Developing nations need trillions of dollars a year to tackle issues like food security, climate change risks and basic infrastructure. But foreign investment into these countries dropped by 16% in 2014, to $1.23tn, further widening the $2.5tn gap needed annually to address the most critical areas.

“The global challenges are so complex and the size of the funding that’s needed is so large, traditional funding sources like philanthropy are probably not going to be sufficient to meet it,” said Anna Kearney, associate director for corporate social responsibility at the Bank of New York Mellon (BNY Mellon), which this week released a white paper on the importance of social finance.

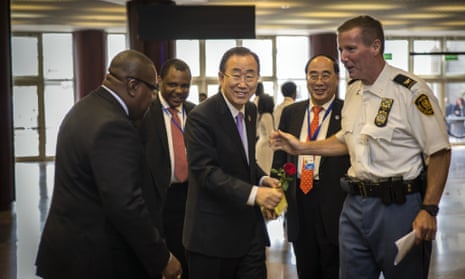

The report comes after a UN summit in Addis Ababa, Ethiopia, last week, where world leaders reached an agreement on how to finance some of the planet’s most pressing development issues.

Impact investing – investments that have a social or environmental benefit while also turning a profit – might be one of the best ways address the financing shortfalls, experts say.

The area has seen tremendous growth in the past two years. There were nearly $7tn in socially responsible investment assets in the US in 2014, a 76% increase over 2012, according to a recent report from the Washington-based nonprofit Forum for Sustainable and Responsible Investment.

A significant portion of this money is going towards helping developing countries. In a survey released in May by financial services firm JP Morgan and the nonprofit Global Impact Investing Network, nearly half of the $60bn in impact investments managed by respondents was invested in emerging markets.

But it’s not enough to fill the gap. While companies have been investing in social and environmental causes for years, mainly in the form of philanthropy, impact investing has only really taken off in the past decade – and still faces plenty of challenges.

For one thing, the fact that it’s still a relatively new field means social finance doesn’t yet have the track record to generate investor confidence, Kearney said. What’s needed are more third party measurement tools – like the Global Impact Investing Rating System (GIIRS), which measures the social and environmental impact of a particular fund – to help investors weigh the impact of various options.

Transparency also remains a major hurdle. Some initiatives have begun to tackle the problem. CDP, for instance, is a UK-based organization that works with companies to disclose their greenhouse gas emissions. The number of companies that have signed up for the initiative has grown dramatically in the past decade, from 253 in 2003 to 5,003 in 2014. This growth reflects a willingness on the part of companies to be more transparent, which in turn helps investors make better decisions, Kearney said.

“CDP has changed the way investors are able to understand the impact of climate change in their portfolio,” Kearney said. “It’s an example of promoting awareness of what risks or benefits are embedded into investments.”

Accessibility is another important factor for investors, Kearney said. Currently, investors aren’t seeing that they have access to attractive products that meet their risks and requirements, she said.

Investments need to be pulled together to create funds that fit a theme – say, early childhood education or women’s issues, she said. This would allow individual investors to invest more easily across asset classes like stocks and bonds to impact the cause they care about.

One example of this is the carbon efficiency strategy recently launched by Mellon Capital, BNY Mellon’s investment boutique. The strategy tackles climate change by favoring companies with low carbon emissions and barring investments in coal mining and production companies.

More products, such as that one, should help grow impact investments: “You need volume to be built over time,” Kearney said. “It’s the chicken or the egg scenario – as dollars flow, more products will be built, and as products are created, more investment will flow.”

Connected to all of this is the need for more collaboration and resource sharing across platforms among investors, companies, institutions and nonprofits.

One example is the relatively new area of social impact bonds – private money that pays for social projects usually funded by the public sector or philanthropists. The bonds typically involve partnerships between private investors, governments and nonprofit organizations.

The UK was one of the first countries to champion the idea, and the results for some of the first social impact bonds are promising. Three programs centered on teenagers and education have been deemed a success – investors have made a return on their investments, and the children’s literacy skills and school attendance has improved.

A version of these, called development impact bonds, aim to help tackle complex social issues in developing countries, but are still in early stages. One example is the Global Alliance for Vaccines and Immunization, which raised more than $5bn from private investors – and secured commitments of $6.3bn from donor governments to repay these investors if certain milestones are achieved – in bonds for vaccines in more than 70 countries. But there are plenty of challenges – and a long way to go.

“[Social impact investment] is a very fragmented and nascent industry,” said William Burckart, CEO of impact investing advisory firm Burckart Consulting. “If we can get everyone speaking on the same page, we’ll generate far greater field activity.”

Comments (…)

Sign in or create your Guardian account to join the discussion