These 8 CEOs can get paid $1.5B to take a hike

CEOs get paid extremely well for doing their jobs. But some get paid just as well to stop doing their jobs, too.

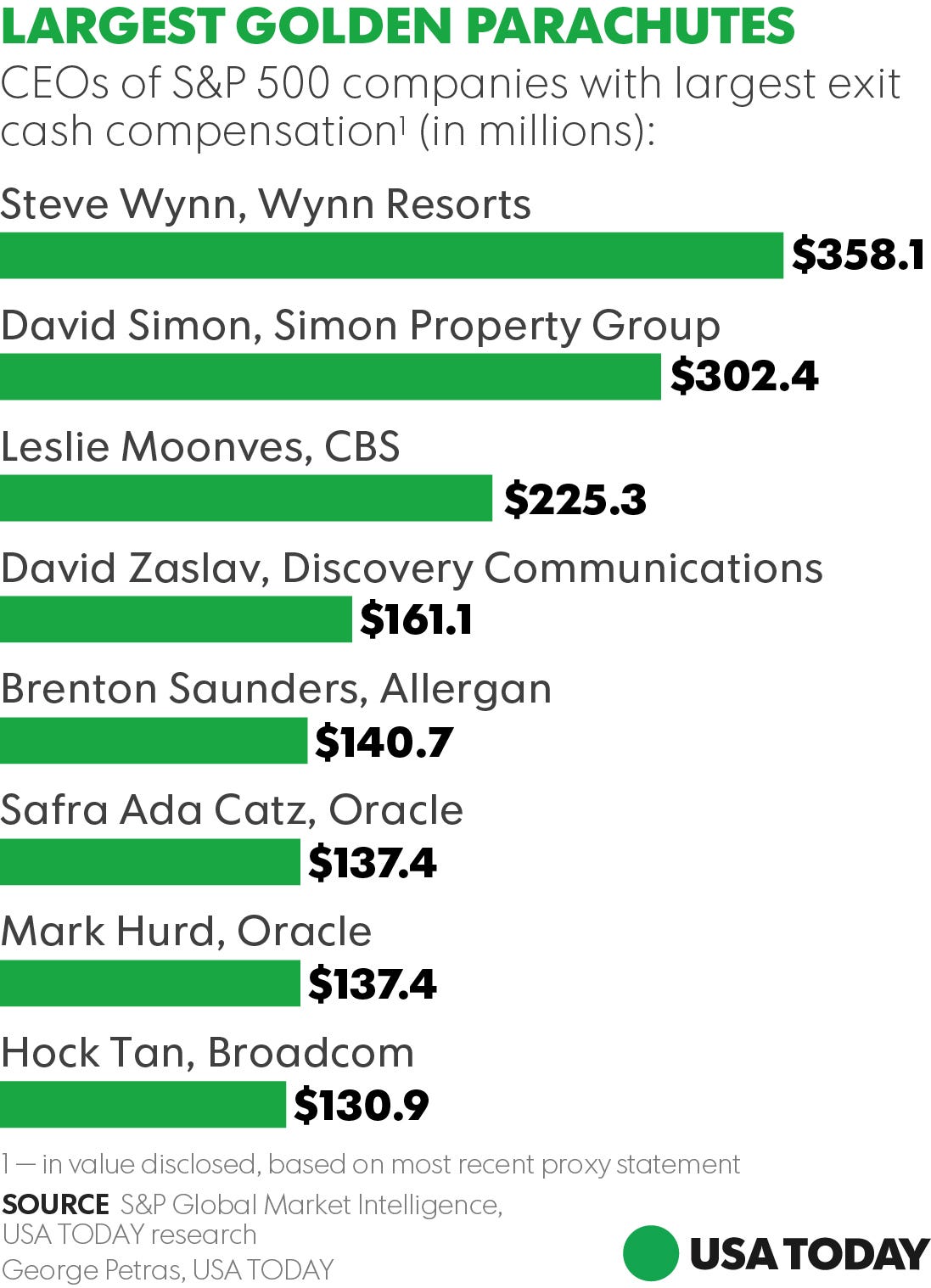

Eight current CEOs in the Standard & Poor's 500, including Stephen Wynn of casino Wynn Resorts (WYNN), David Simon of real-estate firm Simon Property Group (SPG) and Leslie Moonves of CBS (CBS), stand to haul in a collective payout of more than $1.5 billion from golden parachutes if activated, according to a USA TODAY analysis of data from S&P Global Market Intelligence. This tally includes estimated payments triggered either by CEOs losing their positions following a change in control like mergers and also termination without cause, based on the most recent proxy filings.

Massive golden parachutes, or lucrative payments to executives after being removed from their jobs for various reasons, are regaining attention as several lucrative ones are being triggered. Viacom's (VIAB) ousted CEO Philippe Dauman stands to be paid $84 million after being relieved of his duties, says executive pay tracking firm Equilar. And Marissa Mayer of Yahoo (YHOO) could walk with roughly $50 million if she chooses to step away following the sale of the company's core assets to Verizon (VZ).

"Yes, these are large figures and eye-popping," says Dan Marcec, director of content at Equilar. "It has much to do with how the company was paying the CEO in the first place."

But these are far from being the largest golden parachutes. The largest pact on an active CEO that's yet to deploy is a $358.1 million estimated payment to Wynn, who founded his namesake casino empire in 2002. If he were to lose his job due to a change in control at the company, Wynn would be awarded an estimated $358.1 million. Wynn stands to be awarded $240.2 million if he is terminated without cause.

Typically, executives' golden parachutes are much larger when triggered by changes in control, rather than termination without cause. For instance, Simon, CEO of Simon Property group, would be awarded a golden parachute of $302 million after a change in control, which is 163% more than what he would have received if terminated without cause.

Termination without cause can be lucrative, too. Viacom's CEO Moonves, would be awarded an estimated $225.3 million if terminated without cause, while his golden parachute in case of a change in control is $92.4 million.

Periodically, shareholders bristle at these payouts. Last week, more than 60% of Johnson Controls' (JCI) shareholders voted against the company's estimated payment to CEO Alex Molinaroli, which was triggered after the company's combination with Tyco (TYC). Molinaroli's payment from termination after change in control was estimated at $39 million as of the last proxy.

While these payments catch attention when actually deployed, most investors typically accept them, Equilar's Marcec says. A vast majority of large firms have golden parachutes in place, and most win shareholder approval, he says. Equilar found that 91% of golden parachute packages it studied in 2015 passed.

Most investors "understand (golden parachutes are) just a part of business," Marcec says. "If they (investors) are comfortable with how CEOs are being paid in the first place ... they are OK with golden parachutes as structured in their tenure."