Helmerich & Payne (NYSE:HP) has taken full advantage of the North American oil and gas renaissance brought on by fracking.

Helmerich & Payne is a Dividend Achiever with a long dividend history. The company has grown earnings-per-share at 22% a year over the last decade. 20%+ earnings-per-share growth is what you’d expect from a growth-phase social media company (if it even had earnings), not an ‘old economy’ contract drilling services business like Helmerich & Payne.

I will tell you up front, I’m long Helmerich & Payne. The company’s investment thesis is a combination of growth from the North American oil renaissance as well as a value play due to low oil prices.

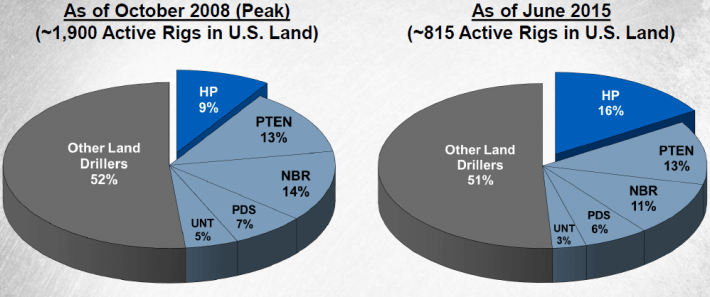

Simply put, Helmerich & Payne has navigated the North American oil boom better than any of its peers. The company is now the market leader in the U.S. land contract drilling services industry, as the image below shows.

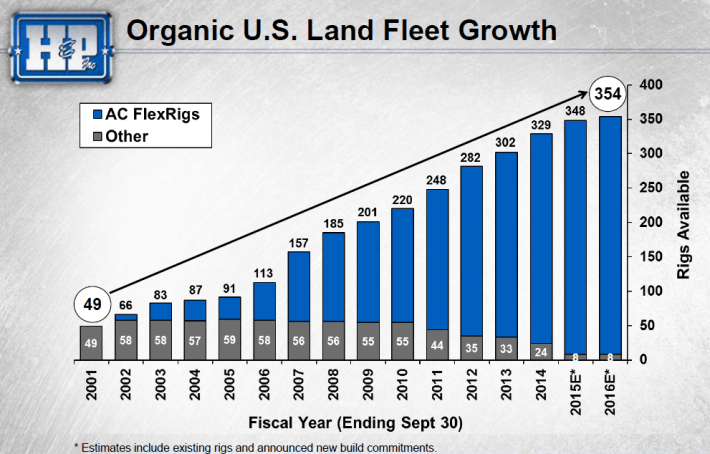

Helmerich & Payne has leap-frogged its competitors to take the leading market share position by providing higher quality rigs. The company has greatly expanded its best-in-class AC Flex Rigs over the last 15 years. The image below shows this rig growth. Note that the company has also sold off nearly all of its old-model rigs to focus on its AC Flex Rigs

Helmerich & Payne and Oil Price Declines

Helmerich & Payne’s 22% earnings-per-share growth rate over the last decade is nothing short of phenomenal. The company’s earnings are actually declining now due to the precipitous decline in oil prices since July.

Helmerich & Payne is in part a victim of its own success. The rise in oil production in North America coupled with reluctance to reduce oil production in other parts of the world has resulted in more oil supply. When supply rises while demand is held steady, prices decline.

We don’t live in a stable world, however. Oil production levels can and will change. Wars, economic sanctions, dwindling reserves, and rising energy demand all have the potential to raise oil prices. Just as oil prices haven’t permanently stayed high, they will not permanently stay low.

Since oil prices fell from over $100 a barrel to around $50 a barrel, Helmerich & Payne’s stock price has suffered. The company’s stock price fell from highs of around $110 to lows of around $55. The stock currently sits at $63.68.

Helmerich & Payne is a Fracking Bargain At Current Prices

“The best thing that happens to us is when a great company gets into temporary trouble… We want to buy them when they’re on the operating table.”

– Warren Buffett

The Warren Buffett quote above applies perfectly to Helmerich & Payne today. Low oil prices have created an opportunity to load up on Helmerich & Payne shares for a fraction of the company’s fair value.

Helmerich & Payne currently trades for a price-to-earnings ratio of 9.8. The company’s earnings will fall in the short-term as its customers reduce drilling due to low oil prices. Still, the company’s long-term earnings power is not reflected in Helmerich & Payne’s current low valuation.

When oil prices rise, investors in Helmerich & Payne will very likely see both rapid earnings growth and an upward revision in the company’s price-to-earnings multiple.

Weathering the Storm

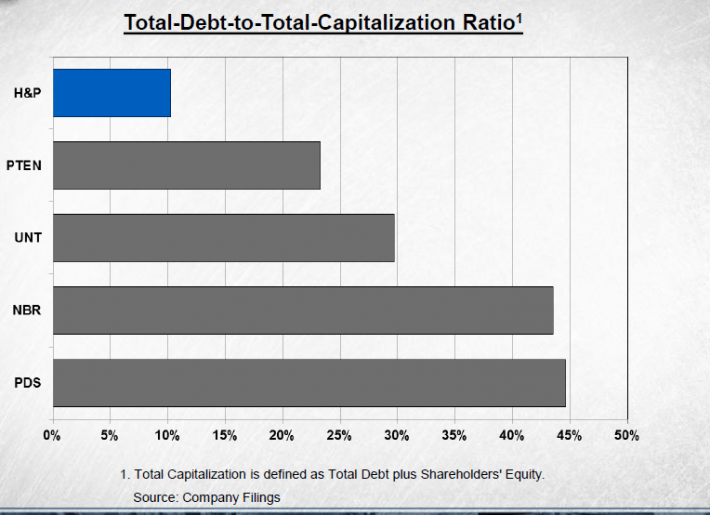

Helmerich & Payne is still profitable despite low oil prices, generating $150 million in its latest quarter. The company has over $700 million in cash on its balance sheet and a debt to capitalization ratio of just 10%. Additionally, the company has a $300 million credit facility. Simply put, Helmerich & Payne is well positioned to outlast low oil prices.

Helmerich & Payne is partially insulated from recessions and low oil prices thanks to well-managed contracts with its customers. The company generally uses 3 year contracts with early termination payment clauses to help offset declining earnings from falling oil prices.

This strategy worked during the Great Recession; the company’s EPS declined only 26% through the Great Recession, better than many oil & gas giants (including ExxonMobil). Helmerich & Payne expects to generate $220 in total from early cancellation fees in the current low oil price scare.

Helmerich & Payne is better positioned than its peers to survive low oil prices. The image below shows the company’s capital structure compared to that of its peers.

Final Thoughts

Helmerich & Payne grows earnings rapidly when oil prices are steady or rising. The company’s long-term contracts with lucrative cancellation clauses help protect the company during falling oil prices.

The company currently has a 4.3% dividend yield. In addition, Helmerich & Payne has paid steady or rising dividends every year since 1987. Helmerich & Payne’s high dividend yield and long history of dividend payments should appeal to dividend growth investors looking for high current income. The company’s measures to protect its downside make it very unlikely Helmerich & Payne’s dividend will be reduced.

The 8 Rules of Dividend Investing are used to find high quality dividend growth stocks trading at fair or better prices. Helmerich & Payne is a high quality business and is trading below fair value. As a result, the company is ranked in the Top 10 using The 8 Rules of Dividend Investing.