This is the fourth in a Reflections series that features retirement-age Canadians. We ask them how their plans for this stage of their lives have played out.

When the Toronto-Dominion Bank closed a credit card processing centre in Winnipeg in 1999, long-term employee Terri Tysowski was laid off.

“It was devastating. I thought I was going to be retiring from the bank,” says Ms. Tysowski, downsized at the age of 52. As a sales and service representative who assisted commercial customers in three provinces, she recalls: “I loved my job. I loved everything about it.”

Now, about to turn 70 in June, the married mother of two grown children has no gold-plated pension, still owes mortgage payments on the house and works part-time for income and, as importantly, for the joy of it.

But even in adversity (such as having to leave and later sell, at a distressed price, the couple’s rural property home because of record-level Red River flooding in 1997), Ms. Tysowski embraces a strategy of resiliency reflected in her philosophy that when a door opens “walk through it.”

“That’s been my motto since leaving the bank,” says Ms. Tysowski. “I never said I am too old or that I can’t find work.”

That outlook guided her response to being laid off 18 years ago.

Ms. Tysowski could have stayed at the bank but had no interest in desk-bound work managing personal loans and mortgages. She preferred the freedom she had enjoyed travelling through Manitoba, Saskatchewan and Northern Ontario to visit her retail business customers. Eligible for unemployment insurance, she cancelled the benefits after only two months to start a home-based business selling health and wellness products.

She owes the early success of her business, featuring products developed by Asian investors in California, to her ease at what for some is a difficult task: making cold calls. With income from her new business, Ms. Tysowski saved her severance from the bank.

She did well as an entrepreneur, qualifying for annual performance bonuses such as trips to Europe and Caribbean cruises that satisfied her craving for travel. “I just kept one foot in front of the other and doors seemed to open for me,” she says.

At times, saving money was a challenge given the day-to-day expenses of raising a family and the extra cost of private-school education for the couple’s two sons. Ms. Tysowski says she and her husband rarely travel and usually buy used cars.

While at TD, Ms. Tysowski set up a Registered Retirement Savings Plan, maximizing annual contributions matched by the bank. After her departure, she no longer made contributions, citing scarce disposable income.

She has no regrets about not keeping up her RRSP. “The way the RRSP evolved, I regret that I didn’t put my money into real estate,” she says, admiring a decision by her self-employed husband to invest more in property than stocks and bonds. “They [her RRSP funds] didn’t grow in the last 20 years the way I expected.”

Disappointed with the returns, she switched financial advisers six years ago and says she now is satisfied with the advice she receives. She contributed to her own tax-free savings account, but later withdrew funds to pay expenses, but says another account for her husband has yielded strong returns.

By working past conventional retirement age, she has generated enough income that she has not tapped into her bank pension yet, but will when she turns 71 next year. At that age, she also must convert her RRSP, as required by law, to a Registered Retirement Income Fund.

She could have withdrawn her Canada Pension Plan benefits at age 60, but held off, given income from her home business. She eventually signed up for the monthly CPP allotment at 63 and only then at the urging of friends.

In 2013, revenue from Ms. Tysowski’s home business slowed, in part, she says, because she has not mastered the new world of online marketing and social media. “I need to get into that,” she concedes ruefully.

In the meantime, she received another door-opening opportunity.

In 2013, she was recruited by Third Quarter, a Manitoba-based non-profit that offers a free service, matching out-of-work job candidates aged 45-plus with companies and organizations across the country. Initially hired as a part-time recruitment adviser, Ms. Tysowski later became an account manager for business development and sales, applying her cold-calling expertise to contact prospective employees in search of experienced workers.

Established in 2010 with financial and in-kind support from industry and the federal government, Third Quarter placed more than 24,000 candidates and worked with more than 3,000 employers. However, the organization has not received new funding from Ottawa and is slated to close this year.

Last December, with her job ending at Third Quarter, Ms. Tysowski walked through another door.

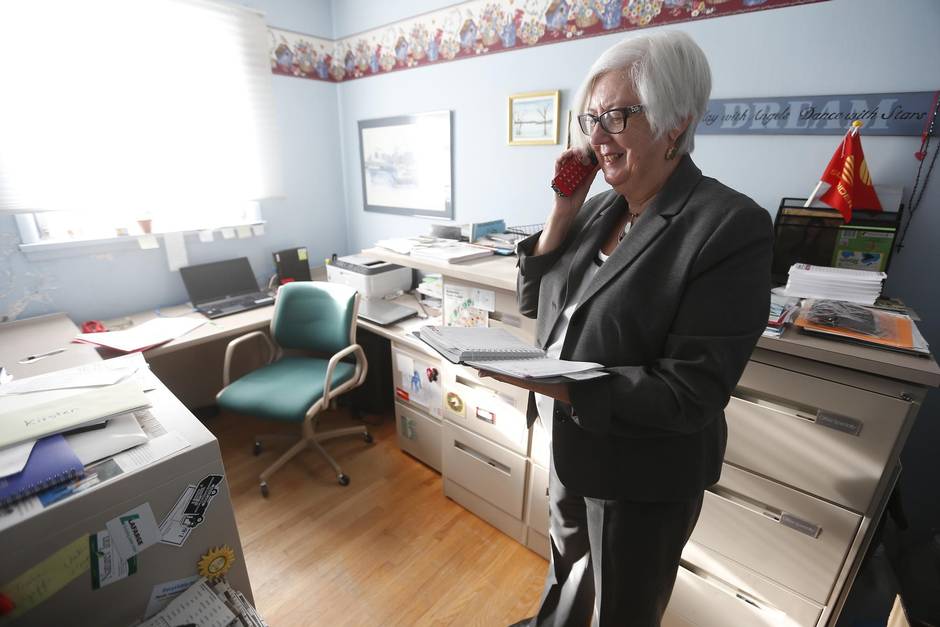

She was approached with an offer of contract work for 15-20 hours a week for a hospital foundation in Winnipeg. “I am cold-calling just like I have been doing all my life,” she says, delighted about her new event-planning job soliciting sponsorships and donations for the hospital, including an annual fundraiser.

Asked to reflect on coping with financial adversity, Ms. Tysowski says her strategy is simple: “I never focus on the setbacks.”

She adds: “Most people would get down in the dumps but how will that help me? I will just get sick if I get depressed.”

As for retirement, she says that’s a decision for later since she still loves to work.

“Call me back next year,” she laughs. “I can’t tell you that because I don’t know.”