The Apple stock (NASDAQ: AAPL) plunged -1.16% after the company announced that will install the device needed at some Starbucks coffee stores, KFC, and Chill’s restaurants to boost mobile-payment service. The service will be in a pilot form and these stores will accept that kind of payment by the end of 2016. The announcement may drop the stock in the short-term, based on the fact that previous efforts of other companies like Google Inc., and eBay Inc. to promote the mobile payment service failed, but in the long-term this may be proved out the start of a new technology leisure in our life, and profitable for Apple Inc., that will promote indirectly the apple watch as well! It’s notable that apple watch is a new-launched device the recorded below forecast sales, unprecedented for the Apple.

Apple stock fell for a second consecutive day, however, the losses were limited. Looking at the weekly performance the stock is set to deliver a second consecutive negative week, following a 3.77% losses the previous week. Moreover, the stock started the month in negating footing as it has been traded negative -0.73% so far this month, following a -2.18% for September, -7.04% for August, -3.28 for July and -3.73% for June; more than 15% losses the last 4 months.

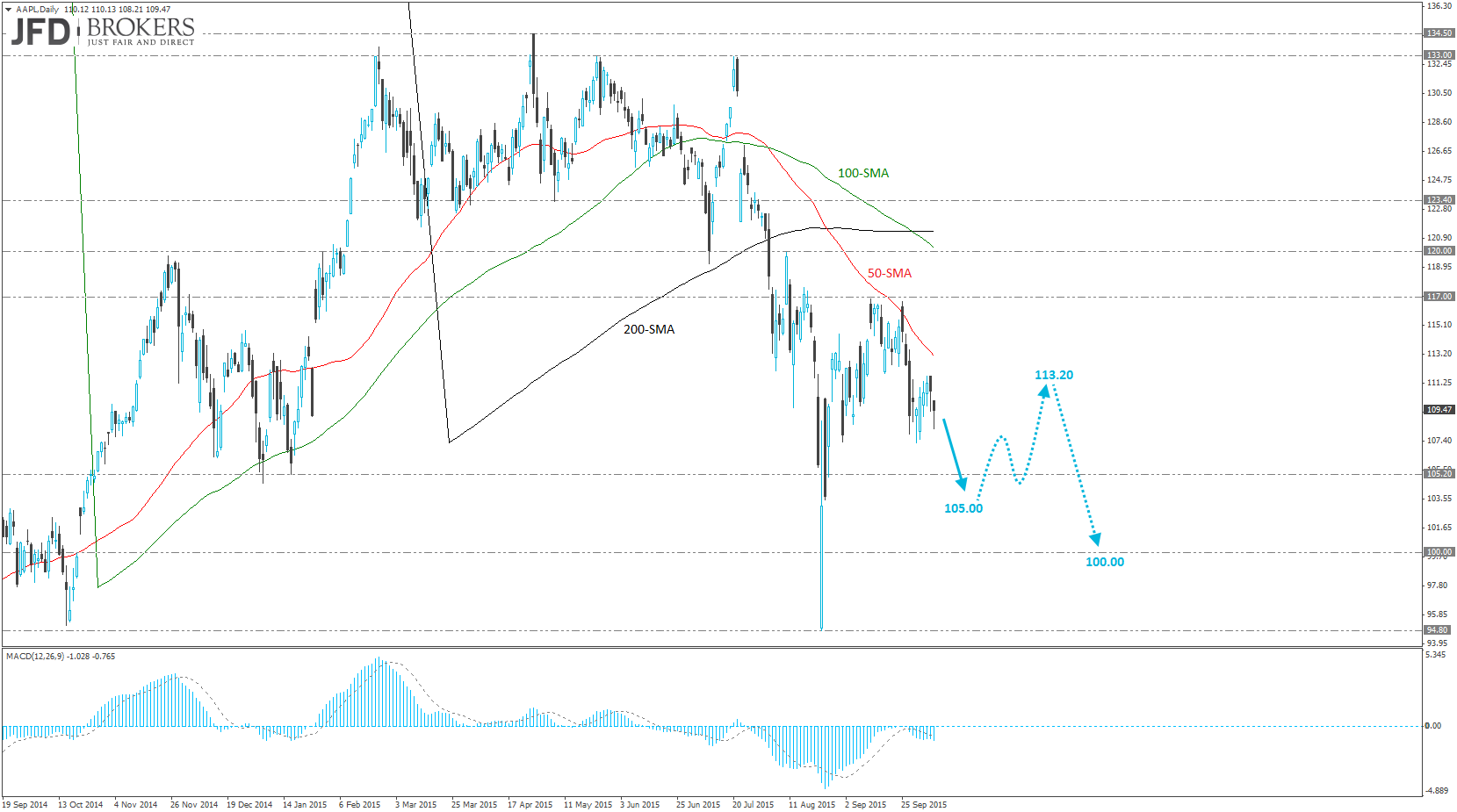

On our August’s Apple report “Is Apple Facing a Double Bite?” we have locked profit on our trading suggestion which forecasted the stock to fall below $100.00. “Such a move could easily spark a more aggressive run towards the ultimate price target and historical level at $100.00.”

Following the mid-August move, where the share moved below the psychological level of $100.00, but didn’t achieve a daily close below that level, it will now be the next highlight for the stock, whether can hold above this level and for how long, following the pressure of the its last Earnings report. The report of the Q3 had missed the estimated revenues and revealed the then new device the company launched, the apple watch, was unable to reach the break-even point, even though its possibilities were “enormous” according to the CEO Tim Cook.

I would expect the stock price to remain under pressure and test the psychological level $105.00 in the short-term. From there, I would expect a pullback and then, is more likely to rise up to $113.20. If the bulls fail to sustain the move above the level of $110.00, I would expect the stock to test the psychological level of $100.00.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.