BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

Enterprise digital assets transfer startup Fireblocks Inc. emerged from stealth mode today with $16 million in funding for its “completely new way to securely transfer digital assets.”

The Series A round was backed by Cyberstarts, Tenaya Capital, Eight Roads, Swisscom Ventures and MState. The company was founded by Michael Shaulov and Pavel Berengolt, who both previously worked at senior positions at Check Point Software Technologies Ltd., and Idan Ofrat, previously at blockchain firm Orbs Ltd.

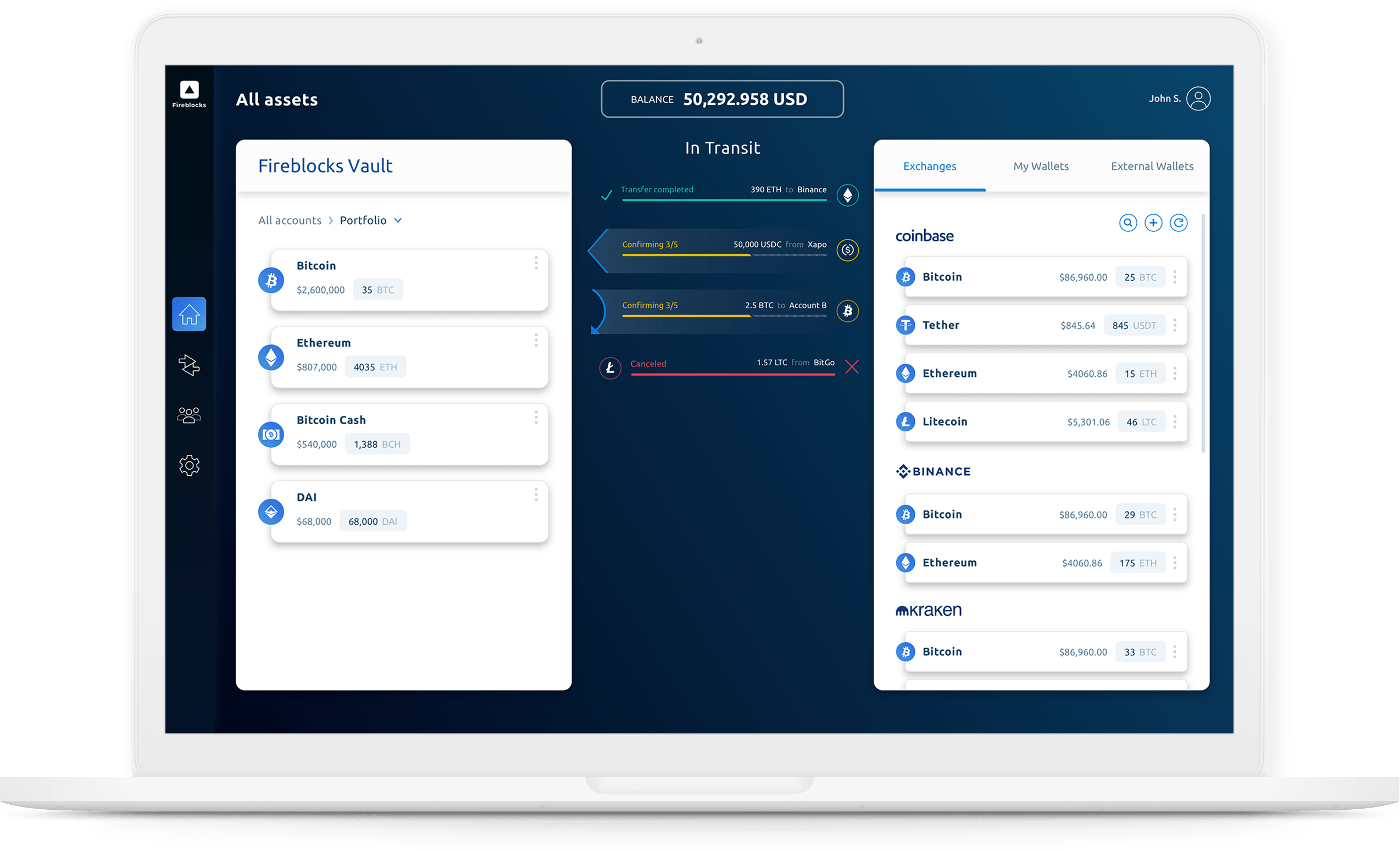

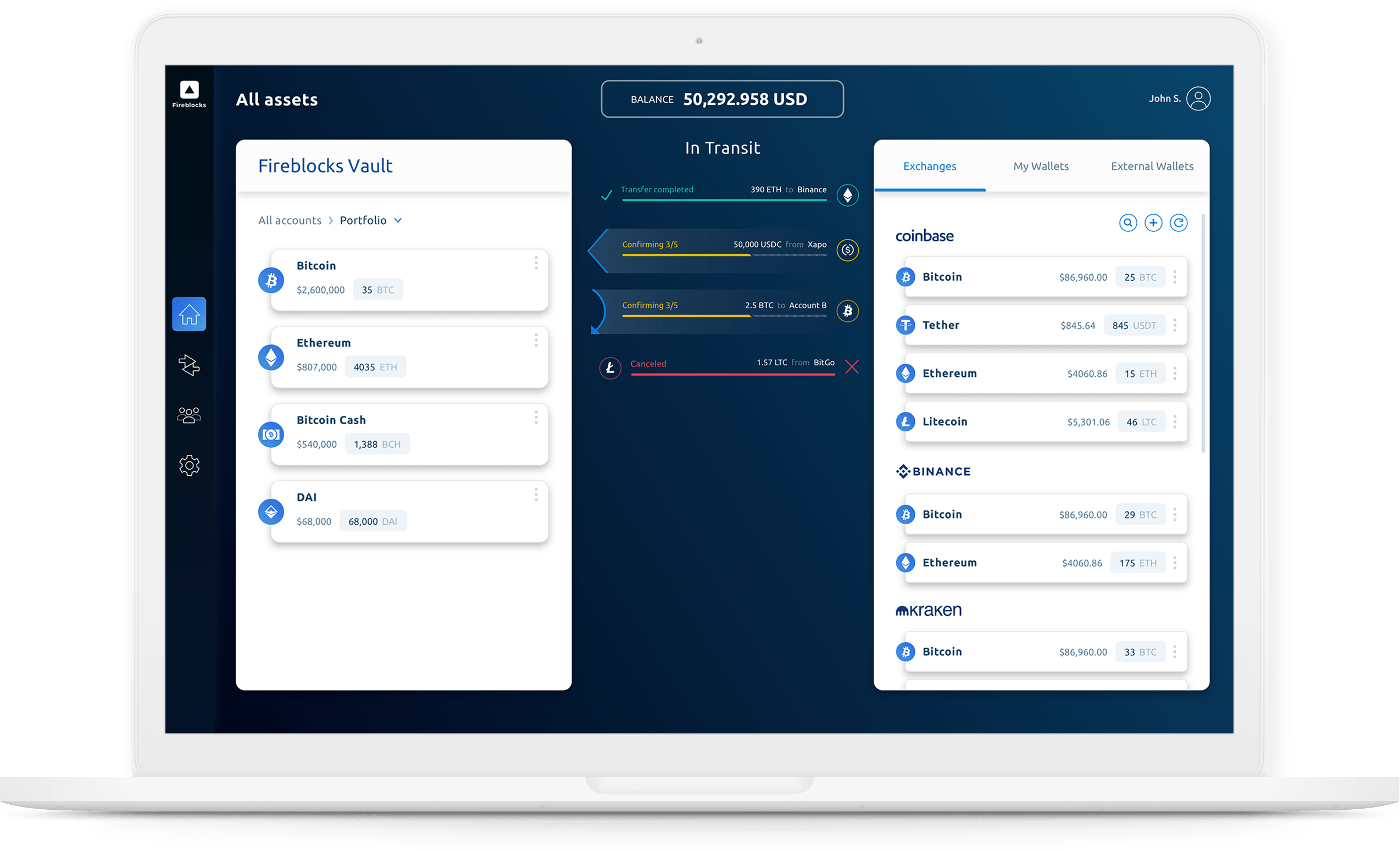

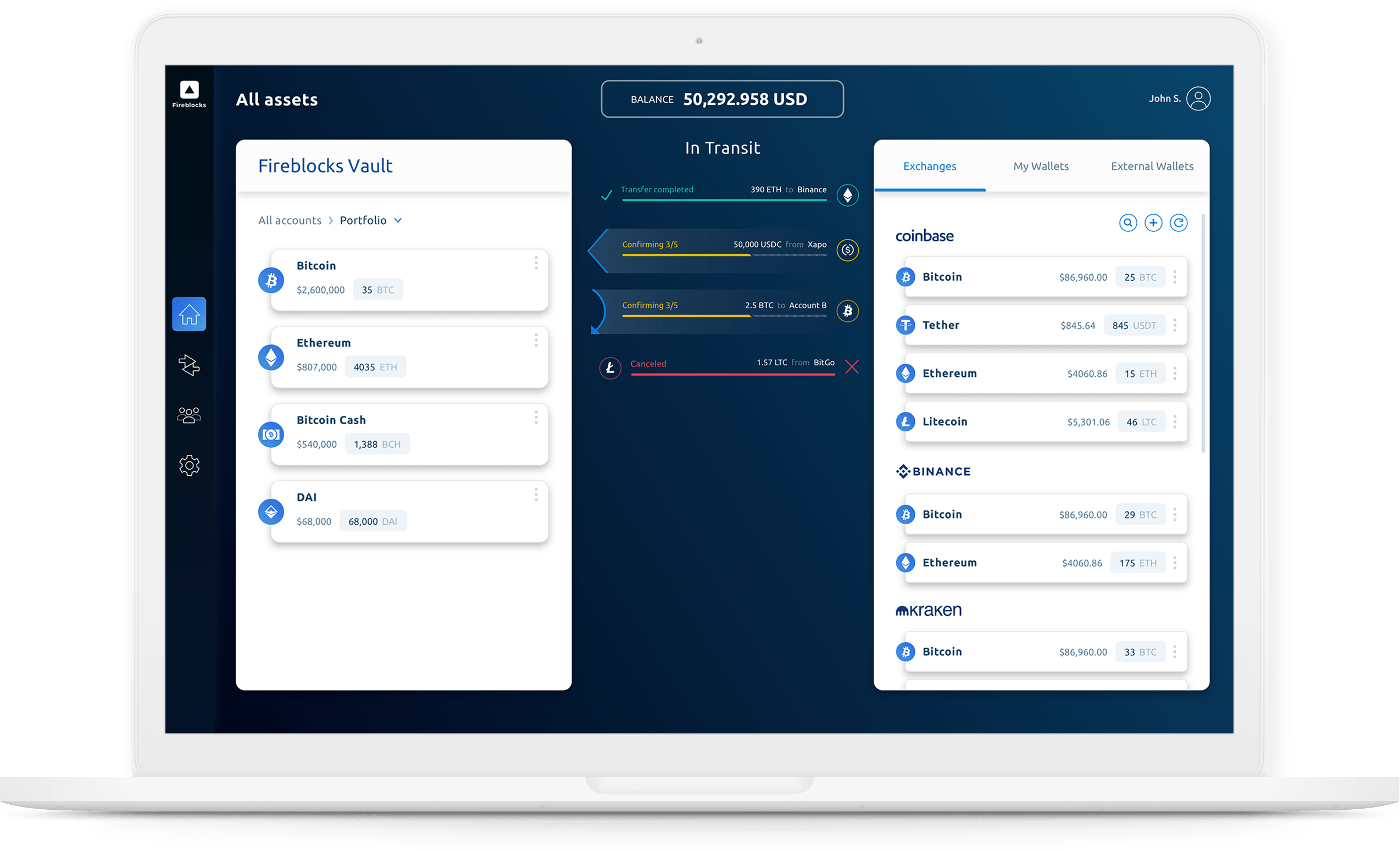

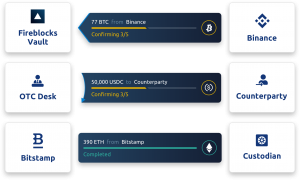

Fireblocks has been designed to eliminate the root cause of digital asset hacks and scams.  The company’s primary service is to secure the transfer of digital assets between exchanges, wallets and counterparties. Acting as a sort of middleman, Fireblocks facilitates the transfers without the need to copy or paste deposit addresses or re-enter the password for every wallet and exchange.

The company’s primary service is to secure the transfer of digital assets between exchanges, wallets and counterparties. Acting as a sort of middleman, Fireblocks facilitates the transfers without the need to copy or paste deposit addresses or re-enter the password for every wallet and exchange.

“While Blockchain based assets by themselves are cryptographically secure, moving digital assets is a nightmare,” co-founder and Chief Executive Officer Shaulov explained. “After interviewing over 100 institutional customers, including hedge funds, broker-dealers, exchanges and banks, we concluded that the current process is slow and highly susceptible to cyber attacks and human errors. We built a platform that secures the process and simplifies the movement of funds into one or two steps.”

The company debuts out of stealth with an already healthy lineup of customers. Among them are Galaxy Digital, a diversified merchant bank dedicated to the digital assets and blockchain technology industry and Genesis Global Trading Inc., an over the counter digital currency trading service provider for high net worth individuals and institutions.

Fireblocks currently provides integrated support for 15 digital asset exchanges and offers support for more than 180 cryptocurrencies, tokens and stablecoins.

Notable among the investors is Eight Roads, the investment arm of Fidelity International. Not only is parent company Fidelity Investments Inc. a multinational financial services corporation it has recently started offering digital asset services to customers. In October, the company launched a digital asset custody and trading service for institutional investors, with reports in May suggesting that a bitcoin trading service may be on its way as well.

THANK YOU