Form 497K BlackRock Funds III

Summary Prospectus

Summary Prospectus

Key Facts About iShares Russell 1000 Large-Cap Index Fund

Investment Objective

The investment objective of iShares Russell 1000 Large-Cap

Index Fund (formerly known as BlackRock Large Cap Index Fund) (“Large-Cap Index Fund” or the “Fund”), a series of BlackRock Funds III (the “Trust”), is to match the performance of the Russell 1000® Index (the “Russell 1000” or the “Underlying Index”) as closely as possible before the deduction of Fund expenses.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if

you buy and hold shares of the Large-Cap Index Fund.

| Annual

Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)1 |

Investor

A Shares |

Institutional

Shares | ||

| Management Fee1,2 | 0.03% | 0.03% | ||

| Distribution and/or Service (12b-1) Fees | 0.25% | None | ||

| Other Expenses | 0.40% | 0.14% | ||

| Administration Fees | 0.01% | 0.01% | ||

| Miscellaneous Other Expenses | 0.39% | 0.13% | ||

| Total Annual Fund Operating Expenses | 0.68% | 0.17% | ||

| Fee Waivers and/or Expense Reimbursements2,3 | (0.30)% | (0.04)% | ||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements2,3 | 0.38% | 0.13% |

| 1 | The fees and expenses shown in the table above and the example that follows include both the expenses of the Fund and its share of the allocated expenses of Large Cap Index Master Portfolio (the “Master Portfolio”), a series of Master Investment Portfolio (“MIP”). The management fees are paid by the Master Portfolio. |

| 2 | As described in the “Management of the Funds” section of the Fund’s prospectus beginning on page 38, BlackRock Fund Advisors (“BFA”), the investment adviser for the Master Portfolio, has contractually agreed to waive the management fee with respect to any portion of the Master Portfolio’s assets estimated to be attributable to investments in other equity and fixed-income mutual funds and exchange-traded funds managed by BFA or its affiliates that have a contractual management fee, through April 30, 2019. The contractual agreement may be terminated upon 90 days’ notice by a majority of the non-interested trustees of MIP or by a vote of a majority of the outstanding voting securities of the Master Portfolio. |

| 3 | As described in the “Management of the Funds” section of the Fund’s prospectus beginning on page 38, BFA, and BlackRock Advisors, LLC (“BAL”), the administrator for the Fund, have contractually agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements of the Fund (excluding Dividend Expense, Interest Expense, Acquired Fund Fees and Expenses and certain other Fund expenses) as a percentage of average daily net assets to 0.38% (for Investor A Shares) and 0.13% (for Institutional Shares), through April 30, 2019. The Fund may have to repay some of these waivers and reimbursements to BFA and BAL in the following two years. This contractual agreement may be terminated upon 90 days’ notice by a majority of the non-interested trustees of the Trust or of MIP, as applicable, or by a vote of a majority of the outstanding voting securities of the Fund or the Master Portfolio, as applicable. |

Example:

This Example is intended to help you compare the cost of investing in the

Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your

investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Investor A Shares | $39 | $187 | $349 | $818 |

| Institutional Shares | $13 | $ 51 | $ 92 | $213 |

Portfolio Turnover:

The Master Portfolio pays transaction costs, such as commissions, when it

buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when shares are held in a taxable account. These costs, which are not

reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Master Portfolio’s portfolio turnover rate was 12% of the average value of its portfolio.

2

Principal Investment Strategies of the Fund

The Large-Cap Index Fund employs a “passive”

management approach, attempting to invest in a portfolio of assets whose performance is expected to match approximately the performance of the Russell 1000. The Fund will be substantially invested in equity securities in the Russell 1000, and will

invest, under normal circumstances, at least 80% of its assets in securities or other financial instruments that are components of or have economic characteristics similar to the securities included in the Russell 1000. Equity securities include

common stock, preferred stock, securities convertible into common stock and securities or other instruments whose price is linked to the value of common stock.

The Fund will invest in the common stocks represented in the

Russell 1000 in roughly the same proportions as their weightings in the Russell 1000. As of April 17, 2018, the companies in the Russell 1000 have a market capitalization ranging from $350 million to $903 billion. The Fund may also engage in futures

transactions. At times, the Fund may not invest in all of the common stocks in the Russell 1000, or in the same weightings as in the Russell 1000. At those times, the Fund chooses investments so that the market capitalizations, industry weightings

and other fundamental characteristics of the stocks chosen are similar to the Russell 1000 as a whole. The Fund may lend securities with a value up to

33 1⁄3% of its total assets to financial institutions that provide cash or securities

issued or guaranteed by the U.S. Government as collateral. The Fund will concentrate its investments (i.e., hold 25% or more of its total assets) in a particular industry or group of industries to approximately the same extent that the Russell 1000

is concentrated.

The Fund is a “feeder” fund

that invests all of its assets in the Master Portfolio, which has the same investment objective and strategies as the Fund. All investments are made at the Master Portfolio level. This structure is sometimes called a “master/feeder”

structure. The Fund’s investment results will correspond directly to the investment results of the Master Portfolio. For simplicity, this prospectus uses the name of the Fund or the term “Fund” (as applicable) to include the Master

Portfolio.

Principal Risks of Investing in the Fund

Risk is inherent in all investing. The value of your

investment in the Large-Cap Index Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. You may lose part or all of your investment in the Fund or your investment may not

perform as well as other similar investments. The following is a summary description of the principal risks of investing in the Fund.

| ■ | Concentration Risk — The Fund reserves the right to concentrate its investments (i.e., invest 25% or more of its total assets in securities of issuers in a particular industry) to approximately the same extent that the Underlying Index concentrates in a particular industry. To the extent the Fund concentrates in a particular industry, it may be more susceptible to economic conditions and risks affecting that industry. |

| ■ | Equity Securities Risk — Stock markets are volatile. The price of equity securities fluctuates based on changes in a company’s financial condition and overall market and economic conditions. |

| ■ | Futures Risk — The Fund’s use of futures may reduce the Fund’s returns. In these transactions, the Fund is subject to liquidity risk and correlation risk (i.e., that fluctuations in a future’s value may not correlate with the change in market value of the instruments held by the Fund). |

| ■ | Index Fund Risk — An index fund has operating and other expenses while an index does not. As a result, while the Fund will attempt to track the Russell 1000 as closely as possible, it will tend to underperform the index to some degree over time. If an index fund is properly correlated to its stated index, the fund will perform poorly when the index performs poorly. |

| ■ | Index-Related Risk — There is no guarantee that the Fund’s investment results will have a high degree of correlation to those of the Underlying Index or that the Fund will achieve its investment objective. Market disruptions and regulatory restrictions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track the Underlying Index. Errors in index data, index computations or the construction of the Underlying Index in accordance with its methodology may occur from time to time and may not be identified and corrected by the index provider for a period of time or at all, which may have an adverse impact on the Fund and its shareholders. |

| ■ | Market Risk and Selection Risk — Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money. |

3

| ■ | Mid Cap Securities Risk — The securities of mid cap companies generally trade in lower volumes and are generally subject to greater and less predictable price changes than the securities of larger capitalization companies. |

| ■ | Securities Lending Risk — Securities lending involves the risk that the borrower may fail to return the securities in a timely manner or at all. As a result, the Fund may lose money and there may be a delay in recovering the loaned securities. The Fund could also lose money if it does not recover the securities and/or the value of the collateral falls, including the value of investments made with cash collateral. These events could trigger adverse tax consequences for the Fund. |

| ■ | Tracking Error Risk — Tracking error is the divergence of the Fund’s performance from that of the Underlying Index. Tracking error may occur because of differences between the securities and other instruments held in the Fund’s portfolio and those included in the Underlying Index, pricing differences, differences in transaction costs, the Fund’s holding of uninvested cash, differences in timing of the accrual of or the valuation of dividends or interest, tax gains or losses, changes to the Underlying Index or the costs to the Fund of complying with various new or existing regulatory requirements. This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because the Fund incurs fees and expenses, while the Underlying Index does not. |

Performance Information

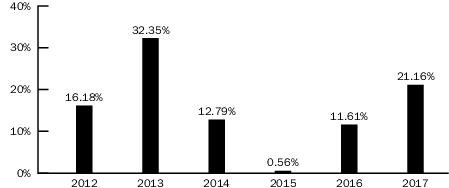

The information shows you how the performance of Large-Cap

Index Fund has varied for the periods since inception and provides some indication of the risks of investing in the Fund. The table compares the Fund’s performance to that of the Russell 1000. To the extent that dividends and distributions

have been paid by the Fund, the performance information for the Fund in the chart and table assumes reinvestment of the dividends and distributions. As with all such investments, past performance (before and after taxes) is not an indication of

future results. The table includes all applicable fees. If BFA, BAL and their affiliates had not waived or reimbursed certain Fund expenses during these periods, the Fund’s returns would have been lower. Updated information on the Fund’s

performance, including its current net asset value, can be obtained by visiting http://www.blackrock.com or can be obtained by phone at (800) 882-0052.

Investor A Shares

ANNUAL TOTAL RETURNS

iShares Russell 1000 Large-Cap Index Fund

As of 12/31

As of 12/31

During the periods shown

in the bar chart, the highest return for a quarter was 13.02% (quarter ended March 31, 2012) and the lowest return for a quarter was -6.87% (quarter ended September 30, 2015).

| As

of 12/31/17 Average Annual Total Returns |

1 Year | 5 Years | Since

Inception (March 31, 2011) |

| iShares Russell 1000 Large-Cap Index Fund — Investor A Shares | |||

| Return Before Taxes | 21.16% | 15.21% | 12.69% |

| Return After Taxes on Distributions | 20.37% | 14.04% | 11.73% |

| Return After Taxes on Distributions and Sale of Fund Shares | 12.42% | 11.94% | 10.08% |

| iShares Russell 1000 Large-Cap Index Fund — Institutional Shares | |||

| Return Before Taxes | 21.46% | 15.58% | 13.03% |

| Russell 1000 Index (Reflects no deduction for fees, expenses or taxes) | 21.69% | 15.71% | 13.18% |

4

After-tax returns are calculated using the historical highest

individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown, and the after-tax returns shown are not

relevant to investors who hold their shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Investor A Shares only, and the after-tax returns for Institutional Shares will

vary.

Investment Adviser

The Master Portfolio’s investment adviser is BlackRock

Fund Advisors (previously defined as “BFA”).

Portfolio Managers

| Name | Portfolio

Manager of the Master Portfolio Since |

Title |

| Alan Mason | 2014 | Managing Director of BlackRock, Inc. |

| Greg Savage, CFA | 2012 | Managing Director of BlackRock, Inc. |

| Jennifer Hsui, CFA | 2016 | Managing Director of BlackRock, Inc. |

| Creighton Jue, CFA | 2016 | Managing Director of BlackRock, Inc. |

| Rachel Aguirre | 2016 | Managing Director of BlackRock, Inc. |

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the Fund each day the New

York Stock Exchange is open. To purchase or sell shares, you should contact your financial professional or your selected securities dealer, broker, investment adviser, service provider or industry professional (including BFA, The PNC Financial

Services Group, Inc. and their respective affiliates) (each a “Financial Intermediary”), or, if you hold your shares through the Fund, you should contact the Fund by phone at (800) 441-7762, by mail (c/o BlackRock Funds III, P.O. Box

9819, Providence, Rhode Island 02940-8019), or by the Internet at www.blackrock.com. The Fund’s initial and subsequent investment minimums generally are as follows, although the Fund may reduce or waive the minimums in some cases:

5

| Investor A Shares | Institutional Shares | |

| Minimum

Initial Investment |

$1,000

for all accounts except: • $50, if establishing an Automatic Investment Plan. • There is no investment minimum for employer-sponsored retirement plans (not including SEP IRAs, SIMPLE IRAs or SARSEPs). • There is no investment minimum for certain fee-based programs. |

There

is no minimum initial investment for: • Employer-sponsored retirement plans (not including SEP IRAs, SIMPLE IRAs or SARSEPs), state sponsored 529 college savings plans, collective trust funds, investment companies or other pooled investment vehicles, unaffiliated thrifts and unaffiliated banks and trust companies, each of which may purchase shares of the Fund through a Financial Intermediary that has entered into an agreement with the Fund’s distributor to purchase such shares. • Investors of Financial Intermediaries that: (i) charge such investors a fee for advisory, investment consulting, or similar services or (ii) have entered into an agreement with the Fund’s distributor to offer Institutional Shares through a no-load program or investment platform. $2 million for individuals and “Institutional Investors,” which include, but are not limited to, endowments, foundations, family offices, local, city, and state governmental institutions, corporations and insurance company separate accounts who may purchase shares of the Fund through a Financial Intermediary that has entered into an agreement with the Fund’s distributor to purchase such shares. $1,000 for clients investing through Financial Intermediaries that offer such shares on a platform that charges a transaction based sales commission outside of the Fund. |

| Minimum

Additional Investment |

$50 for all accounts (with the exception of certain employer-sponsored retirement plans which may have a lower minimum). | No subsequent minimum. |

Tax Information

The Fund’s dividends and distributions may be subject to

U.S. federal income taxes and may be taxed as ordinary income or capital gains, unless you are a tax-exempt investor or are investing through a qualified tax-exempt plan described in section 401(a) of the Internal Revenue Code, in which case you may

be subject to U.S. federal income tax when distributions are received from such tax-deferred arrangements.

Payments to Broker/Dealers and Other Financial

Intermediaries

If you purchase shares of the Fund through a Financial

Intermediary, the Fund and BlackRock Investments, LLC, the Fund’s distributor, or its affiliates may pay the Financial Intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by

influencing the Financial Intermediary and your individual financial professional to recommend the Fund over another investment. Ask your individual financial professional or visit your Financial Intermediary’s website for more

information.

6

[This page intentionally left blank]

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Genesis Digital Appoints Darren Hakeman as Chief Executive Officer

- Ecopetrol announces the dates for the publication of its first quarter 2024 report and conference call

- Regarding the draft alternative resolution submitted to the Ordinary General Meeting of Shareholders of ŽEMAITIJOS PIENAS, AB

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share