Our latest forensic accounting red flags a company whose financial statements may not be entirely reliable.

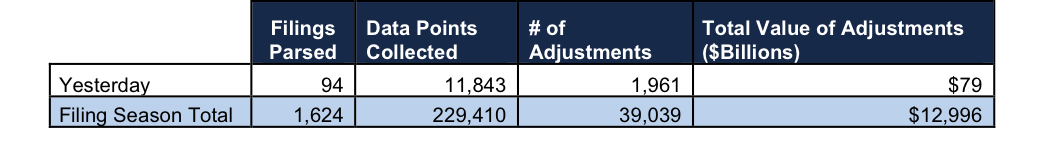

We pulled this highlight from Wednesday's research of 94 10-K filings, from which our robo-analyst technology collected 11,843 data points. Our analyst team used this data to make 1,961 forensic accounting adjustments with a dollar value of $79 billion. The adjustments were applied as follows:

- 779 income statement adjustments with a total value of $7 billion

- 848 balance sheet adjustments with a total value of $43 billion

- 334 valuation adjustments with a total value of $29 billion

Sources: New Constructs, LLC and company filings

We believe this research is necessary to close the gap between the suitability and fiduciary standard of investment advice services.

Today’s Forensic Accounting Needle In A Haystack Is For Technology Investors

Analyst Cody Fincher found an unusual item in ACTG's 10-K.

On page 45, ACTG disclosed that auditor Grant Thornton LLP had identified a material weakness in its internal control over financial reporting. Specifically, it was determined that ACTG lacked the technical expertise to handle complicated and unusual accounting matters, which led to the misapplication of standards around employee stock compensation.

As we’ve previously discussed, any material weakness in internal control is a cause for concern and leads to a higher risk of a stock-price crash. This particular weakness is especially concerning given ACTG’s increased reliance on employee stock compensation. The company began the year with just 15 thousand options outstanding and ended with 5.6 million. ACTG’s employee stock option liability now totals ~$13 million, or 5% of its market cap.

Disclosure: David Trainer, Cody Fincher, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.