The New Economics of Moore’s Law

The subtle dynamics of the semiconductor industry are often underappreciated. Since working at Cypress Semiconductor in 1997, this industry has always been a key focus of study for me. I’m fond of saying, “There is no greater predictor of the future than understanding semiconductor roadmaps”. Knowing what is possible in silicon several years from now or longer, helps us know what will be possible and, more importantly, when.

While Moore’s law states the number of transistors on a microprocessor can double every two years or so, the underlying point of the law is that this doubling must also do so economically. In other words, it should cost less to put twice as much on that same piece of silicon than it cost two years prior.

This cost reduction, plus the efficiency gained in performance and lower power consumption, is engrained into the pursuit of Moore’s Law. However, as of late, and because of the many technological challenges facing Moore’s Law, the economic benefits of the law are fading. Companies like Intel, Samsung, TSMC, and others can still technologically continue the law but it is becoming less economically beneficial to do so. As the costs to pursue Moore’s Law increase, the implications throughout the industry add a new dynamic.

For example, if the costs to move from 20nm to 14nm go from $10 billion dollars to $16 billion dollars, then the company must believe they will have customers willing to pay the increase in chipset costs in order to profit from the investment. As PCs, smartphones, tablets, and other devices become more commodity items and hardware costs go down, it becomes harder to find customers willing to pay a premium for premium chipsets.

These few customers willing to pay premium prices are doing so to fund the technological advancement of Moore’s Law, not necessarily the economic advancement. Which means either they do so but volumes are low and prices don’t come down or they have a lock on premium performance and low-power chipsets, or no foundry is willing to invest in leading edge process technology and Moore’s Law ends.

We are already in the “fewer customers willing to pay the premium for leading edge process technology” phase. Where we go next is unclear.

Twitter Earnings

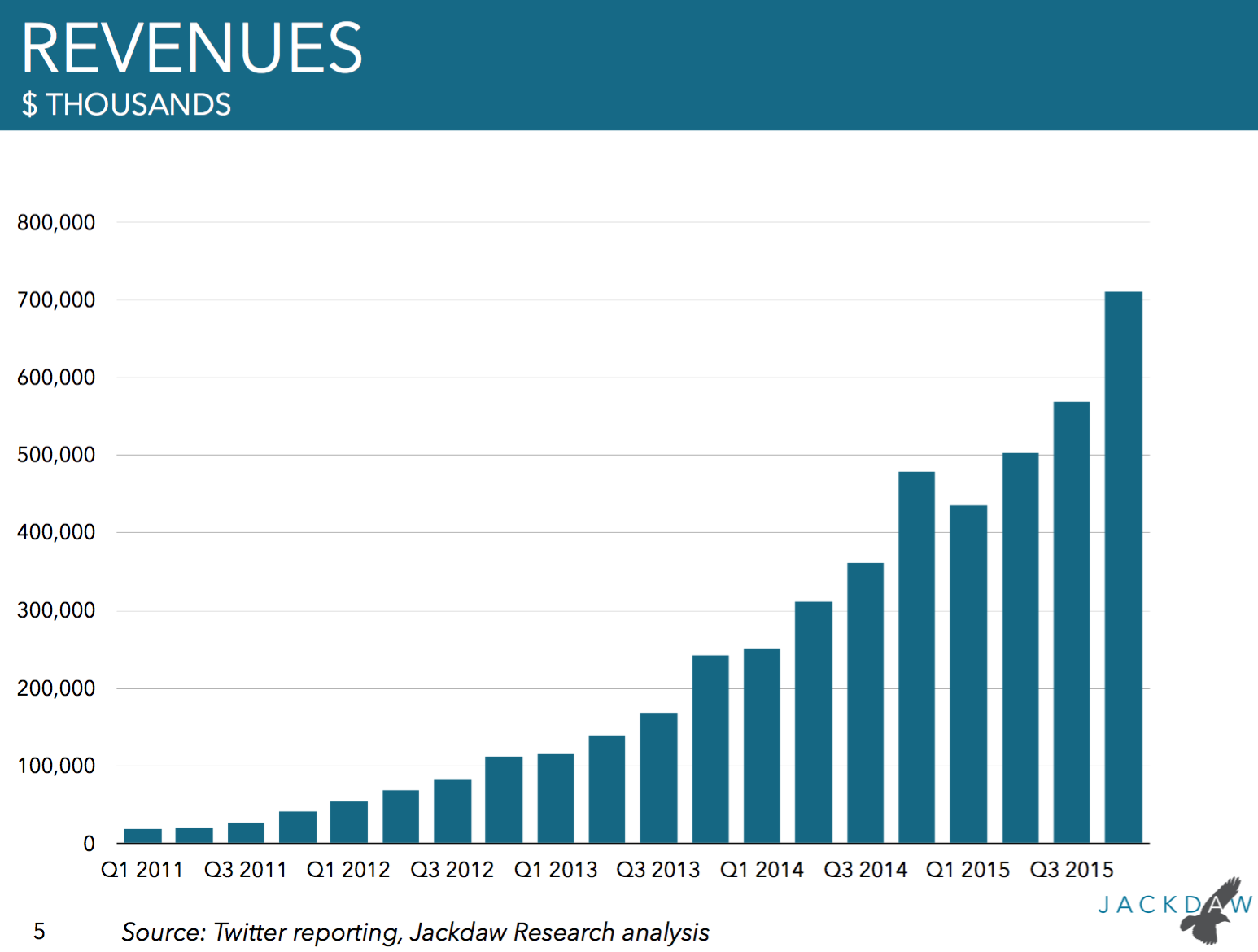

Two charts, related to Twitter earnings, tell most of the story. First, revenues continue to trend upwards.

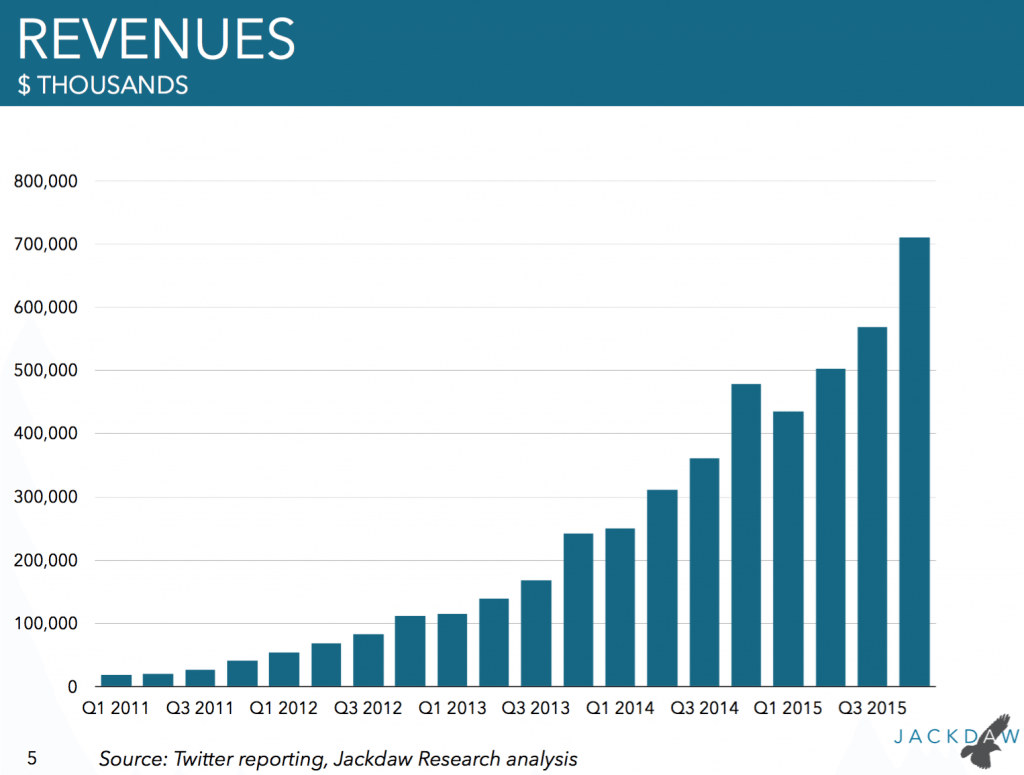

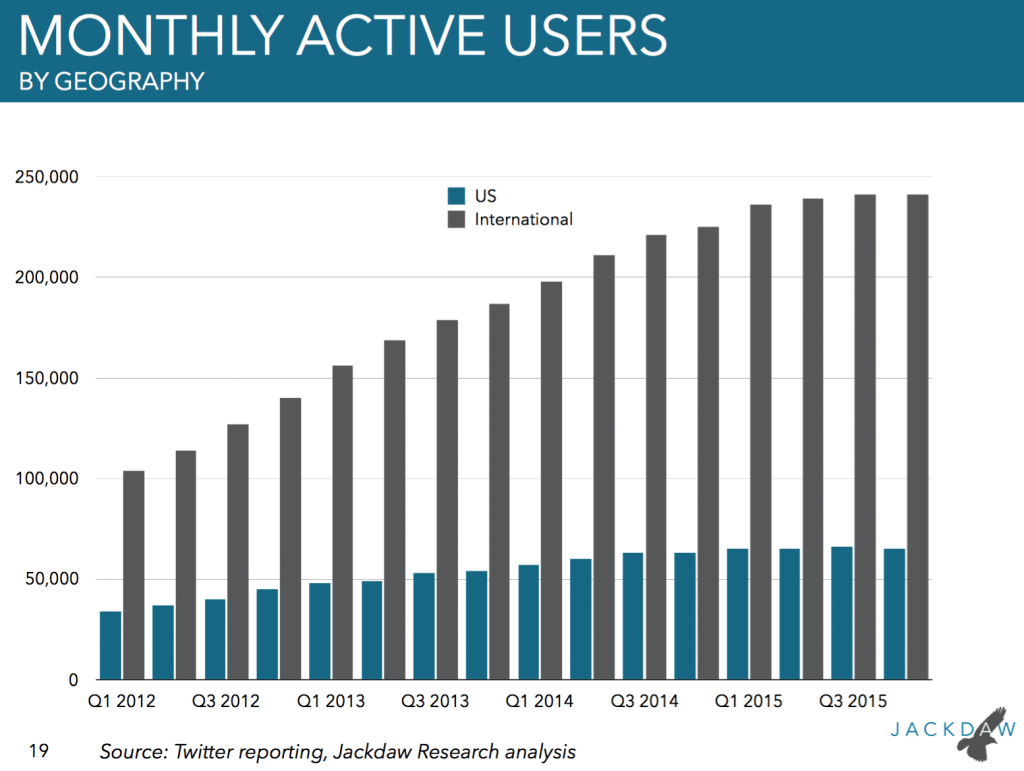

However, Twitter is not adding new users in the US or abroad.

Predictably, Twitter is attempting what I anticipated — better monetize their user base. This is the standard tactic for when your growth stops or slows. Most of Twitter’s adjustments and new features are designed to maximize their revenue per user and increase that ARPU over time.

The issue with this tactic is you run the risk of making the service’s experience poor due to the severe attempt to monetize and thus, lose your user base. There are only so many ads a person can take. Twitter can certainly make the ads better, more relevant, include transactions, etc., and they likely will, but this tactic can only go so far.

Twitter’s challenge will increasingly be keeping their most engaged users happy while tweaking the service to be easier to use and more attractive to new people. I still maintain they can do this with a pro (paid service) and free service. I myself use Tweetbot exclusively for Twitter and, therefore, I’m sheltered from ads, Moments, and other tweaks to the service. I find when I want to have the more all-encompassing Twitter experience, I’ll use the app but when I need to produce/do work in Twitter I use Tweetbot. Hence the need for a pro and free version of the service.

Twitter is proving they can monetize their base and this is good. However, if the shift to mobile internet advertising is a “winner take most” market between Facebook and Google, Twitter is likely better off selling to one of them and joining Facebook or Google’s app family.

Facebook Free Basics

I’m watching with much interest what is happening in India and the ruling to block Facebook’s attempt to bring the internet to those who can’t afford it. Many things are fascinating about this which could shed insight into how best to bring the internet to poorer regions.

Part of Facebook’s thesis is that as the internet comes to places that did not have it, the economic status of that region will rise. Global economists are largely in agreement that the internet adds anywhere from 1-3% GDP rise to a region when it gets it for the first time. They also largely agree that, as the broadband speeds increase in said regions, GDP can rise .5%.

Suffice it to say, it is difficult to argue the internet is not a benefit. What we are observing with India is perhaps the growing pains of the global internet economy. Everyone who can afford an internet connection has one and those who don’t need to increase their economic status in order to get it. Yet this is the hump we are not sure how they will overcome. If not free then how?

This article makes some interesting points using metrics to present the argument that, even while it was not blocked, Facebook Free Basics was not adding users at a significant rate. Whether because of device acquisition costs (smartphones are not $10 yet) or the monthly rate or simply not grasping the value, the issue it not fully known yet. But how this plays out could be an important case study in what happens in other markets like Africa, rural China, South East Asia, and other regions where the same economic issues apply.

The next two billion will likely come online, but it may take quite a bit longer than myself and many others originally anticipated.

The freemium model could work for this “publication”, but not by giving away a headline and expecting people will pay to read the actual story. How about allowing to read an entire article then pay if you want more? Trust me, there is absolutely nothing your ‘team’ will have in their analysis that is unique other than their own opinions.

Pretty! This has been a really wonderful post. Many thanks for providing these details.