In its weekly note to clients, Morgan Stanley discusses its current outlook and strategy for trading the USD.

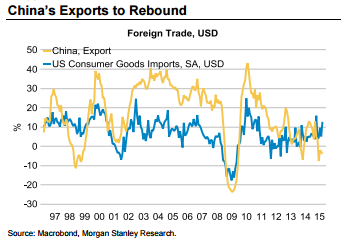

EM rally has legs: "With the help of rebounding risk appetite and rising commodity prices, we expect the EM rally to gain momentum. The detailed read of August trade statistics suggests that rising US imports ultimately mean higher Asian exports. Better Asian export data should help to contain capital outflows, which allows for greater control over monetary conditions. China cutting its RRR and interest rates should boost risk appetite further.

At the same time, markets may put fears of a quick pace of Fed tightening aside. In September, the Fed was appropriately cautious by keeping rates on hold amid low inflation expectations. Markets may anticipate a relatively flat US rate profile going forward, which should take some wind out of USD’s sail," MS argues.

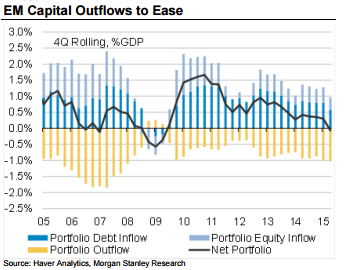

Slowing repatriation: "Nonetheless, our strongest argument for USD coming off from here is found in the analysis of flows. USD has risen on repatriation flows coming on the back of EM portfolio liquidation. Seeing EM portfolio outflows for 11 consecutive weeks (as per our daily EM flow tracker) is unusual, indicating that holdings have been reduced materially. A slight improvement in EM’s macro outlook may lead to a good rebound as investors reassess relative investment returns, especially given the higher yields being offered," MS adds.

Selling USD tactically: "We have removed all USD long positioning from our Strategic FX Portfolio. We tactically position for USD to lose another 5% from current levels, implying a decline in the Fed’s broad TWI to 113/114," MS advises.

MS runs a short AUD/USD position in its portfolio targeting a move to 0.71.

This content has been provided under specific arrangement with eFXnews.

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats to 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated to the 1.0700 area. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 with first reaction to US data

GBP/USD declined below 1.2500 and erased a portion of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold falls below $2,330 as US yields push higher

Gold came under modest bearish pressure and declined below $2,330. The benchmark 10-year US Treasury bond yield is up more than 1% on the day after US GDP report, making it difficult for XAU/USD to extend its daily recovery.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.