Aldoxorubicin trials resume as clinical hold lifted

The lifting of a partial clinical hold imposed on aldoxorubicin improves clarity on its future development and enables the firm to maintain its existing timeline projections for the ongoing clinical trials. CytRx (NASDAQ:CYTR) is confident its funds on hand should be sufficient to reach top-line data in mid-2016 from its Phase III study in second-line soft tissue sarcoma (STS).

Partial hold lifted; timeline targets maintained

The FDA has removed the partial clinical hold imposed on aldoxorubicin randomised clinical trials (RCTs) since November 2014. CytRx is amending the RCTs to include blood electrolyte tests before treatment to avoid risks in patients with acidosis. The RCTs, including the Phase III study in STS, should resume recruitment over the next few weeks. CytRx maintained its previous guidance for completion of the STS Phase III study enrolment by year end 2015, with top-line data in mid-2016 and possible commercialisation in 2017.

Phase IIb STS overall survival (OS) data released

OS for the aldoxorubicin arm of the Phase IIb (n=123) first-line STS trial was 16.0 months vs 14.4 months for the doxorubicin arm (p=0.21). Top-line data from late 2013 showed significant benefits in progression-free survival (PFS), the primary endpoint. As this trial was not powered to detect improvements in OS, we do not believe the lack of statistically significant OS data would negatively affect the prospects of the ongoing Phase III STS study, particularly given that the primary endpoint of this trial will be PFS, not OS.

Interim GBM and Kaposi's sarcoma (KS) clinical data

Preliminary Phase II data in glioblastoma multiforme (GBM; n=12) and KS (n=9) showed indications of a treatment effect. CytRx interprets the GBM findings as suggesting that aldoxorubicin can effectively cross the blood-brain barrier. The company expects to provide more data from these studies by mid-2015.

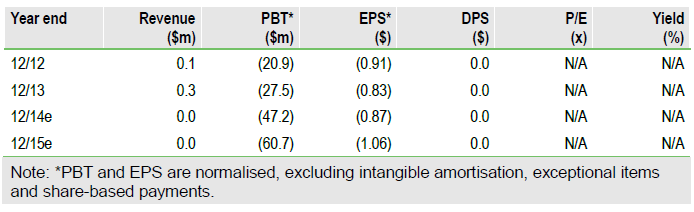

Valuation: $286m equity value provides upside

We estimate CytRx had $77.7m net cash at end-2014, and the firm estimates its resources should be sufficient to attain top-line STS data. With the lifting of the clinical hold, we have raised our success probability estimates for aldoxorubicin from 60% to 67.5% in STS, leading to a new pipeline rNPV of $208.5m (vs $182.0m previously). Including our year-end 2014 net cash estimate provides an equity valuation of $286.2m, or $5.05 per share.

To Read the Entire Report Please Click on the pdf File Below