small brands have declined 2.6% annually. In the household and personal

care categories in which we compete, it is not brand size that matters; it is performance that drives purchase.

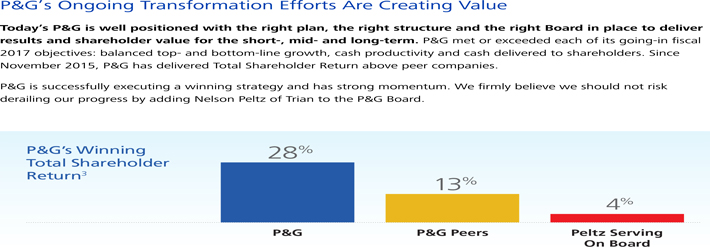

P&G’s Ongoing Transformation Efforts Are Creating Value

Today’s P&G is well positioned with the right plan, the right structure and the right Board in place to deliver results and shareholder value for the short-, mid- and long-term. P&G met or exceeded each of its going-in fiscal 2017 objectives: balanced top- and bottom-line growth, cash

productivity and cash delivered to shareholders. Since November 2015, P&G has delivered Total Shareholder Return above peer companies.

P&G is successfully

executing a winning strategy and has strong momentum. We firmly believe we should not risk derailing our progress by adding Nelson Peltz of Trian to the P&G Board.

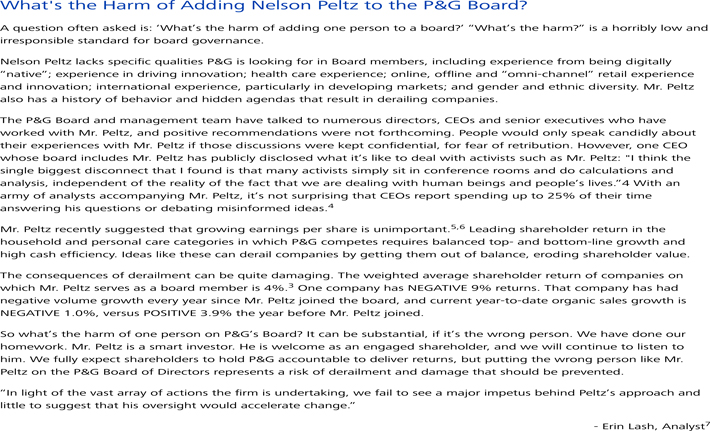

What’s the Harm of Adding Nelson Peltz to the P&G Board?

A question often asked is: ‘What’s the harm of adding one person to a board?’ “What’s the harm?” is a horribly low and irresponsible standard for

board governance.

Nelson Peltz lacks specific qualities P&G is looking for in Board members, including experience from being digitally “native”;

experience in driving innovation; health care experience; online, offline and “omni-channel” retail experience and innovation; international experience, particularly in developing markets; and gender and ethnic diversity. Mr. Peltz

also has a history of behavior and hidden agendas that result in derailing companies.

The P&G Board and management team have talked to numerous directors, CEOs

and senior executives who have worked with Mr. Peltz, and positive recommendations were not forthcoming. People would only speak candidly about their experiences with Mr. Peltz if those discussions were kept confidential, for fear of

retribution. However, one CEO whose board includes Mr. Peltz has publicly disclosed what it’s like to deal with activists such as Mr. Peltz: “I think the single biggest disconnect that I found is that many activists

simply sit in conference rooms and do calculations and analysis, independent of the reality of the fact that we are dealing with human beings and people’s lives.”4 With an army of analysts accompanying Mr. Peltz, it’s not

surprising that CEOs report spending up to 25% of their time answering his questions or debating misinformed ideas.4

Mr. Peltz recently suggested that growing

earnings per share is unimportant. Leading shareholder return in the

household and personal care categories in which P&G competes requires balanced top- and bottom-line growth and

high cash efficiency. Ideas like these can derail companies by getting them out of balance,

eroding shareholder value.

The consequences of derailment can be quite damaging. The weighted average shareholder return of companies on

which Mr. Peltz serves as a board member is 4%. One company has NEGATIVE 9% returns. That company has had

negative volume growth every year since Mr. Peltz joined the board, and current year-to-date

organic sales growth is

NEGATIVE 1.0%, versus POSITIVE 3.9% the year before Mr. Peltz joined.

So what’s the harm of one person on P&G’s Board? It can be substantial, if it’s the wrong person. We have done our

homework. Mr. Peltz is a smart investor. He is welcome as an engaged shareholder, and we will continue to listen to

him. We fully expect shareholders to hold P&G accountable to deliver returns, but putting the wrong person like Mr.

Peltz on the P&G Board of Directors represents a risk of derailment and damage that should be prevented.

“In light of the vast array of actions the firm is undertaking, we fail to see a major impetus behind Peltz’s approach and

little to suggest that his oversight would accelerate change.”

- Erin Lash, Analyst7

P&G Is On the Right Track

P&G people are

working with passion, ownership and commitment to create value for consumers and for you— P&G shareholders. We are transforming P&G with a strategy that is working. We never quit. We intend to win with consumers and win in the

marketplace. We would have it no other way. This is why the P&G Board, management team, and I continue to strongly believe it is in the best interest of our Company—and all of us who care about P&G—to

VOTE BLUE.

On behalf of your Board of Directors, we thank you for your continued support.

Sincerely,

David S. Taylor

Chairman of the Board, President and Chief Executive Officer September 20, 2017

Vote BLUE

for the board and management team that are delivering results

Vote the BLUE Proxy Card to continue advancing our plan, which is creating value for you, P&G

shareholders.

We urge you NOT to vote using any white proxy card or voting instruction forms you might receive from Nelson Peltz of Trian. Please disregard and

discard the white proxy card.

Vote the BLUE PROXY CARD Today

Online Voting Is

Quick And Easy To Use

Find Your Unique Control Number Next to the Located In the Box on Your BLUE Proxy Card Recently Mailed to You

Forward-Looking Statements

Certain statements in

this release or presentation, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are

based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These

forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements

are based on current expectations and assumptions, which are subject to risks and uncertainties that may cause results to differ materially from those expressed or implied in the forward-looking statements. We undertake no obligation to update or

revise publicly any forward-looking statements, whether because of new information, future events or otherwise.

Risks and uncertainties to which our

forward-looking statements are subject include, without limitation: (1) the ability to successfully manage global financial risks, including foreign currency fluctuations, currency exchange or pricing controls and localized volatility;

(2) the ability to successfully manage local, regional or global economic volatility, including reduced market growth rates, and to generate sufficient income and cash flow to allow the Company to affect the expected share repurchases and

dividend payments; (3) the ability to manage disruptions in credit markets or changes to our credit rating; (4) the ability to maintain key manufacturing and supply arrangements (including execution of supply chain optimizations, and sole

supplier and sole manufacturing plant arrangements) and to manage disruption of business due to factors outside of our control, such as natural disasters and acts of war or terrorism; (5) the ability to successfully manage cost fluctuations and

pressures, including prices of commodity and raw materials, and costs of labor, transportation, energy, pension and healthcare; (6) the ability to stay on the leading edge of innovation, obtain necessary intellectual property protections and

successfully respond to changing consumer habits and technological advances attained by, and patents granted to, competitors; (7) the ability to compete with our local and global competitors in new and existing sales channels, including by

successfully responding to competitive factors such as prices, promotional incentives and trade terms for products; (8) the ability to manage and maintain key customer relationships; (9) the ability to protect our reputation and brand

equity by successfully managing real or perceived issues, including concerns about safety, quality, ingredients, efficacy or similar matters that may arise; (10) the ability to successfully manage the financial, legal, reputational and

operational risk associated with third party relationships, such as our suppliers, distributors, contractors and external business partners; (11) the ability to rely on and maintain key company and third party information technology systems,

networks and services, and maintain the security and functionality of such systems, networks and services and the data contained therein; (12) the ability to successfully manage uncertainties related to changing political conditions (including

the United Kingdom’s decision to leave the European Union) and potential implications such as exchange rate fluctuations and market contraction; (13) the ability to successfully manage regulatory and legal requirements and matters

(including, without limitation, those laws and regulations involving product liability, intellectual property, antitrust, privacy, tax, environmental, and accounting and financial reporting) and to resolve pending matters within current estimates;

(14) the ability to manage changes in applicable tax laws and regulations including maintaining our intended tax treatment of divestiture transactions; (15) the ability to successfully manage our ongoing acquisition, divestiture and joint

venture activities, in each case to achieve the Company’s overall business strategy and financial objectives, without impacting the delivery of base business objectives; and (16) the ability to successfully achieve productivity

improvements and cost savings and manage ongoing organizational changes, while successfully identifying, developing and retaining key employees, including in key growth markets where the availability of skilled or experienced employees may be

limited. For additional information concerning factors that could cause actual results and events to differ materially from those projected herein, please refer to our most recent 10-K, 10-Q and 8-K reports.

Important Additional Information and Where to Find It

The Company has filed a definitive proxy statement on Schedule 14A and form of associated BLUE proxy card with the Securities and Exchange Commission (“SEC”) in

connection with the solicitation of proxies for its 2017 Annual Meeting of Shareholders (the “Definitive Proxy Statement”). The Company, its directors and certain of its executive officers will be participants in the solicitation of

proxies from shareholders in respect of the 2017 Annual Meeting. Information regarding the names of the Company’s directors and executive officers and their respective interests in the Company by security holdings or otherwise is set forth in

the Definitive Proxy Statement. Details concerning the nominees of the Company’s Board of Directors for election at the 2017 Annual Meeting are included in the Definitive Proxy Statement. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND

SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT AND ANY SUPPLEMENTS THERETO AND ACCOMPANYING BLUE PROXY CARD, BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION. Shareholders may obtain a free copy of the Definitive Proxy Statement and other relevant documents that the Company files with the SEC from the SEC’s website at www.sec.gov or the Company’s website at

http://www.pginvestor.com as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC.

1U.S. market share as of

July 2017.

2Based on IRI New Product Pacesetters Reports: Non-Food Innovations.

3TSR calculations since November 1, 2015. Market data as of September 6, 2017. The peers selected by Trian in its September 6, 2017 White Paper are as follows:

Beiersdorf, Church & Dwight, Clorox, Colgate-Palmolive, Edgewell Personal Care, Henkel, Kimberly-Clark, L’Oreal, Reckitt Benckiser and Unilever. The TSR for “Peltz Serving on Board” is a weighted average based on the market

capitalization of Madison Square Garden, Mondelez, Sysco and Wendy’s. The TSR for “P&G Peers” is a simple average, which follows the same methodology utilized by Trian in its measurement of the same peer constituency in its

presentation filed with the SEC on September 6, 2017.

4Source: Business Insider, “The CEO of Mondelēz explains what it’s like to be targeted by

Bill Ackman and Nelson Peltz”, 7.7.17. Permission to use the quotation neither sought nor obtained.

5Source: Bernstein Conference Call with Ali Dibadj,

9.11.17.

6Source: CNBC, “Squawk on the Street”, 9.8.17. Permission to use the quotation neither sought nor obtained.

7Source: Erin Lash, Analyst, Morningstar, “Peltz Vies for Board Seat at P&G in Effort to Accelerate Change; Shares a Bit Undervalued”, 7.17.17. Permission to use the

quotation neither sought nor obtained.

HOME OUR RESULTS FROM THE CEO OUR PLAN OUR BOARD FAQ

Vote Blue Discard White HOW TO VOTE î—^

Touching lives, improving life.

© 2017 Procter & Gamble | Disclaimer

HOW TO VOTE Our Results “We met or exceeded each of our going-in objectives for the Fiscal Year 2017 in a challenging macro and competitive environment. We made significant progress on our key priorities ... now is the time to accelerate our efforts to execute and deliver on the plans we’ve put into action.” DAVID TAYLOR, P&G CHAIRMAN, PRESIDENT & CHIEF EXECUTIVE OFFICER

P&G is on the Right Track Our fiscal 2017 results demonstrate that the actions we have taken and the plan we have in place are working. In fact, we met or exceeded each of our fiscal 2017 objectives. Delivery of our financial goals has also translated into share price gains for our shareholders. Since the CEO transition on November 1, 2015, our team has delivered total shareholder return (“TSR”) of 28% — well above the vast majority of peers throughout that same time period. P&G also outperformed the S&P 500, which delivered a TSR of 21% in that same timeframe. Now is the time to build on our momentum, and prevent anything from derailing the work that is delivering improvement.

P&G’s Winning Total Shareholder Return *Market data as of September 6, 2017. P&G Peers include Beiersdorf, Church & Dwight, Clorox, Colgate-Palmolive, Edgewell Personal Care, Henkel, Kimberly-Clark, L’Oréal, Reckitt Benckiser, Unilever. The TSR for “Peltz Serving on Board” is a weighted average based on the market capitalization of Madison Square Garden, Mondelez, Sysco and Wendy’s. “S&P Consumer Staples Index” and “S&P 500 Index” represent the TSR of indices maintained by Standard & Poor’s, that are weighted based on the market capitalization of the index constituents. The TSR for “P&G Peers” is a simple average, which follows the same methodology utilized by Trian in its measurement of the same peer constituency in its presentation filed with the SEC on July 17, 2017.

Fiscal 2017 Results Our robust fiscal 2017 results demonstrate that the actions we have taken and the strategic plan we have in place are working. $22 billion of value was returned to shareholders through the combination of $7.2 billion of dividend payments, $9.4 billion of share exchanges in the Beauty Brands transaction and $5.2 billion of direct share repurchases. Organic sales growth of two percent for the year Net sales were $65.1 billion, unchanged versus the prior year, including a negative two percentage point impact from foreign exchange. $12.8 billion of operating cash flow was generated, with adjusted free cash flow productivity of 94%. To learn more about how we’re continuing to deliver balanced growth, value creation and total shareholder return view these downloads below: OUR FULL FOURTH QUARTER AND FISCAL YEAR 2017 RESULTS REPORT OUR 2017 ANNUAL REPORT

Much Stronger & Positioned to Win David S. Taylor Chairman of the Board, VIEW THE MESSAGE President and Chief Executive Officer HOME OUR RESULTS Vote Blue FROM THE CEO OUR PLAN OUR BOARD FAQ Discard White HOW TO VOTE Touching lives, improving life.

Forward-Looking Statements

Certain statements in this release or presentation, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions, which are subject to risks and uncertainties that may cause results to differ materially from those expressed or implied in the forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events or otherwise.

Risks and uncertainties to which our forward-looking statements are subject include, without limitation: (1) the ability to successfully manage global financial risks, including foreign currency fluctuations, currency exchange or pricing controls and localized volatility; (2) the ability to successfully manage local, regional or global economic volatility, including reduced market growth rates, and to generate sufficient income and cash flow to allow the Company to affect the expected share repurchases and dividend payments; (3) the ability to manage disruptions in credit markets or changes to our credit rating; (4) the ability to maintain key manufacturing and supply arrangements (including execution of supply chain optimizations, and sole supplier and sole manufacturing plant arrangements) and to manage disruption of business due to factors outside of our control, such as natural disasters and acts of war or terrorism; (5) the ability to successfully manage cost fluctuations and pressures, including prices of commodity and raw materials, and costs of labor, transportation, energy, pension and healthcare; (6) the ability to stay on the leading edge of innovation, obtain necessary intellectual property protections and successfully respond to changing consumer habits and technological advances attained by, and patents granted to, competitors; (7) the ability to compete with our local and global competitors in new and existing sales channels, including by successfully responding to competitive factors such as prices, promotional incentives and trade terms for products; (8) the ability to manage and maintain key customer relationships; (9) the ability to protect our reputation and brand equity by successfully managing real or perceived issues, including concerns about safety, quality, ingredients, efficacy or similar matters that may arise; (10) the ability to successfully manage the financial, legal, reputational and operational risk associated with third party relationships, such as our suppliers, distributors, contractors and external business partners; (11) the ability to rely on and maintain key company and third party information technology systems, networks and services, and maintain the security and functionality of such systems, networks and services and the data contained therein; (12) the ability to successfully manage uncertainties related to changing political conditions (including the United Kingdom’s decision to leave the European Union) and potential implications such as exchange rate fluctuations and market contraction; (13) the ability to successfully manage regulatory and legal requirements and matters (including, without limitation, those laws and regulations involving product liability, intellectual property, antitrust, privacy, tax, environmental, and accounting and financial reporting) and to resolve pending matters within current estimates; (14) the ability to manage changes in applicable tax laws and regulations including maintaining

our intended tax treatment of divestiture transactions; (15) the ability to successfully manage our ongoing acquisition, divestiture and joint venture activities, in each case to achieve the Company’s overall business strategy and financial objectives, without impacting the delivery of base business objectives; and (16) the ability to successfully achieve productivity improvements and cost savings and manage ongoing organizational changes, while successfully identifying, developing and retaining key employees, including in key growth markets where the availability of skilled or experienced employees may be limited. For additional information concerning factors that could cause actual results and events to differ materially from those projected herein, please refer to our most recent 10-K, 10-Q and 8-K reports.

Important Additional Information and Where to Find It

The Company has filed a definitive proxy statement on Schedule 14A and form of associated BLUE proxy card with the Securities and Exchange Commission (“SEC”) in connection with the solicitation of proxies for its 2017 Annual Meeting of Shareholders (the “Definitive Proxy Statement”). The Company, its directors and certain of its executive officers will be participants in the solicitation of proxies from shareholders in respect of the 2017 Annual Meeting. Information regarding the names of the Company’s directors and executive officers and their respective interests in the Company by security holdings or otherwise is set forth in the Definitive Proxy Statement. Details concerning the nominees of the Company’s Board of Directors for election at the 2017 Annual Meeting are included in the Definitive Proxy Statement. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT AND ANY SUPPLEMENTS THERETO AND ACCOMPANYING BLUE PROXY CARD, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders may obtain a free copy of the Definitive Proxy Statement and other relevant documents that the Company files with the SEC from the SEC’s website at www.sec.gov or the Company’s website at http://www.pginvestor.com as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Procter & Gamble (PG) PT Raised to $160 at DZ Bank

- ProVen VCT plc: Extension of 2024/2025 Offer

- Western Illinois University Selects Regent Award Suite

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share