A humorous look at the companies that caught our eye, for better or worse, this week

LINKEDIN - DOG

The only thing worse than getting an unwanted solicitation on LinkedIn is owning shares of the networking site. Despite second-quarter results that topped expectations, the shares plunged as investors worried that LinkedIn’s core growth is slowing.

LNKD (NYSE), $203.26 (U.S.), down $21.80 or 9.7% over week

TWITTER - DOG

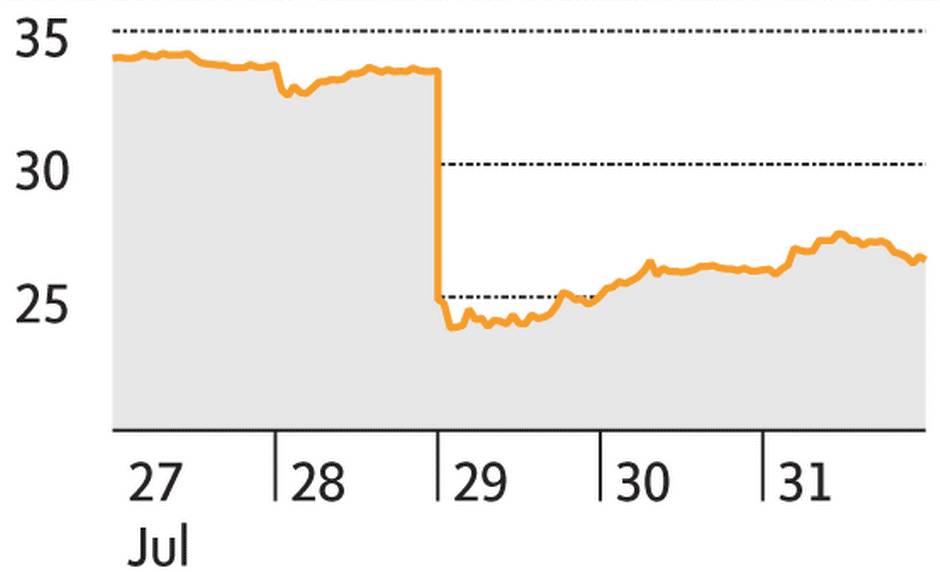

Hands up if you use Twitter regularly. Hello? Anyone? Even as Twitter’s ad revenue jumped in the second quarter, the shares slid to a 52-week low after the number of users who access the microblogging service at least once a month rose a scant 2.6 per cent from the previous quarter.

TWTR (NYSE), $31.01 (U.S.), down $4.41 or 12.5% over week

YELP - DOG

Hair in your soup? Rude service? Tell the world about it on Yelp. Unfortunately, the review site itself is also getting nothing but negative feedback from investors: Citing lower sales growth and the elimination of display ads, the company cut its full-year revenue guidance.

YELP (NYSE), $26.40 (U.S.), down $8.16 or 23.6% over week

PFB CORP. - STAR

Bad pickup line: “What are your thoughts on home insulation?” Better pickup line: “Care to hear how I doubled my money on an insulation stock?” Shares of PFB – whose materials are used in building envelopes, walls and foundations – have gained more than 100 per cent this year.

PFB (TSX), $9.19, up $1.84 or 25% over week

REYNOLDS AMERICAN - STAR

Shares of No. 2 U.S. tobacco company surged after it posted strong second-quarter results, raised its full-year outlook and lifted its dividend by 7.5 per cent. With Reynolds inhaling Lorillard in a recent acquisition, the shares are smokin’.

RAI (NYSE), $85.79 (U.S.), up $6.24 or 7.8% over week